Business or Farm Statement 2012-2025 free printable template

Get, Create, Make and Sign farm statement form

How to edit farm statement online online

Uncompromising security for your PDF editing and eSignature needs

How to fill out farm statement fillable form

How to fill out Business or Farm Statement

Who needs Business or Farm Statement?

Video instructions and help with filling out and completing business farm statement

Instructions and Help about farm statement printable

You hello my name is Miguel Safari with Penn State Extension most farmers use the cash basis income statement a list of cash receipts from which cash disbursements and depreciation are subtracted to arrive a net cash income it is preferred by farmers for its simplicity and for income tax purposes but a cash-based income statement does not reveal through profit as a cruel farm income statement does because these will include revenues for all that was produced during the year even if not all cash was received and all the expenses incurred even if not all were paid you can convert the cash based income statement to an accrual income statement by applying the accrual adjustments to the cash based income statement and this presentation provides the steps to take such conversion the main difference between a cruel and cash basis accounting is the timing when revenue and expenses are recognized cash basis includes the cash transactions only it accounts for revenue only when the money is received and for expenses only when the money is paid out accrual basis recognizes revenues when earned and expenses when incurred even if cash has not been received or no cash has been paid to illustrate the necessary adjustments to move from cash based to a crop based income statements let's look at Richards farm Richard has completed a cash-based income statement in this example receipts are two hundred and fifty thousand dollars of cash sales and one hundred and thirty-five thousand dollars in expenses including a non-cash expense depreciation because it focuses on the cash in hand during the year the value of items produced but not sold will not appear in this statement likewise any expenses that were not paid during the period are excluded from this statement we realized though that we want to have a more precise account of the values produced during this year and that's why we need to adjust this adjustment to accrual basis the farm financial standard Council recommends applying accrual adjustments to your cash based income statement on an annual basis this table shows the necessary adjustments that are calculated by comparing values in the ending balance sheet of the previous year with those in the ending balance sheet of the current year asset and liability values are compared in different ways depending on their category because inventories of grain market livestock and raised breeding livestock were produced in the current accounting period you must subtract the beginning inventory value produced in the previous year from the ending inventory value and add that amount to the corresponding cash receipts regardless of whether the payments for the sale were received in the current or next year in this example ending crop inventories of $30,000 — beginning crop inventories of $25,000 yields a change of $5,000 to be added to the receipts for crops when we adjust disbursements there are two different procedures if expense items were incurred but not paid this is...

People Also Ask about how to farm statement

Can I deduct farm expenses without income?

What is a farm statement of cash flows?

What is Form 4835 used for?

What is the IRS form for farm expenses?

What is a farm statement?

What is the point of a farm income statement?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my farm statement print directly from Gmail?

Can I create an electronic signature for signing my business farm statement form in Gmail?

How do I fill out the business farm statement form form on my smartphone?

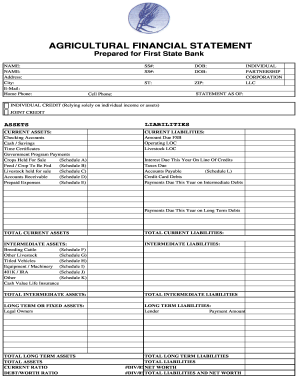

What is Business or Farm Statement?

Who is required to file Business or Farm Statement?

How to fill out Business or Farm Statement?

What is the purpose of Business or Farm Statement?

What information must be reported on Business or Farm Statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.