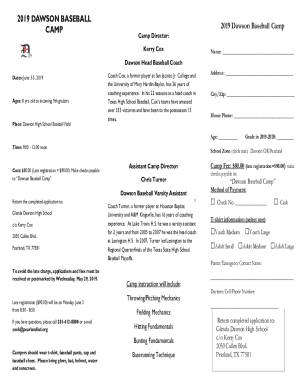

Get the free MicroLOAN South Dakota Loan Program Borrower Application

Show details

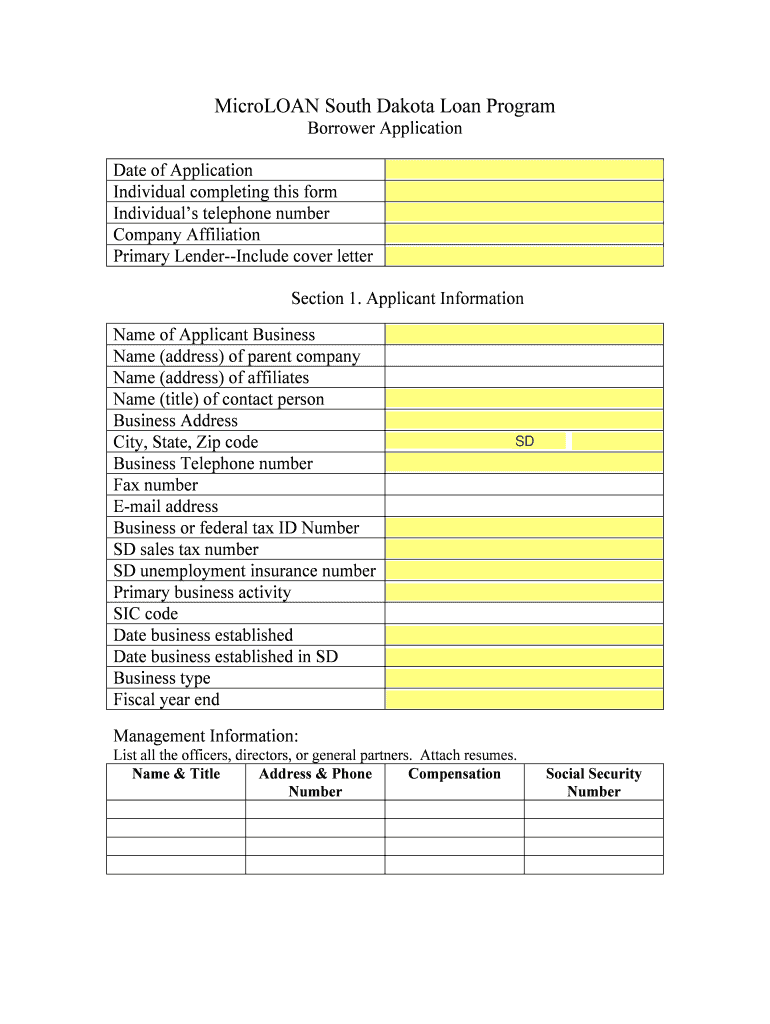

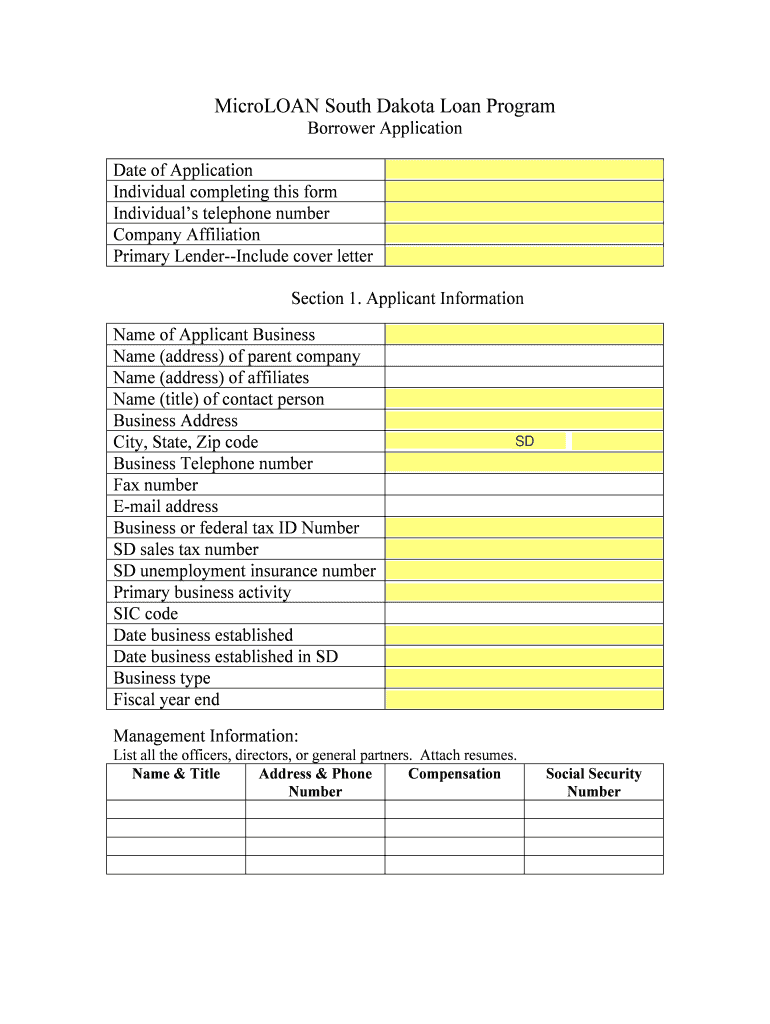

This form is used for applicants seeking microloans through the South Dakota Department of Tourism and State Development. It includes sections for applicant information, purpose of the loan, project

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign microloan south dakota loan

Edit your microloan south dakota loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your microloan south dakota loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing microloan south dakota loan online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit microloan south dakota loan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out microloan south dakota loan

How to fill out MicroLOAN South Dakota Loan Program Borrower Application

01

Obtain the MicroLOAN South Dakota Loan Program Borrower Application form from the official website or local office.

02

Begin by filling out your personal information including your name, address, and contact details.

03

Provide details about your business, such as its name, address, and the type of business structure.

04

Complete the financial information section, including your revenue, expenses, and any existing debts.

05

Describe the purpose of the loan and how you plan to use the funds.

06

Attach necessary documentation, such as business plans, financial statements, and tax returns.

07

Review the application for accuracy and completeness.

08

Submit the application either online or in person, as per the instructions provided.

Who needs MicroLOAN South Dakota Loan Program Borrower Application?

01

Small business owners in South Dakota seeking funding for their business operations.

02

Entrepreneurs looking to start or expand their business.

03

Individuals who require financial assistance for specific business projects.

Fill

form

: Try Risk Free

People Also Ask about

What credit score do you need for a SBA microloan?

It will likely be easier to get an SBA microloan than many other types of business loans. Startups and businesses with bad credit may still qualify for an SBA microloan. What credit score do you need for an SBA microloan? Generally, you'll want to have a credit score of 620 or higher to get an SBA microloan.

How fast can I get a loan with a new LLC?

Many lenders offer LLC loans. Online lenders let you apply online and upload supporting documents to the online dashboard for review. You'll most likely receive a decision in just minutes or as soon as one business day.

Is it hard to get a microloan?

Does everyone get approved for SBA loans? No, SBA loans tend to have strict guidelines for eligibility because businesses have to meet the SBA's as well as the lender's specific criteria. SBA loans are also competitive because they offer relatively low interest rates and long repayment terms.

