Get the free Sample Section 24(c) Report - epa

Show details

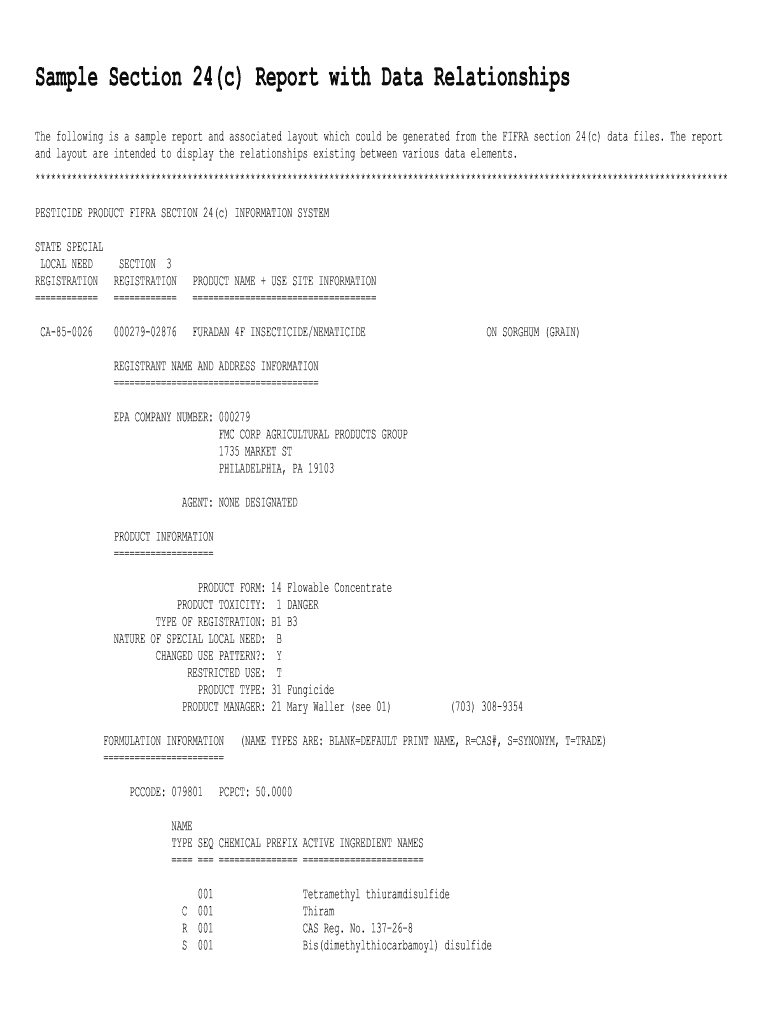

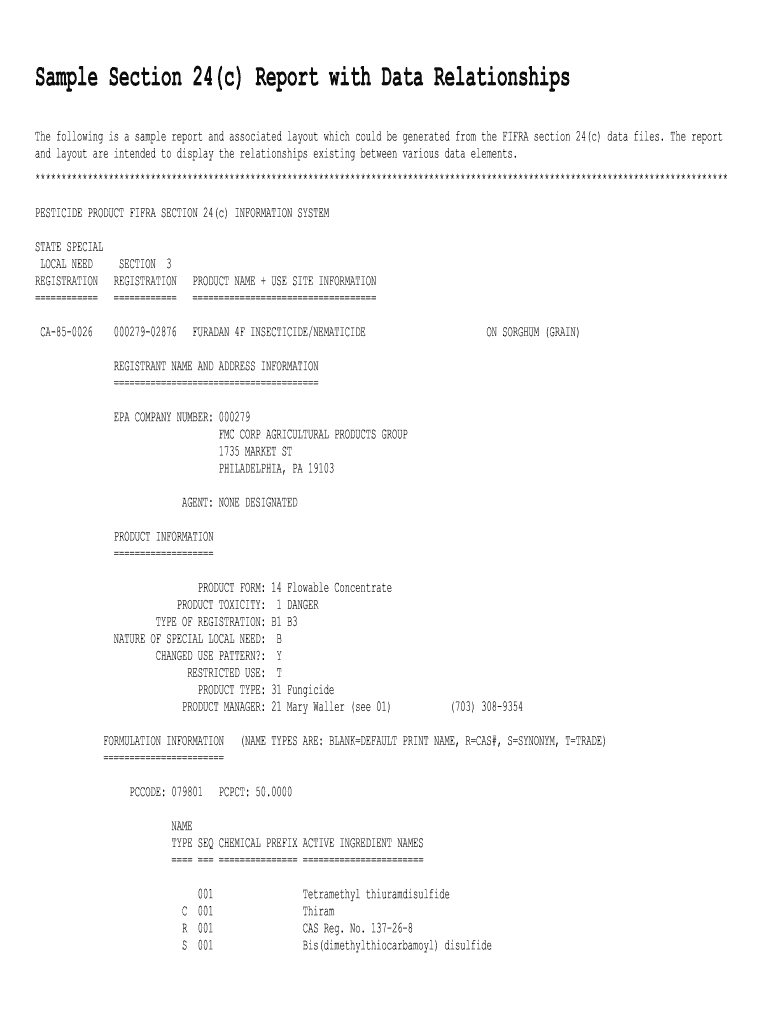

Este es un informe de muestra y un diseño asociado que podría generarse a partir de los archivos de datos de la sección 24(c) de FIFRA. El informe y el diseño están destinados a mostrar las relaciones

