Get the free Indirect Cost Recovery (IDC) Allocation Carry Forward Request Form - busfin uga

Show details

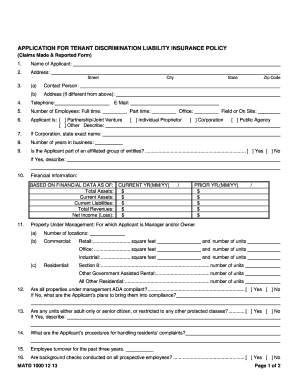

This form is used to request the carry forward of Indirect Cost Recovery (IDC) funds into the next fiscal year. It includes fields for identifying the school or college, department, account number,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indirect cost recovery idc

Edit your indirect cost recovery idc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

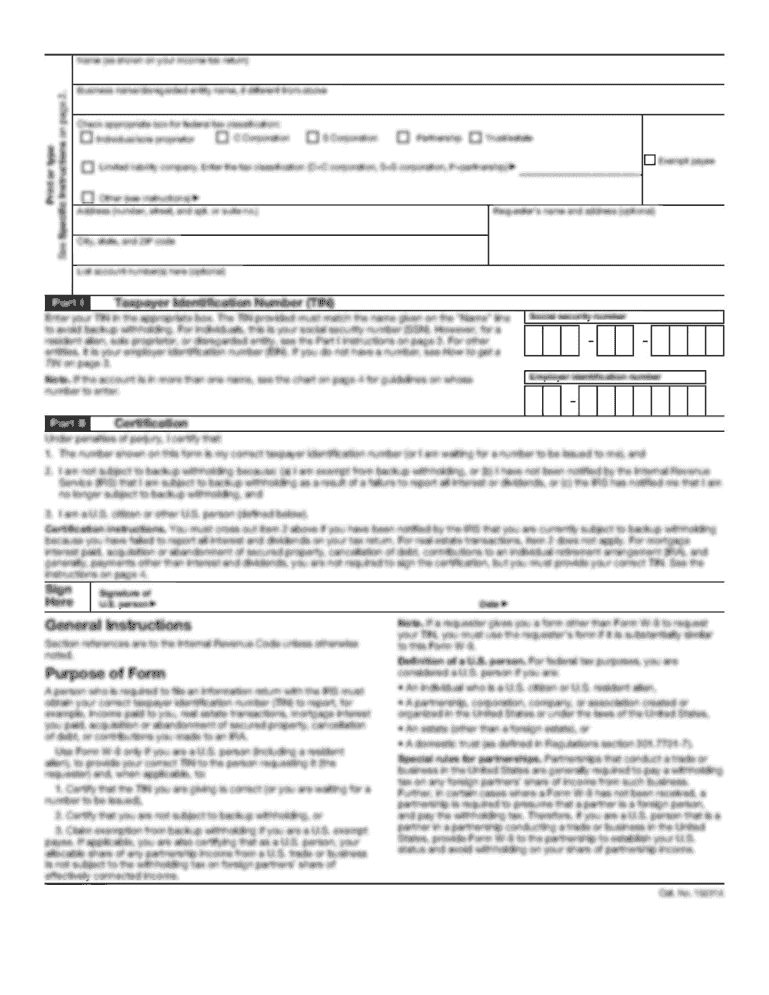

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indirect cost recovery idc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit indirect cost recovery idc online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit indirect cost recovery idc. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indirect cost recovery idc

How to fill out Indirect Cost Recovery (IDC) Allocation Carry Forward Request Form

01

Obtain the Indirect Cost Recovery (IDC) Allocation Carry Forward Request Form from your organization's finance department or website.

02

Read the instructions carefully to understand the eligibility and requirements for filling out the form.

03

Fill in your organization's name and contact information at the top of the form.

04

Specify the fiscal year for which you are requesting the carry forward.

05

Provide a detailed breakdown of the indirect costs that you intend to carry forward.

06

Include any necessary supporting documentation, such as previous approval letters or financial reports, as indicated in the form guidelines.

07

Review the filled-out form for accuracy and completeness, ensuring all sections are addressed.

08

Obtain necessary signatures from authorized personnel as indicated in the form.

09

Submit the completed form to the designated office or individual, as per your organization's submission process.

Who needs Indirect Cost Recovery (IDC) Allocation Carry Forward Request Form?

01

Organizations that receive grants or contracts with indirect cost recovery provisions.

02

Finance or accounting departments within these organizations.

03

Project managers or principal investigators responsible for managing grant funds.

Fill

form

: Try Risk Free

People Also Ask about

Who approves the indirect cost rate?

The cognizant agency for indirect costs means the Federal agency responsible for reviewing, negotiating, and approving cost allocation plans or indirect cost proposals developed under this part on behalf of all Federal agencies.

What is a reasonable indirect cost rate for nonprofits?

For example: F&A Costs/Direct Costs = $50,000/$100,000 = an F&A Rate of 50% Factor in Cost Share Commitments of $20,000: F&A Costs/(Direct Costs + Cost Share Commitments) = $50,000/($100,000 + $20,000) = an F&A Rate of 42%

How to allocate indirect cost?

You can allocate indirect costs by taking your total indirect expenses and dividing them by some sort of allocation measure, like direct labor expenses, direct machine costs, or direct material costs. The formula gives you a ratio.

How do you get a federally approved indirect cost rate?

Indirect costs are allocated using an indirect cost rate (ICR). An organization can either use the de minimis ICR or establish a negotiated ICR with a cognizant federal agency, such as the U.S. Department of Justice. The ICR will then apply across all federal grant programs that an organization operates.

What is an example of indirect cost recovery?

Examples include building maintenance, utilities, administrative support, and compliance services.

How do you get a federal indirect cost rate?

Indirect costs are allocated using an indirect cost rate (ICR). An organization can either use the de minimis ICR or establish a negotiated ICR with a cognizant federal agency, such as the U.S. Department of Justice. The ICR will then apply across all federal grant programs that an organization operates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Indirect Cost Recovery (IDC) Allocation Carry Forward Request Form?

The Indirect Cost Recovery (IDC) Allocation Carry Forward Request Form is a document used by organizations to request the carry forward of unspent indirect cost recovery funds to the next fiscal period.

Who is required to file Indirect Cost Recovery (IDC) Allocation Carry Forward Request Form?

Organizations or departments that have unspent indirect cost recovery funds and wish to carry them forward for future use are required to file this form.

How to fill out Indirect Cost Recovery (IDC) Allocation Carry Forward Request Form?

To fill out the form, organizations need to provide relevant details such as the amount of unspent funds, the specific project or program they pertain to, and justification for the carry forward request.

What is the purpose of Indirect Cost Recovery (IDC) Allocation Carry Forward Request Form?

The purpose of the form is to formally request the allowance to carry forward unused indirect cost funds to ensure that they can be utilized in future projects or fiscal periods.

What information must be reported on Indirect Cost Recovery (IDC) Allocation Carry Forward Request Form?

The form must report information including but not limited to the total amount of unspent indirect cost recovery, the justification for carrying forward these funds, and specifics about the related program or project.

Fill out your indirect cost recovery idc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indirect Cost Recovery Idc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.