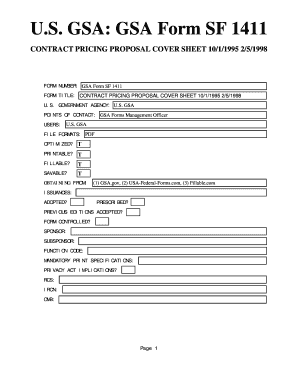

Get the free McHenry County Micro Loan Fund Application - downtowncl

Show details

Este documento es una aplicación para el Fondo de Micro Préstamos del Condado de McHenry, diseñado para apoyar el crecimiento económico y financiar negocios en el condado. Incluye información

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mchenry county micro loan

Edit your mchenry county micro loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mchenry county micro loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mchenry county micro loan online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mchenry county micro loan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mchenry county micro loan

How to fill out McHenry County Micro Loan Fund Application

01

Gather necessary documentation including personal identification, business plan, and financial statements.

02

Download the McHenry County Micro Loan Fund Application form from the official website.

03

Fill out the applicant information section with your personal details.

04

Provide a description of your business, including its mission and services offered.

05

Detail the amount of funding needed and how the funds will be used.

06

Include a projected budget and revenue statement for your business.

07

Review the application for completeness and accuracy.

08

Submit the application along with all required documents by the specified deadline.

Who needs McHenry County Micro Loan Fund Application?

01

Small business owners in McHenry County seeking financial assistance.

02

Entrepreneurs looking to start a new business or expand an existing one.

03

Individuals who may not qualify for traditional loans but have a viable business plan.

04

Businesses needing funding for operational costs, equipment, or inventory.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get approved for a micro loan?

The SBA's turnaround time is 2 to 10 business days, but approval from your chosen lender can take 30 to 60 days. Microloans are loans for smaller amounts of $50,000 or less. As you'll be working directly with an SBA-approved microlender that is often nonprofit, approval timelines will vary.

How to get a micro loan?

To apply for a microloan, work with an SBA-approved intermediary in your area. SBA-approved lenders make all credit decisions and set all terms for your microloan.

How much is a typical micro loan?

Qualified small business owners can borrow up to $50,000. The average microloan is $13,000, ing to the SBA. Interest rates typically range from 8 percent to 13 percent. Although the SBA guarantees these loans, it doesn't fund them.

What qualifies as a micro loan?

In the United States, microcredit has generally been defined as loans of less than $50,000 to people—mostly entrepreneurs—who cannot, for various reasons, borrow from a bank.

Do banks give micro loans?

Microloans are designed for individuals not served by traditional banks and are generally offered by specialized financial services providers often called Microfinance Institutions (MFIs).

What are the requirements for a microloan?

SBA microloan requirements Collateral and/or a personal guarantee from the business owner. Minimum credit score - 620 or higher is good to have, but intermediary lenders may accept lower scores. Owner's Personal finance history. Business finance history, with current cash flow or cash flow projections.

What is micro loan programs?

Key Takeaways. Microlending is the process of connecting a borrower and a lender for a non-traditional, smaller loan. A borrower usually uses microloans if they do not have access to local financial institutions, if they have poor credit, or if they want a loan smaller than what their bank will allow.

How hard is it to get a micro loan?

Depending on your business's finances and credit score, it may be easier to get a microloan from a lender than a term loan from a major bank. Traditional term loans can be hard to qualify for without a stellar credit score, whereas the requirements for a microloan are more flexible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is McHenry County Micro Loan Fund Application?

The McHenry County Micro Loan Fund Application is a formal request for financial assistance through a micro loan program aimed at supporting small businesses in McHenry County, providing them with funds to cover various business-related expenses.

Who is required to file McHenry County Micro Loan Fund Application?

Small business owners located in McHenry County who are seeking financial assistance through the micro loan program are required to file the application.

How to fill out McHenry County Micro Loan Fund Application?

To fill out the McHenry County Micro Loan Fund Application, applicants should gather necessary documentation, complete the application form with accurate business and financial information, and submit it according to the guidelines provided by the program administration.

What is the purpose of McHenry County Micro Loan Fund Application?

The purpose of the McHenry County Micro Loan Fund Application is to provide a structured process for small businesses to access funding that can help them grow, expand operations, or stabilize financial conditions.

What information must be reported on McHenry County Micro Loan Fund Application?

Applicants must report information including their business name, address, contact information, the purpose of the loan, the amount requested, and detailed financial information, including income statements and balance sheets.

Fill out your mchenry county micro loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mchenry County Micro Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.