Get the free Professionalism program credit card payment bformb - imq

Show details

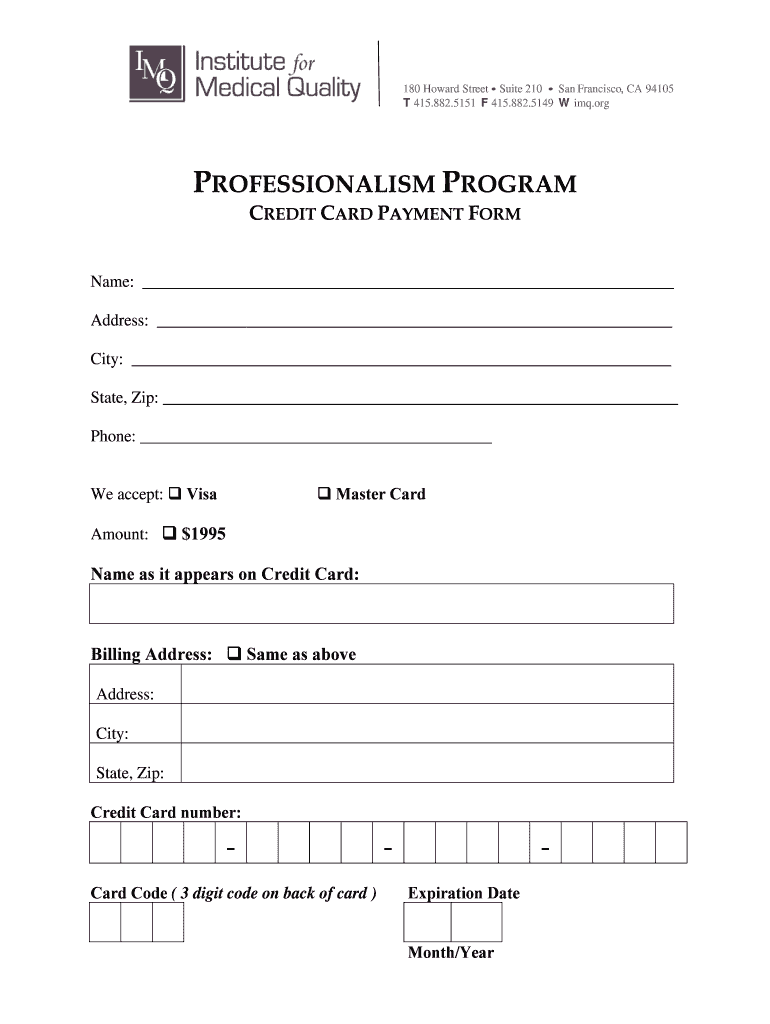

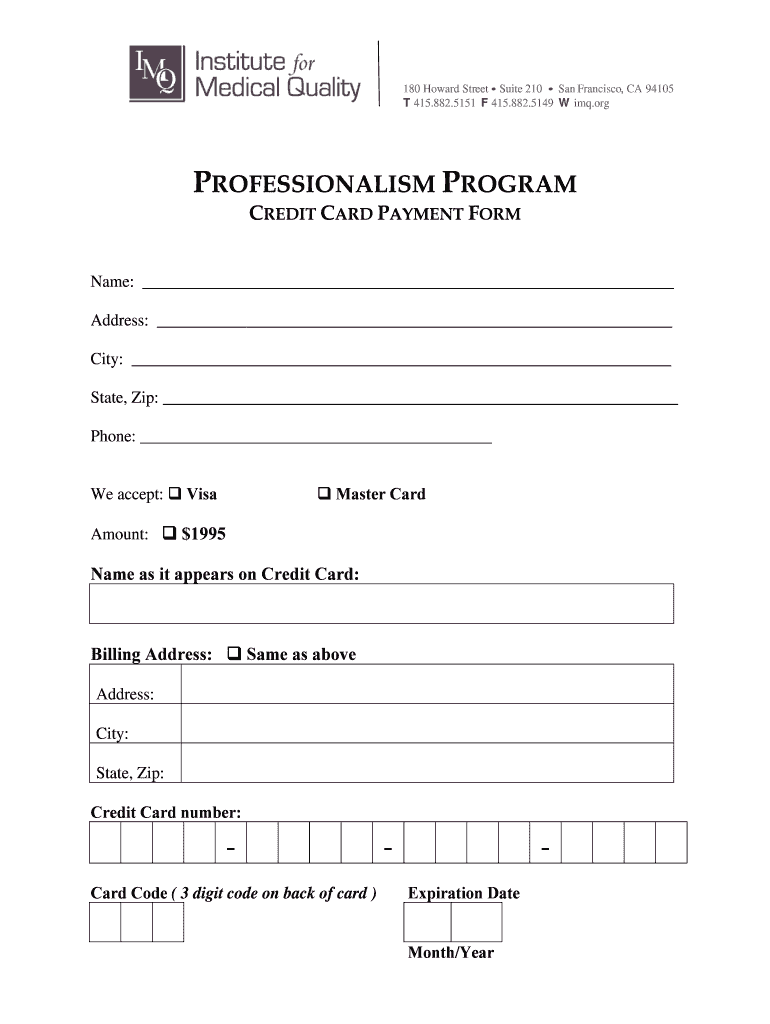

Amount: ? B$1995/b. Name as it appears on Credit Card: Billing Address: ? Same BR as above. Address: City: State, Zip: Credit Card number:. . . Card Code (3 ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign professionalism program credit card

Edit your professionalism program credit card form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your professionalism program credit card form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing professionalism program credit card online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit professionalism program credit card. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out professionalism program credit card

How to fill out professionalism program credit card:

01

Gather necessary information: Before you begin filling out the professionalism program credit card application, make sure you have all the required information. This may include personal details, such as your name, address, contact information, and social security number.

02

Review the eligibility criteria: Before applying for the professionalism program credit card, it's essential to review the eligibility criteria. Ensure that you meet the requirements set by the credit card issuer, such as age, income, and employment status.

03

Access the application form: Obtain the professionalism program credit card application form. This can usually be found on the issuer's website or by visiting a local branch if applicable.

04

Complete personal information: Fill in all the necessary personal information accurately. This may include your full name, date of birth, residential address, phone number, and email address.

05

Provide employment details: In the application, you'll likely need to provide your employment information. Include your job title, employer's name, and contact information.

06

Income and financial details: The application may ask you to disclose your annual income and other financial details. This information is crucial for the credit card issuer to assess your creditworthiness.

07

Read and understand the terms and conditions: Take the time to carefully read and understand the terms and conditions associated with the professionalism program credit card. Pay attention to interest rates, fees, penalties, and any other important information provided.

08

Check for accuracy: Before submitting the application, double-check all the information you have entered. Make sure there are no errors or omissions that could cause delays or complications.

09

Submit the application: Once you are confident that the application is complete and accurate, submit it as instructed by the credit card issuer. This may involve submitting it online, mailing it, or delivering it in person.

