Get the free Lower Your Interest Rates

Show details

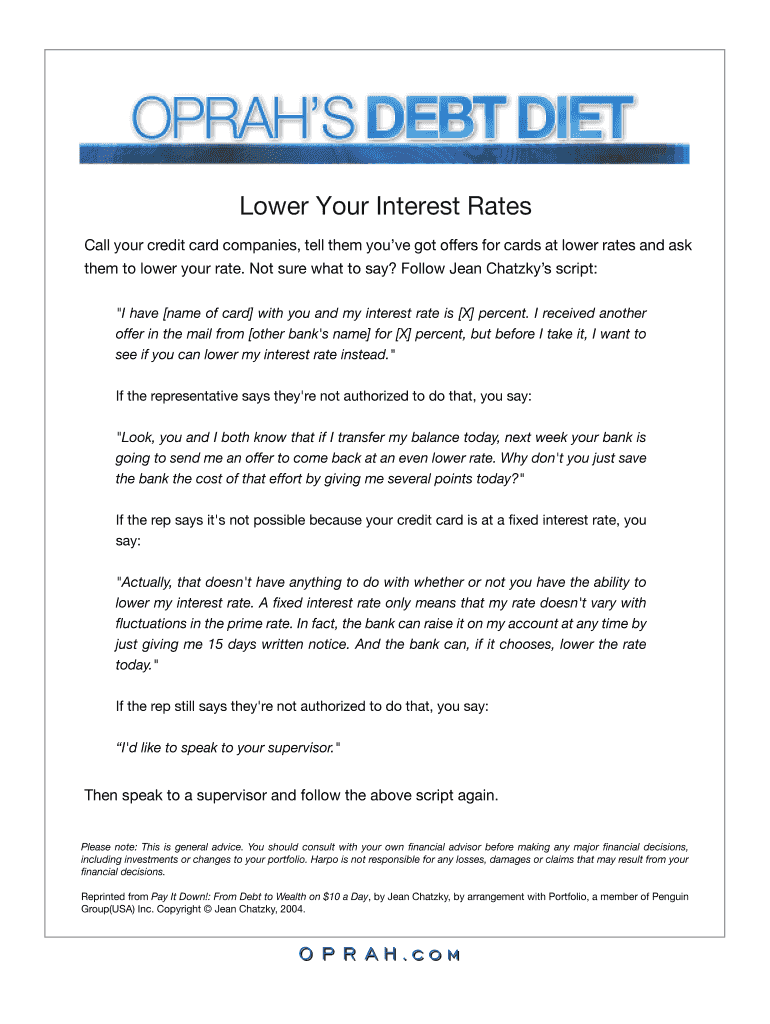

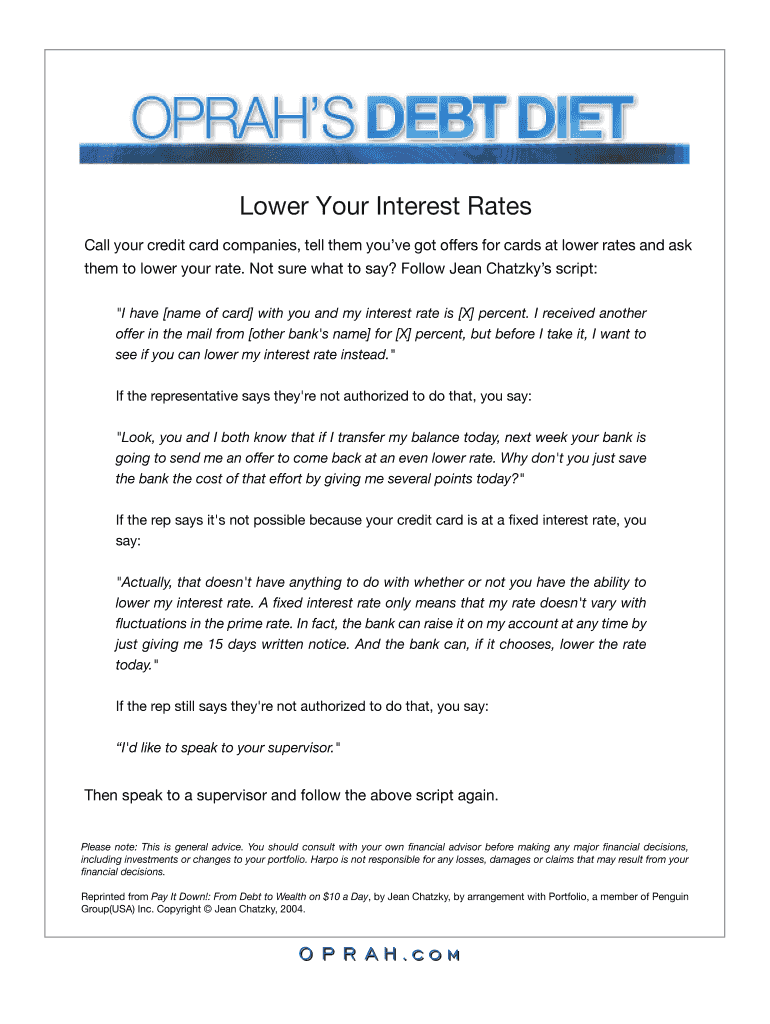

Lower Your Interest Rates Call your credit card companies, tell them you've got offers for cards at lower rates and ask them to lower your rate. Not sure what to say? Follow Jean Chalky script: “I

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lower your interest rates

Edit your lower your interest rates form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lower your interest rates form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lower your interest rates online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit lower your interest rates. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lower your interest rates

How to lower your interest rates:

01

Review your credit score: Before attempting to lower your interest rates, it's essential to assess your current creditworthiness. Obtain a free copy of your credit report from a reputable credit bureau and check for any errors or negative items that may be impacting your score. Addressing these issues can potentially improve your creditworthiness and increase your chances of negotiating lower interest rates.

02

Compare interest rates: Research and compare interest rates offered by different lenders or financial institutions. Look for competitive rates in the market that may be lower than what you're currently paying. This step will help you identify potential opportunities for refinancing or negotiating better terms with your existing lender.

03

Negotiate with your lender: If you have a good payment history or if you've improved your credit score since taking on the loan, consider reaching out to your current lender. Ask if they're willing to lower your interest rate based on your improved creditworthiness. Be prepared to provide supporting documentation and make a persuasive case for why they should consider lowering your rates.

04

Refinance your loan: Another option to consider is refinancing your loan with a different lender. If you qualify for a loan with a lower interest rate, you may be able to use the new loan to pay off the existing one, reducing your overall interest burden. Be sure to weigh any potential fees associated with refinancing against the potential savings in interest payments.

05

Seek professional advice: If you're having difficulty navigating the process of lowering your interest rates, consider consulting a financial advisor or credit counseling service. These professionals can offer guidance tailored to your specific situation and help you develop a personalized plan to achieve lower interest rates.

Who needs lower your interest rates?

01

Individuals with high-interest debts: High-interest debts, such as credit card balances or personal loans, can accumulate quickly and become financially burdensome. Lowering the interest rates on these debts can help individuals save money in interest payments and potentially pay off their debts faster.

