Get the free Wage Execution Exemption and Modification Claim Form - ctb uscourts

Show details

This form is utilized for claiming exemptions from wage execution or for requesting modifications to wage execution amounts in accordance with the United States Bankruptcy Court regulations in Connecticut.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wage execution exemption and

Edit your wage execution exemption and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wage execution exemption and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

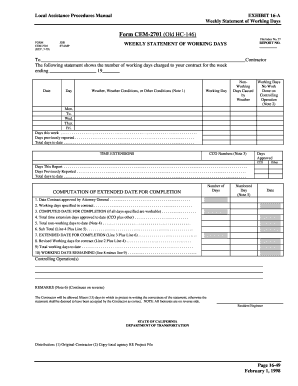

Editing wage execution exemption and online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wage execution exemption and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wage execution exemption and

How to fill out Wage Execution Exemption and Modification Claim Form

01

Obtain the Wage Execution Exemption and Modification Claim Form from your local court or online.

02

Fill out your personal information at the top of the form, including your name, address, and contact information.

03

Provide details about your income, including your employer's name, salary, and any other sources of income.

04

List any exemptions you are claiming, such as financial hardships or necessary living expenses.

05

Attach any supporting documentation that verifies your claims, such as pay stubs, bills, or bank statements.

06

Review the completed form for accuracy and completeness before submission.

07

Submit the form to the appropriate court or agency as directed.

Who needs Wage Execution Exemption and Modification Claim Form?

01

Individuals who are facing wage garnishment due to court judgments.

02

People who believe they qualify for exemptions or modifications based on their financial situation.

03

Debtors looking to protect certain income or assets from being garnished.

Fill

form

: Try Risk Free

People Also Ask about

What is the right to claim exemptions?

If a judgment creditor wants to seize some of your property or wages in order to get paid, and that property is partly or fully exempt, you must file a claim of exemption in order to protect the property.

How to fill out wage garnishment exemption?

You fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. The judge will determine if you qualify for that particular exemption.

Can someone garnish my wages without me knowing?

So, yes, your employer will know that your wages have been garnished. Your immediate supervisor may not, but if there's an HR department, it will know, and whoever in your company has legal authority to sign the response to the court will also know.

What happens if a defendant does not pay a judgment in CT?

There are three types of Executions that you can seek to levy against a defendant that has not paid as ordered in a judgment. There are Property Executions, Wage Executions, and Financial Institution or Bank Executions.

What's the maximum they can garnish from your paycheck?

Federal law limits wage garnishments to 25% of your disposable income (15% for federal student loans) or the amount exceeding 30 times the federal minimum wage, whichever is less. Individuals with a child support order can garnish up to 65% of disposable earnings for child support.

What are the garnishment laws in CT?

In Connecticut, the most that can be garnished from your wages is the lesser of the following two options: 25% of your weekly disposable earnings, or. the amount by which your weekly disposable earnings exceed 40 times the federal hourly minimum wage or the Connecticut minimum fair wage, whichever is greater.

What makes a garnishment invalid?

Grounds to challenge a garnishment typically include: The garnishment being issued in error. The property being garnished is exempt. The garnishee's response to the garnishment is incorrect.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Wage Execution Exemption and Modification Claim Form?

The Wage Execution Exemption and Modification Claim Form is a legal document used to claim exemption from wage garnishment or to request a modification of the amount being garnished due to financial hardship.

Who is required to file Wage Execution Exemption and Modification Claim Form?

Individuals who have had wages garnished and believe they qualify for an exemption or need a modification to the garnishment amount are required to file this form.

How to fill out Wage Execution Exemption and Modification Claim Form?

To fill out the form, individuals must provide personal information, details about their income, expenses, and any relevant financial documentation to support their claim for exemption or modification.

What is the purpose of Wage Execution Exemption and Modification Claim Form?

The purpose of the form is to allow individuals to legally request a review of their wage garnishment situation, enabling them to protect certain income from garnishment or reduce the amount being deducted from their wages.

What information must be reported on Wage Execution Exemption and Modification Claim Form?

The form typically requires reporting personal identification information, income sources and amounts, necessary living expenses, and any dependents claiming support.

Fill out your wage execution exemption and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wage Execution Exemption And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.