Get the free K-1

Show details

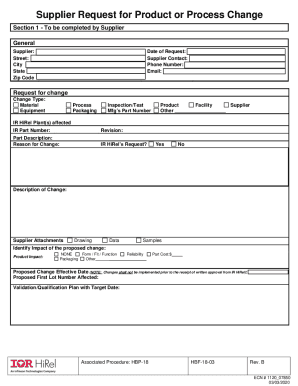

El formulario K-1 se utiliza para reportar la participación de un accionista en los ingresos, pérdidas, deducciones y créditos de una S Corporation en Alabama para el año fiscal 1998. Los accionistas

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign k-1

Edit your k-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your k-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit k-1 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit k-1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out k-1

How to fill out K-1

01

Obtain the K-1 form from the partnership or S corporation.

02

Fill in your name, address, and taxpayer identification number at the top of the form.

03

Fill out the box related to income, deductions, credits, and any other information as provided by the partnership or S corporation.

04

Ensure each section is completed accurately, according to your share of the partnership or S corporation.

05

Consult the instructions provided with the K-1 form if you are unclear about any section.

06

Once completed, use the information on your K-1 when preparing your tax return.

Who needs K-1?

01

Partners in a partnership.

02

Shareholders of an S corporation.

03

Estate and trust beneficiaries receiving income from a partnership or S corporation.

Fill

form

: Try Risk Free

People Also Ask about

What does level one in English mean?

Level A1 corresponds to basic users of the language, i.e. those able to communicate in everyday situations with commonly-used expressions and elementary vocabulary.

What is a 1 level in English?

English level A1 is the first level of English in the Common European Framework of Reference (CEFR), a definition of different language levels written by the Council of Europe. In everyday speech, this level would be called “beginner”, and indeed, that is the official level descriptor in the CEFR, also used by EF SET.

What does K 1 mean in school?

Welcome to Kindergarten / First Grade! In the kindergarten/first grade classroom, children's days are brimming with peer interactions, time for quieter independent work and play, meaning-making, dialogue, choice, and social-emotional experiences.

What are first graders learning in English?

1(5) Developing and sustaining foundational language skills: listening, speaking, reading, writing, and thinking—self- sustained reading. The student reads grade-appropriate texts independently. The student is expected to self-select text and interact independently with text for increasing periods of time.

What is English level 1 English?

English level A1 is the first level of English in the Common European Framework of Reference (CEFR), a definition of different language levels written by the Council of Europe. In everyday speech, this level would be called “beginner”, and indeed, that is the official level descriptor in the CEFR, also used by EF SET.

Is K 1 kindergarten?

If your child is 3 years old and is not able to grip a pencil, we suggest starting from K1. If your child is 4 years old, we suggest starting from K2.

What is English level 1 equivalent to?

Functional Skills English Level 1 is equivalent to a GCSE English grade 1 to 3 (D to G). It's an alternative qualification to GCSE English for adults and GCSE pupils who learn better with practical, real-life examples. Did you find GCSE English difficult and confusing?

What English topics are in level 1?

General English Course at Beginner Level A1 Language skills and systems covered GRAMMARPRONUNCIATION 1.1 On business or holiday? Verb be (I/you) 1.2 Where are you from? Verb be (we/you) Saying names of countries 1.3 How do you spell that? Question words The alphabet 1.4 Speaking and writing 1 more row

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is K-1?

K-1 is a tax form used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts to the IRS, as well as to the individual partners or shareholders.

Who is required to file K-1?

Partnerships, S corporations, estates, and trusts are required to file K-1 forms to report the income and distributions to their partners, shareholders, or beneficiaries.

How to fill out K-1?

To fill out K-1, provide the entity's information, the recipient's information, and report the relevant income, deductions, and credits on the form according to IRS guidelines.

What is the purpose of K-1?

The purpose of K-1 is to ensure that income from pass-through entities is appropriately reported on individual tax returns, allowing the IRS to track tax liabilities.

What information must be reported on K-1?

K-1 must report the entity's name, the recipient's name, their share of income, deductions, credits, and other relevant tax information associated with the partnership, S corporation, estate, or trust.

Fill out your k-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

K-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.