MO DoR 2175 2011 free printable template

Get, Create, Make and Sign MO DoR 2175

Editing MO DoR 2175 online

Uncompromising security for your PDF editing and eSignature needs

MO DoR 2175 Form Versions

How to fill out MO DoR 2175

How to fill out MO DoR 2175

Who needs MO DoR 2175?

Instructions and Help about MO DoR 2175

Auto licensing Missouri well you can do it the easy way through us just by filling out the form to your right, or you can take these steps on your own Missouri government website new used boat wholesale manufacturers motorcycle and trailer dealers are required to be licensed if they sell six or more vehicles / boats per year application a bona fide place of business deal a surety bond criminal record check and registration fee must be submitted statement of insurance certification required license expires December 31 annually dealer license fees one hundred and fifty dollars motor vehicle dealers $80 marine dealers fees operated on date of application body shop / rebuild her used parts dealer Salvage / dismantle ER or mobile scrap processor must call Jefferson City for information only salvage dealers and dismantles can purchase vehicles from a salvaged pull fee one hundred and thirty dollars per license prorated / designation expiration is June 30 biennially out-of-state salvage dealers must call Jefferson City for information fee $$2525,000 corporate surety bond my auto license States auto licensing Missouri

People Also Ask about

What Missouri tax forms do I need?

Does Missouri have state income tax withholding?

Does Missouri use 1040 or 1040A?

Does Missouri require a state withholding form?

What is a mo-1040?

Why is Missouri personal property tax so high?

What is the county tax in Missouri?

What is the tax rate in Missouri?

Does Missouri have property tax?

How much is property tax in Missouri?

What percentage should be withheld for state taxes?

How much should I withhold for Missouri state taxes?

How do I pay Missouri state income tax?

How much should I withhold for Missouri taxes?

What do I need to include in my Missouri tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MO DoR 2175 from Google Drive?

How can I send MO DoR 2175 for eSignature?

Can I edit MO DoR 2175 on an Android device?

What is MO DoR 2175?

Who is required to file MO DoR 2175?

How to fill out MO DoR 2175?

What is the purpose of MO DoR 2175?

What information must be reported on MO DoR 2175?

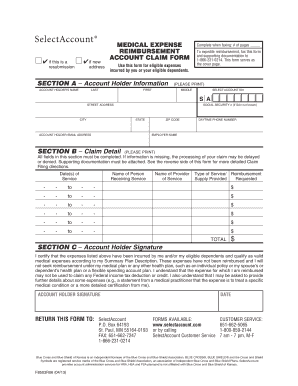

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.