Get the free BORROWER INFORMATION FORM - santacruzpl

Show details

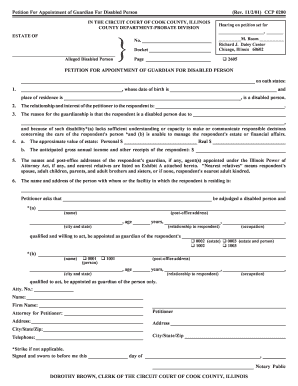

A form to collect personal information from library borrowers including contact details, identification, and preferences for notifications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign borrower information form

Edit your borrower information form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your borrower information form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing borrower information form online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit borrower information form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out borrower information form

How to fill out BORROWER INFORMATION FORM

01

Start by entering your personal details, including your full name.

02

Provide your date of birth in the specified format.

03

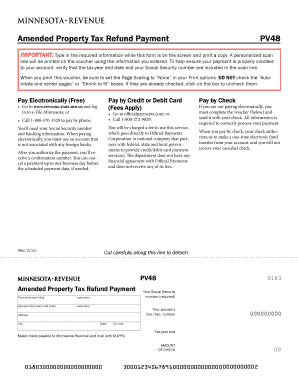

Fill in your Social Security number or Tax Identification number.

04

Enter your current address, including city, state, and zip code.

05

Indicate how long you have lived at your current address.

06

Provide information about your previous addresses if applicable.

07

Fill in your contact information, including your phone number and email address.

08

Include your employment history, such as employer name, job title, and duration of employment.

09

If applicable, provide information regarding your co-borrower or joint applicant.

10

Review all the filled sections for accuracy before submission.

Who needs BORROWER INFORMATION FORM?

01

Individuals applying for a loan, mortgage, or line of credit.

02

Anyone seeking financing for the purchase of a vehicle or other personal loans.

03

Borrowers who are required to disclose their financial information to lenders.

Fill

form

: Try Risk Free

People Also Ask about

What is SBA form 1920?

The purpose of this form is to collect identifying information about the Lender, the Small Business Applicant ("Applicant"), the loan guaranty request, sources and uses of funds, the proposed structure and compliance with SBA Loan Program Requirements, as defined in 13 CFR § 120.10.

What is a 1919 form?

SBA Form 1919, or the Borrower Information Form, is part of a larger application process small businesses go through to obtain 7(a) loans. The seven-page form includes sections for information about the business, ownership interest, uses of funds, and the nature of the business, and was last updated in December 2023.

Is the SBA form 1050 still required?

While this form remains available on the SBA website, the Agency clarified that its use is no longer required for any disbursement of any size 7(a) loan. SOPs 50 10 7 and 7.1 removed the requirement that this form be used to document the first disbursement on Standard 7(a) loans (those over $500,000).

Who needs to fill out the SBA form 1919?

To receive a 7(a) loan, small businesses must fill out Form 1919. A copy of the form must be filled out by each principal stakeholder or owner who controls at least 20% of the business, trustors, and anyone hired to run the business' general operations.

What are the changes to the SBA form 1919?

The new SBA Form 1919 removed questions about past criminal history and replaced them with a question on whether the Applicant or any Associate of the Applicant is presently incarcerated, on probation, on parole or presently subject to an indictment for a felony or any crime involving financial misconduct or false

What is the function of borrowers form?

The purpose of this form is to collect information about the Small Business Applicant (“Applicant”) and its owners, the loan request, existing indebtedness, information about current or previous government financing, and certain other topics.

Is the SBA form 1920 still required?

SBA Form 1920 has been retired as of August 1, 2023.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BORROWER INFORMATION FORM?

The BORROWER INFORMATION FORM is a document used to collect essential details about an individual or entity applying for a loan or credit. It includes personal, financial, and identification information.

Who is required to file BORROWER INFORMATION FORM?

Individuals or businesses seeking to obtain loans or credit from lending institutions are required to file the BORROWER INFORMATION FORM as part of the application process.

How to fill out BORROWER INFORMATION FORM?

To fill out the BORROWER INFORMATION FORM, provide accurate personal details such as name, address, Social Security number, employment information, income details, and any other information requested in the form.

What is the purpose of BORROWER INFORMATION FORM?

The purpose of the BORROWER INFORMATION FORM is to gather necessary information to assess the borrower's creditworthiness and ability to repay the loan, thus facilitating decision-making by the lender.

What information must be reported on BORROWER INFORMATION FORM?

The BORROWER INFORMATION FORM must report information such as the borrower's name, address, Social Security number, income sources, employment details, existing debts, and any collateral offered.

Fill out your borrower information form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Borrower Information Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.