How long does it take to get approved for a micro loan?

For SBA Microloans, the timeline for your lender's decision can be as quick as 5 – 7 business days but can take up to 30, depending on the strength of your loan application. With SBA 504 loans, it can take up to 45 days from when your lender receives your full application.

Is it hard to get a SBA microloan?

The SBA's turnaround time is 2 to 10 business days, but approval from your chosen lender can take 30 to 60 days. Microloans are loans for smaller amounts of $50,000 or less. As you'll be working directly with an SBA-approved microlender that is often nonprofit, approval timelines will vary.

How long does it take to get approved for a microloan?

Since SBA Microloans offer smaller amounts of funding, the processing and approval of these loans are also typically faster. Approval can take anywhere from one to three months.

How long does it take to get approved for a small personal loan?

Most personal loans take a few business days to be approved. However, turnaround times depend on many factors, including the lender's approval process, how quickly you submit your documentation, and where the funds are deposited.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MicroLOAN South Dakota Loan Program Borrower Application?

The MicroLOAN South Dakota Loan Program Borrower Application is a form that individuals or businesses must complete to apply for microloans through the MicroLOAN South Dakota program, which aims to provide financial assistance to small businesses and entrepreneurs.

Who is required to file MicroLOAN South Dakota Loan Program Borrower Application?

Individuals or businesses seeking financial assistance through the MicroLOAN South Dakota program are required to file the application.

How to fill out MicroLOAN South Dakota Loan Program Borrower Application?

To fill out the MicroLOAN South Dakota Loan Program Borrower Application, applicants must provide personal and business information, describe their loan purpose, and may need to submit supporting documentation to demonstrate their eligibility.

What is the purpose of MicroLOAN South Dakota Loan Program Borrower Application?

The purpose of the MicroLOAN South Dakota Loan Program Borrower Application is to assess the eligibility of applicants for microloans aimed at supporting small business growth and development in South Dakota.

What information must be reported on MicroLOAN South Dakota Loan Program Borrower Application?

The application typically requires reporting personal identification information, business details, the amount of loan requested, the purpose of the loan, and financial projections or business plans.

Fill out your microloan south dakota loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Microloan South Dakota Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.