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sample section 24c report

Edit your sample section 24c report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample section 24c report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sample section 24c report online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sample section 24c report. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sample section 24c report

How to fill out Sample Section 24(c) Report

01

Begin by downloading the Sample Section 24(c) Report form from the official website.

02

Fill in the requested personal information at the top of the report, including name, address, and contact number.

03

Describe the sample being reported, providing details such as the type of sample, collection date, and any relevant identifiers.

04

Document the location where the sample was collected, ensuring to include precise geographical coordinates if applicable.

05

Include any observations made at the time of sampling, such as environmental conditions or unusual findings.

06

Attach any supporting documents or photographs that may assist in the review of the report.

07

Review the completed report for accuracy and completeness before submission.

08

Submit the report to the designated authority via the preferred method, whether by mail or electronically.

Who needs Sample Section 24(c) Report?

01

Researchers conducting studies that require detailed sample analysis.

02

Organizations involved in environmental monitoring and assessment.

03

Regulatory agencies evaluating compliance with environmental standards.

04

Contractors or consultants providing environmental services.

Fill

form

: Try Risk Free

People Also Ask about

What is office expense schedule C?

Office expenses. Use this category to categorize office supplies you bought during the tax year. Office expenses are small purchases and items you use up quickly, like tape or postage stamps. Items you hold onto for longer periods of time, like computers or file cabinets, are assets.

How to report cost of goods sold on tax return?

If your business produces income by manufacturing, selling, or purchasing goods, you can deduct some of your expenses in the Cost of Goods Sold section of your Schedule C. In order to complete this section, you will need to input your beginning and ending inventory amounts.

What is an example of a Schedule C expense?

Gross. Expenses. Office In Home. Advertising. Mortgage Interest. Printing. Property Taxes. Internet. Business Liability. Electric. Health. Building. Beginning Inventory. Credit Card (business) Equipment. Storage. Vehicle. Building. Standard Mileage Method. Other _ Interest. Hotels. Parking. Insurance. Business. Repairs.

What is considered office expense on Schedule C?

The IRS defines office expenses as office supplies and postage. ingly, a number of different items you purchase could be considered qualifying office expenses. Note that office expenses do not include rent, utilities, payroll or other operating costs.

Can speeding tickets be claimed on Schedule C?

Commuting and other personal automobile expenses such as depreciation, lease payments, maintenance and repairs, gasoline (including gasoline taxes), oil, insurance, parking tickets, traffic fines, or vehicle registration fees are not deductible.

What is the $2500 expense rule?

Simplified tax recordkeeping: Property owners can immediately deduct expenses for purchases like appliances or minor upgrades if they cost $2,500 or less per item.

What is the meaning of office expenses?

Office expenses are intangible or high-cost items, such as furniture or annual software subscription services. Office supplies are usually lower-cost items such as paper, writing utensils and break room supplies. Related: Administrative Expenses (Definition and Example)

How many years can you claim a loss on Schedule C?

The IRS will only allow you to claim losses on your business for three out of five tax years. If you don't show that your business is starting to make a profit, then the IRS can prohibit you from claiming your business losses on your taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Sample Section 24(c) Report?

A Sample Section 24(c) Report is a specific format used for reporting pesticide registration data under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) to facilitate the registration of pesticides in specific states.

Who is required to file Sample Section 24(c) Report?

Pesticide registrants or manufacturers who wish to register their agricultural chemicals or pesticides for use in specific states are required to file a Sample Section 24(c) Report.

How to fill out Sample Section 24(c) Report?

To fill out a Sample Section 24(c) Report, one must provide detailed information about the pesticide, including its label, application guidelines, and environmental impact data, ensuring compliance with state regulations.

What is the purpose of Sample Section 24(c) Report?

The purpose of the Sample Section 24(c) Report is to allow states to approve the use of certain pesticide products with labeling that may differ from federal standards, to address local pest control needs.

What information must be reported on Sample Section 24(c) Report?

The information that must be reported includes the product name, EPA registration number, use sites, target pests, application methods, and any additional labeling instructions specific to the state.

Fill out your sample section 24c report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Section 24c Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.