02

Homeowners with mortgages: Mortgage rates play a significant role in the overall cost of homeownership. Lowering your mortgage interest rate can result in substantial savings over the life of your loan. Homeowners who have improved their credit scores or who want to take advantage of lower interest rates in the market may consider refinancing their mortgage.

03

Borrowers with auto loans: Auto loans often come with higher interest rates, especially for individuals with less-than-perfect credit. Lowering the interest rate on your auto loan can lead to lower monthly payments and significant long-term savings.

04

Small business owners: Lower interest rates can greatly benefit small business owners who rely on loans or lines of credit to finance their operations. By reducing interest expenses, business owners can free up cash flow and invest in growth opportunities.

In conclusion, individuals and businesses that want to save money, reduce debt or improve their financial situation can benefit from lowering their interest rates. By following the steps outlined above and understanding who needs lower interest rates, individuals can take control of their financial well-being.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lower your interest rates?

Lowering your interest rates typically refers to negotiating with your lender to reduce the amount of interest you pay on a loan or credit card.

Who is required to file lower your interest rates?

Individuals who wish to lower their interest rates on loans or credit cards are required to initiate the process with their lenders.

How to fill out lower your interest rates?

To fill out a request to lower your interest rates, you will need to contact your lender and provide information about your current financial situation.

What is the purpose of lower your interest rates?

The purpose of lowering your interest rates is to potentially save money on interest payments and make it easier to repay your debt.

What information must be reported on lower your interest rates?

You may need to provide details about your income, expenses, debt amount, and reasons for requesting a lower interest rate.

How can I manage my lower your interest rates directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your lower your interest rates and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I sign the lower your interest rates electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your lower your interest rates in minutes.

How do I edit lower your interest rates on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign lower your interest rates. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your lower your interest rates online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lower Your Interest Rates is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.