Get the free Residential Credit Application PDF File - Harbert Oil

Show details

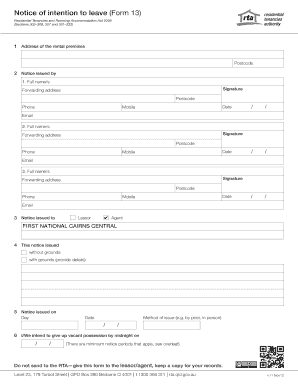

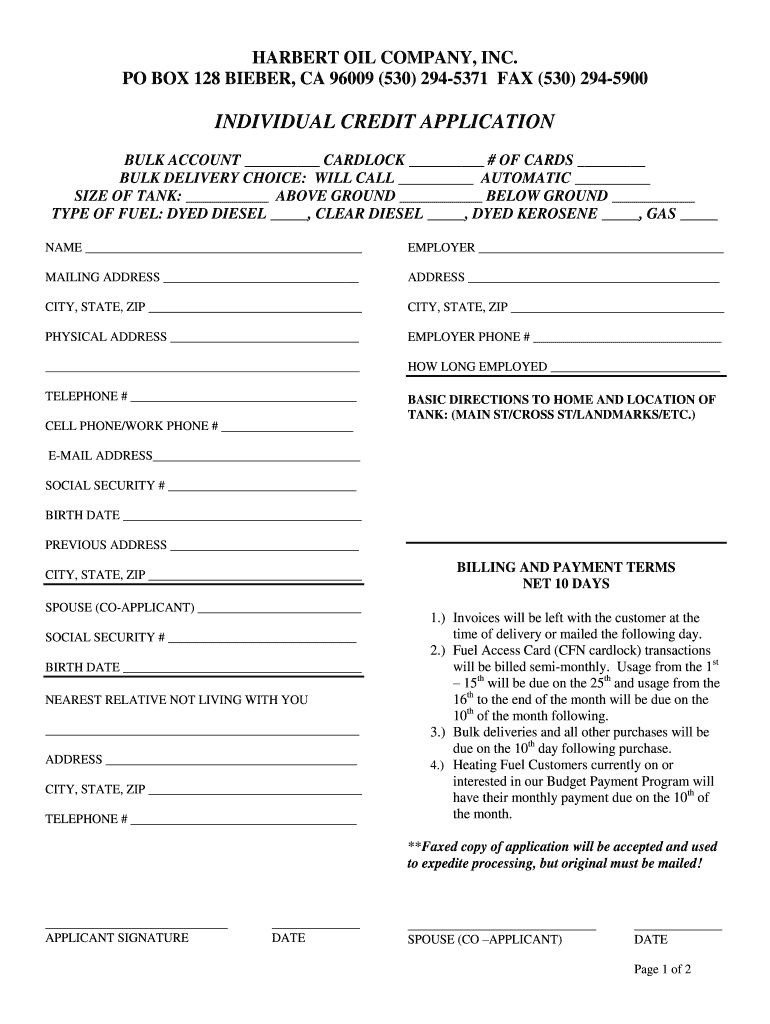

HERBERT OIL COMPANY, INC. PO BOX 128 BIEBER, CA 96009 (530) 2945371 FAX (530) 2945900 INDIVIDUAL CREDIT APPLICATION BULK ACCOUNT WARLOCK # OF CARDS BULK DELIVERY CHOICE: WILL CALL AUTOMATIC SIZE OF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign residential credit application pdf

Edit your residential credit application pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your residential credit application pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit residential credit application pdf online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit residential credit application pdf. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out residential credit application pdf

01

The first step in filling out a residential credit application pdf is to gather all the necessary information. This typically includes personal details such as your full name, address, social security number, employment history, and financial information like your income and assets.

02

Once you have collected all the necessary information, open the residential credit application pdf on your computer or device. You will need a PDF reader program such as Adobe Acrobat Reader to fill out the form electronically.

03

Start by clicking on the first blank field on the application form and begin entering your personal information as accurately as possible. Pay close attention to the instructions provided on the form and make sure to provide all the required information.

04

When it comes to providing financial details, be prepared to provide accurate information about your income, employment, and any other financial obligations or debts you may have. It is crucial to be honest and transparent about your financial situation to ensure the accuracy of your credit assessment.

05

Take your time to review the completed form before submitting it. Double-check all the information you have entered to ensure there are no typos or errors. It is important to provide accurate information as any discrepancies may affect your creditworthiness.

06

Once you are confident that all the information entered is accurate, save a copy of the completed residential credit application pdf for your records. It is also recommended to print a physical copy for your reference.

Who needs a residential credit application pdf?

01

Individuals who are applying for a rental property: When renting a residential property, landlords often require prospective tenants to complete a residential credit application pdf. This allows the landlord to assess the applicant's creditworthiness and determine if they are financially capable of fulfilling their rental obligations.

02

Banks and financial institutions: Banks and financial institutions may require a residential credit application pdf to evaluate the creditworthiness of individuals who are applying for mortgages or loans to purchase residential properties. This helps the lenders assess the individual's ability to repay the loan and make informed lending decisions.

03

Real estate agencies and property management companies: These entities may use residential credit application pdfs to screen potential tenants for various rental properties. Completing a credit application helps assess the applicant's financial stability and suitability for the property, ensuring a reliable tenant for the property owner.

In summary, filling out a residential credit application pdf involves gathering all necessary information, opening the form with a PDF reader, entering personal and financial details accurately, reviewing the completed form, and saving/printing copies. Different entities such as renters, banks, and real estate agencies may require a residential credit application pdf to evaluate creditworthiness and make informed decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is residential credit application pdf?

Residential credit application pdf is a document used by individuals applying for a residential credit, such as a mortgage or rental application, to provide their financial information to the lender or landlord.

Who is required to file residential credit application pdf?

Individuals who are applying for a residential credit, such as a mortgage or rental application, are required to file a residential credit application pdf.

How to fill out residential credit application pdf?

To fill out a residential credit application pdf, applicants need to provide their personal information, financial details, employment history, and any other requested information accurately and completely.

What is the purpose of residential credit application pdf?

The purpose of residential credit application pdf is to help lenders or landlords assess the creditworthiness of individuals applying for a residential credit.

What information must be reported on residential credit application pdf?

Information such as personal details, financial information, employment history, credit history, and references must be reported on a residential credit application pdf.

How do I modify my residential credit application pdf in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your residential credit application pdf and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get residential credit application pdf?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific residential credit application pdf and other forms. Find the template you want and tweak it with powerful editing tools.

How can I edit residential credit application pdf on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit residential credit application pdf.

Fill out your residential credit application pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Residential Credit Application Pdf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.