Who needs professionalism program credit card?

01

Professionals seeking career development: The professionalism program credit card is designed for professionals who are looking to enhance their career and professional growth. It offers various benefits and rewards tailored to their needs and aspirations.

02

Individuals attending professional development courses or conferences: Those who frequently attend professional development courses or conferences can benefit from a professionalism program credit card. The card may offer perks such as discounted registration fees, travel rewards, or exclusive access to industry events.

03

Entrepreneurs and business owners: Professionals running their own businesses can find value in a professionalism program credit card. It may provide unique benefits such as business expense tracking, higher credit limits, and specialized rewards for business-related purchases.

In summary, anyone seeking to advance their professional journey, attend development programs, or manage their business-related expenses can benefit from a professionalism program credit card.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is professionalism program credit card?

Professionalism program credit card is a tool used to track and report an individual's participation in professionalism programs.

Who is required to file professionalism program credit card?

Legal professionals such as lawyers and judges are required to file professionalism program credit card.

How to fill out professionalism program credit card?

To fill out a professionalism program credit card, one must provide information on the programs attended, dates, and hours of participation.

What is the purpose of professionalism program credit card?

The purpose of professionalism program credit card is to ensure that legal professionals stay current on ethical and professional standards.

What information must be reported on professionalism program credit card?

Information such as program names, dates attended, and number of hours completed must be reported on professionalism program credit card.

Where do I find professionalism program credit card?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific professionalism program credit card and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in professionalism program credit card?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your professionalism program credit card to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit professionalism program credit card on an iOS device?

You certainly can. You can quickly edit, distribute, and sign professionalism program credit card on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your professionalism program credit card online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Professionalism Program Credit Card is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.