Get the free Core Principles and Other Requirements for Swap Execution Facilities - cftc

Show details

This document discusses the proposed rules and guidance for the registration and operation of Swap Execution Facilities (SEFs) as mandated by the Dodd-Frank Act. It outlines compliance with core principles,

We are not affiliated with any brand or entity on this form

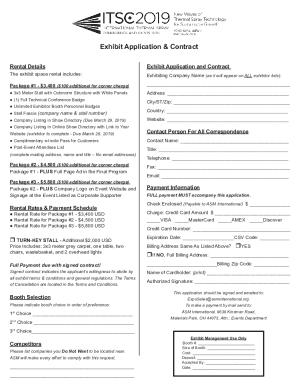

Get, Create, Make and Sign core principles and oformr

Edit your core principles and oformr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your core principles and oformr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit core principles and oformr online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit core principles and oformr. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out core principles and oformr

How to fill out Core Principles and Other Requirements for Swap Execution Facilities

01

Review the definitions and requirements outlined in the Dodd-Frank Act and CFTC regulations regarding Swap Execution Facilities (SEFs).

02

Gather necessary documentation and information on the SEF’s operational framework, including governance, risk management, and compliance structures.

03

Draft a detailed description of the SEF's trading protocols and mechanisms, ensuring they meet the required core principles.

04

Implement and document policies for market participants, including criteria for access and participation in the SEF.

05

Establish processes for trade execution, clearing, and reporting in line with regulatory requirements.

06

Ensure that anti-manipulation and anti-fraud measures are integrated into operational practices.

07

Develop a robust risk management program highlighting measures for monitoring and managing systemic risk.

08

Prepare for regular audits and compliance reviews to assess adherence to core principles.

09

Submit the completed documentation to the CFTC for review and approval.

Who needs Core Principles and Other Requirements for Swap Execution Facilities?

01

Entities that operate Swap Execution Facilities (SEFs) are required to adhere to Core Principles and Other Requirements.

02

Market participants engaging in swap transactions must be aware of these requirements as they impact trading practices.

03

Regulatory bodies, such as the CFTC, need this information to ensure compliance and oversight of the SEF market.

Fill

form

: Try Risk Free

People Also Ask about

Are all swaps required to be transacted on a designated contract market?

Under the trade execution requirement, swap transactions subject to the clearing requirement must be traded on either a DCM or a SEF unless no DCM “makes the swap available to trade” or the transaction is not subject to the clearing requirement under section 2(h)(7) of the CEA.

Are all swaps required to be transacted through SEF?

Are swaps required to be transacted through a swap execution facility? While many swaps now must be traded on a SEF, financial institutions can still transact certain swaps over-the-counter (OTC) directly between one another. But, swap trades that are eligible to be cleared must use a SEF.

How does a SEF work?

How a SEF Works. A Swap Execution Facility (SEF) is a regulated platform that facilitates the trading of swaps and other derivatives. Established under the Dodd-Frank Wall Street Reform and Consumer Protection Act, SEFs aim to increase transparency and reduce systemic risk in the derivatives market.

How does a swap execution facility work?

How a SEF Works. A Swap Execution Facility (SEF) is a regulated platform that facilitates the trading of swaps and other derivatives. Established under the Dodd-Frank Wall Street Reform and Consumer Protection Act, SEFs aim to increase transparency and reduce systemic risk in the derivatives market.

What needs to be traded on a SEF?

As we've explained before, certain types of interest rate and credit default swaps generally must be traded on a SEF, but for other types of swaps – which notably include energy and other commodity-based swaps – a market participant has a choice whether to trade over a SEF, and on which one, or through some other

What must be traded on a SEF?

As we've explained before, certain types of interest rate and credit default swaps generally must be traded on a SEF, but for other types of swaps – which notably include energy and other commodity-based swaps – a market participant has a choice whether to trade over a SEF, and on which one, or through some other

What is a swap facility?

Swap Execution Facilities (SEFs) are trading facilities that operate under the regulatory oversight of the CFTC, pursuant to Section 5h of the Commodity Exchange Act (“the Act”), 7 U.S.C. 7b-3.

What is a swap execution facility order book?

The final regulations require a facility that must register as a SEF to provide a minimum trading functionality, which is defined as an “Order Book.” Order Book means an electronic trading facility as defined in CEA Section 1a(16), a trading facility as defined in CEA Section 1a(51), or a trading system or platform in

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Core Principles and Other Requirements for Swap Execution Facilities?

Core Principles and Other Requirements for Swap Execution Facilities are regulatory guidelines established under the Dodd-Frank Act that define the operational and regulatory framework for Swap Execution Facilities (SEFs). They ensure transparency, promote market integrity, and protect market participants.

Who is required to file Core Principles and Other Requirements for Swap Execution Facilities?

Entities that are registered as Swap Execution Facilities (SEFs) are required to file Core Principles and Other Requirements. This includes organizations that facilitate the trading of swaps and derivatives in accordance with the regulations set forth by the Commodity Futures Trading Commission (CFTC).

How to fill out Core Principles and Other Requirements for Swap Execution Facilities?

To fill out the Core Principles and Other Requirements, SEFs must provide detailed information about their operations, compliance measures, trading platform functionalities, risk management practices, and customer protection policies by following CFTC guidelines.

What is the purpose of Core Principles and Other Requirements for Swap Execution Facilities?

The purpose of Core Principles and Other Requirements is to ensure that SEFs operate in a manner that fosters transparent and efficient swaps trading. They aim to enhance market integrity, reduce systemic risk, and safeguard the interests of market participants.

What information must be reported on Core Principles and Other Requirements for Swap Execution Facilities?

SEFs must report information that includes their trading practices, compliance measures, risk management protocols, business continuity plans, and details regarding their governance structures, as specified by the CFTC.

Fill out your core principles and oformr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Core Principles And Oformr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.