Get the free Multistate Transactions - Cap on New York Mortgage - Form 1

Show details

This document outlines the maximum amount of indebtedness secured by a mortgage, the treatment of borrowings and repayments, and conditions under which the secured obligations can increase or decrease.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign multistate transactions - cap

Edit your multistate transactions - cap form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your multistate transactions - cap form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit multistate transactions - cap online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit multistate transactions - cap. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

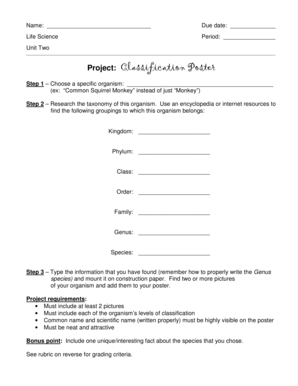

How to fill out multistate transactions - cap

How to fill out Multistate Transactions - Cap on New York Mortgage - Form 1

01

Obtain the Multistate Transactions - Cap on New York Mortgage - Form 1 from the relevant regulatory body or a legal website.

02

Review the instructions provided with the form carefully to understand the requirements.

03

Fill in the personal information section, including your name, address, and contact details.

04

Provide specific information about the mortgage transaction, including loan amount, property address, and loan purpose.

05

Complete the sections detailing the multistate aspects of the transaction, if applicable.

06

Ensure that you include any additional documentation required as per the instructions.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form, ensuring that you are authorized to submit it.

09

Submit the form through the designated channels, either electronically or by mail, ensuring you retain a copy for your records.

Who needs Multistate Transactions - Cap on New York Mortgage - Form 1?

01

Individuals or entities involved in mortgage transactions that cross state lines and need to comply with New York regulations.

02

Real estate professionals requiring clarity on caps for mortgages pertaining to New York properties.

03

Mortgage lenders and brokers handling loans that are subject to multistate regulations.

Fill

form

: Try Risk Free

People Also Ask about

How many pages is a mortgage?

Uniform Instruments are the Fannie Mae/Freddie Mac and Freddie Mac Notes, Riders, and Security Instruments (Deeds of Trust and Mortgages) used when originating Single-Family residential mortgage loans, in all States and U. S. Territories, as identified in the List of Single-Family Uniform Instruments provided on this

What is a security instrument in a mortgage?

Is New York a Mortgage State or a Deed of Trust State? New York is a Mortgage state.

What is a security instrument best defined as?

A security instrument is best defined as: a document that is given by the borrower to hypothecate (pledge) the property to the lender as collateral for the loan.

Is New York a mortgage state?

Mortgages, as it should make sense, are recorded instruments, because they create a lien against the property. Mortgages are usually six to 10 pages in length but are often longer because they typically are accompanied by different riders and addenda, which make specific demands against the type of lien on the land.

When the security instrument is a mortgage foreclosure generally requires a?

When a mortgage is the security instrument, the lender usually has to go through a court action to foreclose. This is called a judicial foreclosure.

What is considered a mortgage security instrument?

Use of Security Instruments Security instruments for regularly amortizing mortgages include the Fannie Mae/Freddie Mac Uniform Mortgages, Deeds of Trust, and Security Deeds. In some cases, the uniform security instruments may have to be adapted to meet the lender's needs or local jurisdictional requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Multistate Transactions - Cap on New York Mortgage - Form 1?

Multistate Transactions - Cap on New York Mortgage - Form 1 is a regulatory form used to report specific financial activities related to mortgage transactions that occur across multiple states, particularly focused on capping transactions in New York.

Who is required to file Multistate Transactions - Cap on New York Mortgage - Form 1?

Entities or individuals involved in multistate mortgage transactions that exceed certain limits and interact with New York mortgage regulations are required to file this form.

How to fill out Multistate Transactions - Cap on New York Mortgage - Form 1?

To fill out the form, you need to provide detailed information regarding the nature of the multistate transactions, participant details, transaction amounts, and comply with specific instructions provided in the form guide.

What is the purpose of Multistate Transactions - Cap on New York Mortgage - Form 1?

The purpose of the form is to ensure compliance with New York's mortgage regulations and to monitor and cap the volume of mortgage transactions that take place across state lines.

What information must be reported on Multistate Transactions - Cap on New York Mortgage - Form 1?

Information required includes transaction amounts, parties involved, the nature of the transactions, compliance with caps and regulations, and relevant financial data as stipulated by New York state law.

Fill out your multistate transactions - cap online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Multistate Transactions - Cap is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.