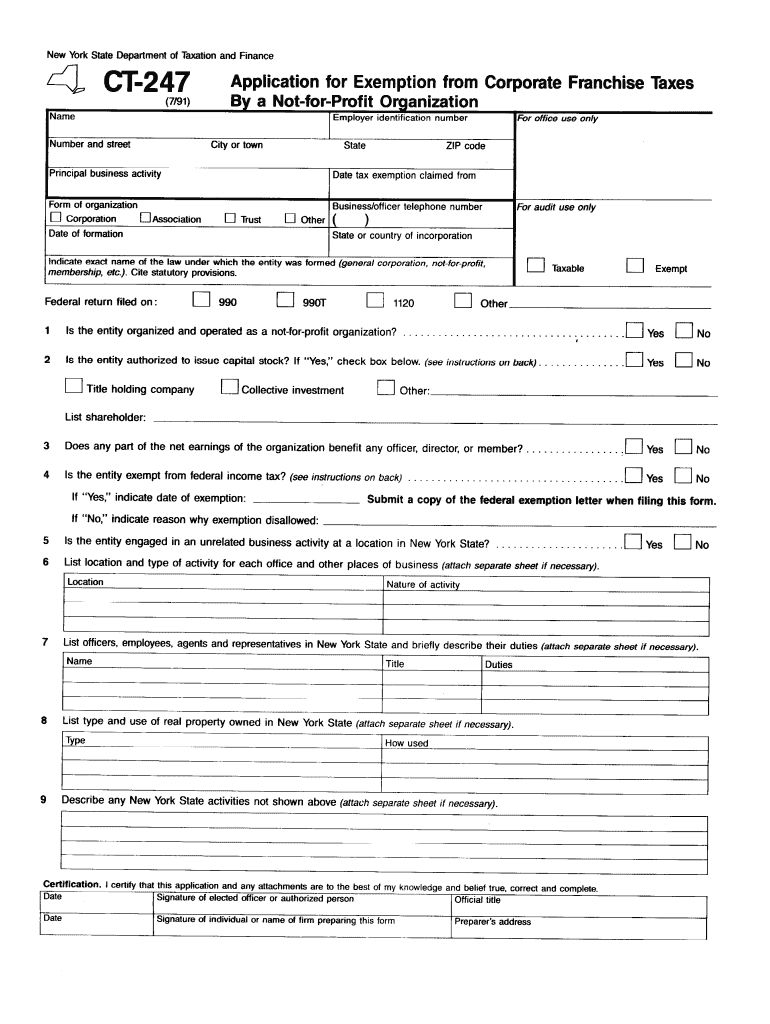

Who needs a CT-247 form?

All non-profit and religious organizations who want to apply for exemption from New York State corporation tax, must file this form with NYS Tax Department. If the application is approved, the organization will be exempt from New York State corporation tax only.

What is form CT-247 for?

There are certain requirements to meet before applying for this kind of tax exemption: an organization must be organized and operated as a non-profit; it must not have stock or shares, or certificates for stock and shares; no part of its net earnings may benefit any officer, director, or member; and it must be exempt from federal income taxation under IRC section 501.

Is it accompanied by other forms?

There are no general requirements for anyone filing this form. However, non-stock organizations must file form CT-13, Unrelated Income Tax Return, and all non-profits must file form 1120 and in some cases, form CT-3, General Business Corporation Franchise Tax return.

When is form CT-247 due?

File this form once, unless its exempt status has been revoked and later restored by the IRS.

How do I fill out form CT-247?

You should write the mailing name and address of your organization on the top of the form. Then you should add information about its main business activity and the date from which the tax exemption is being claimed. Determine the form of organization and the date of formation, state or country of incorporation and the exact name of law under which the entity was formed. Answer a series of yes/no questions about your organization, then write about the activities of each office, its employees and agents, and the type and use of real property in NYS.

Where do I send it?

Send it to the following address:

NYS Tax Department

Corporation Tax Account Resolution

W A Harriman Campus

Albany NY 12227-0852