Get the free Teacher Loan Forgiveness Program - tgslc

Show details

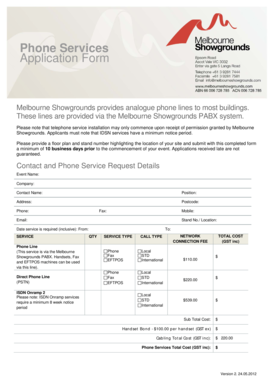

The Teacher Loan Forgiveness Program (TLFP) was established by Congress to encourage individuals to enter and continue in the teaching profession in low-income schools. Borrowers who qualify can have

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign teacher loan forgiveness program

Edit your teacher loan forgiveness program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your teacher loan forgiveness program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing teacher loan forgiveness program online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit teacher loan forgiveness program. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out teacher loan forgiveness program

How to fill out Teacher Loan Forgiveness Program

01

Step 1: Verify eligibility for the Teacher Loan Forgiveness Program by ensuring you are a full-time teacher at a qualifying low-income school or educational service agency for five consecutive years.

02

Step 2: Confirm that your loans qualify for the program; generally, Direct Subsidized and Unsubsidized Loans, as well as Stafford Loans, are eligible.

03

Step 3: Complete the Teacher Loan Forgiveness Application, which can be found on the Federal Student Aid website.

04

Step 4: Gather necessary documentation, such as proof of employment and your loan information.

05

Step 5: Submit the application and any required documentation to your loan servicer for review.

06

Step 6: Follow up with your loan servicer to check the status of your application and ensure all requirements were satisfied.

Who needs Teacher Loan Forgiveness Program?

01

Teachers who work in low-income schools or educational service agencies.

02

Full-time teachers who have been employed for five consecutive years.

03

Teachers with qualifying federal student loans looking for loan forgiveness.

Fill

form

: Try Risk Free

People Also Ask about

Do speech language pathologists qualify for teacher loan forgiveness?

Teacher Loan Forgiveness and Public Service Loan Forgiveness. SLPs are eligible for TLF if they work 5 years for a public school. They are considered special educators.

Who qualifies for the student loan forgiveness program?

If you work full time for a government or nonprofit organization, you may qualify for forgiveness of the entire remaining balance of your Direct Loans after you've made 120 qualifying payments—i.e., at least 10 years of payments. To benefit from PSLF, you need to repay your federal student loans under an IDR plan.

Which is better, teacher loan forgiveness or PSLF?

Given your loan balance, unless you are getting paid exceptionally well for a teacher, PSLF will probably be better. Teacher loan forgiveness is generally better for people with smaller loan balances where the 17.5k will knock out most of the loan amount.

Is teacher loan forgiveness better than PSLF?

PSLF is better for teachers if they have more that the 17500 in loan total and if the teacher does not qualify for the TFL due to their eligibility (meaning they do not teach a subject in high demand for urban and low income schools).

What subjects are covered by teacher loan forgiveness?

To be eligible for up to $17,500 in loan forgiveness, you must meet all the requirements above and teach high school math or science, or special education. If you didn't teach math, science, or special education, you may receive up to $5,000 in loan forgiveness if you meet the other requirements.

Can I get both teacher loan forgiveness and PSLF?

Some people could benefit from both PSLF and TLF. For example, you could receive TLF after 5 years and PSLF after 15 years. This is a rare situation that is ideal for a borrower with a higher loan balance and a lower annual gross income.

What is the success rate of PSLF loan forgiveness?

Applications are approved at roughly the same rate. 2.3% of processed applications for PSLF had been approved since the program's inception. In the program's first year, 0.32% of applications were approved. Prior to 2021, 3.3 million student loan borrowers were eligible to apply for PSLF (though only 6.9% applied).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Teacher Loan Forgiveness Program?

The Teacher Loan Forgiveness Program is a federal program that provides loan forgiveness to qualifying teachers who work in low-income schools or educational service agencies for a specified number of years.

Who is required to file Teacher Loan Forgiveness Program?

Teachers who have qualifying federal student loans and have completed the required teaching service in eligible schools are required to file for the Teacher Loan Forgiveness Program.

How to fill out Teacher Loan Forgiveness Program?

To fill out the Teacher Loan Forgiveness Program application, eligible teachers must complete the Teacher Loan Forgiveness Application form, which can be submitted to their loan servicer along with any required documentation of qualifying service.

What is the purpose of Teacher Loan Forgiveness Program?

The purpose of the Teacher Loan Forgiveness Program is to encourage individuals to pursue and continue a career in teaching, especially in low-income areas, by providing them with relief from student loan debt.

What information must be reported on Teacher Loan Forgiveness Program?

The Teacher Loan Forgiveness Program application requires reporting personal identifying information, the details of qualifying loans, documentation of teaching service, and confirmation that the educator meets the eligibility requirements.

Fill out your teacher loan forgiveness program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Teacher Loan Forgiveness Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.