Get the free Nonsupervised Lender’s Nomination and Recommendation of Credit Underwriter - vba va

Show details

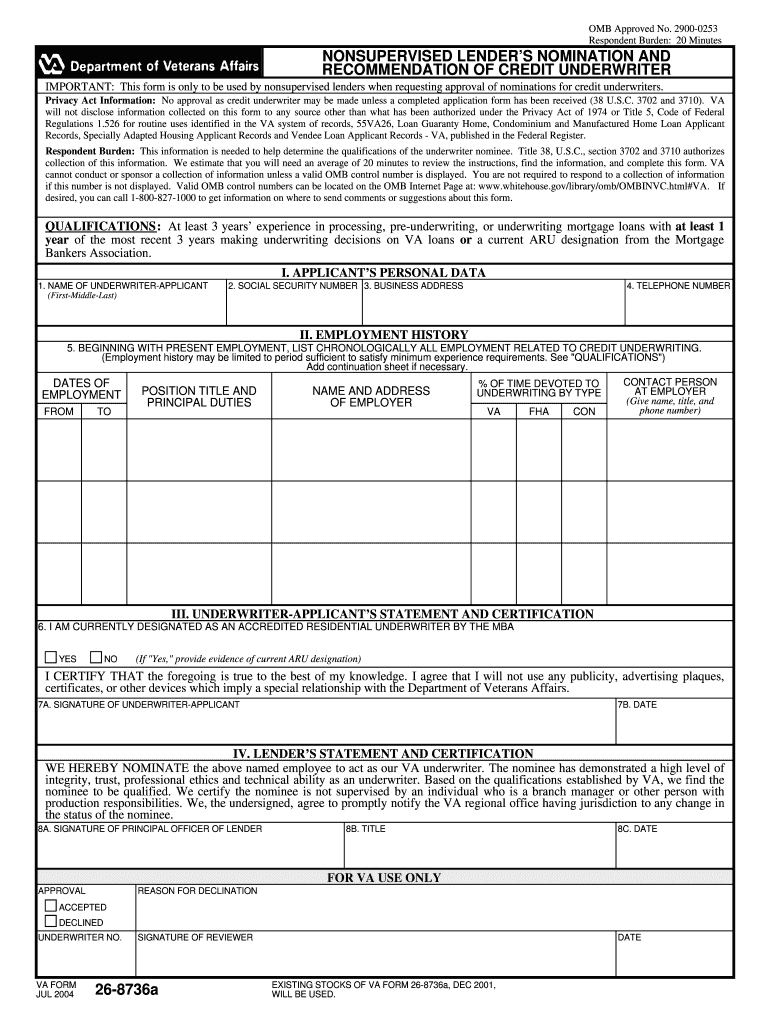

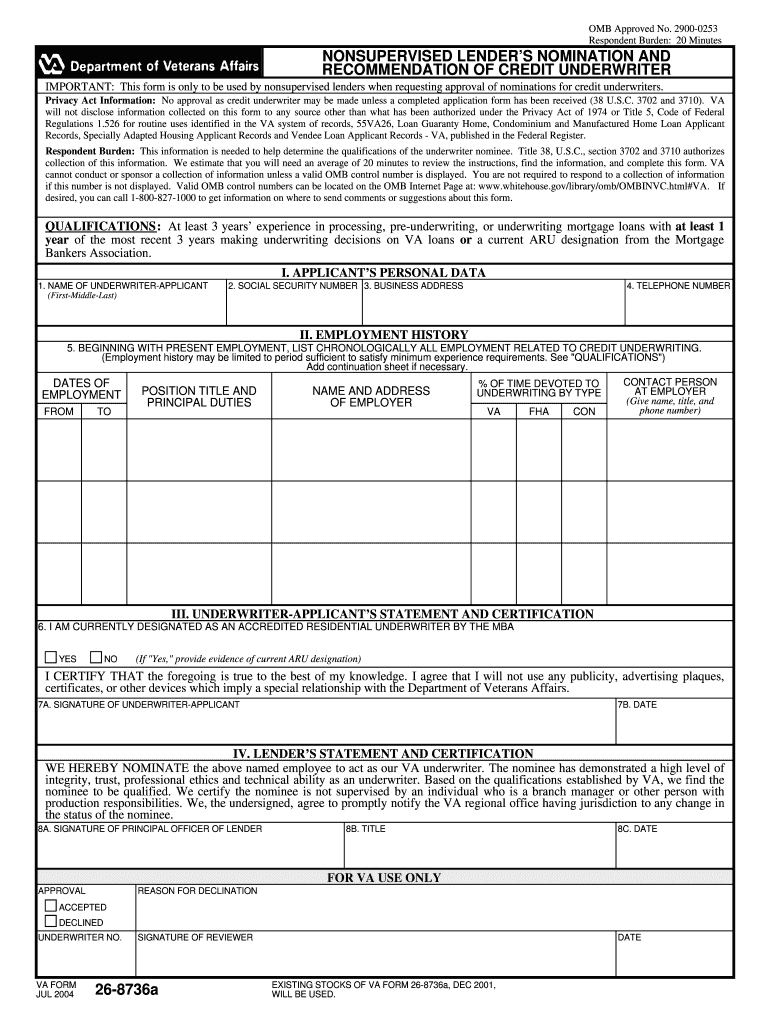

This form is for nonsupervised lenders to request approval of nominations for credit underwriters, detailing qualifications, applicant’s personal data, employment history, and certifications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonsupervised lenders nomination and

Edit your nonsupervised lenders nomination and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonsupervised lenders nomination and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nonsupervised lenders nomination and online

In order to make advantage of the professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nonsupervised lenders nomination and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nonsupervised lenders nomination and

How to fill out Nonsupervised Lender’s Nomination and Recommendation of Credit Underwriter

01

Obtain the Nonsupervised Lender’s Nomination and Recommendation of Credit Underwriter form.

02

Fill in the lender's details in the designated sections, including name, address, and contact information.

03

Provide information about the loan type and amount being underwritten.

04

Complete the section detailing the qualifications and experience of the nominated credit underwriter.

05

Include any supporting documents if required, such as financial statements or a resume of the underwriter.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form to the relevant authority or organization as specified in the instructions.

Who needs Nonsupervised Lender’s Nomination and Recommendation of Credit Underwriter?

01

Lenders looking to nominate a credit underwriter for loans they are managing.

02

Financial institutions that require appointed underwriters for their loan approval processes.

03

Any organization involved in the lending process that needs to formally recommend a credit underwriter.

Fill

form

: Try Risk Free

People Also Ask about

What is the automated underwriting system for VA loans?

VA lenders generally rely on an “Automated Underwriting System,” or AUS, to determine a buyer's preapproval status. An AUS is a computer program that instantly evaluates a buyer's eligibility based on a variety of factors. Not every qualified borrower will obtain AUS approval.

What would cause an underwriter to deny a VA loan?

Increased debt is a common reason for mortgage denials. Even with a good credit score, how much money you owe in relation to your income is a major consideration for lenders. Before reapplying, try to lower your debt where possible—whether that be paying off high-interest credit cards or auto loans.

How long does it take for underwriters to approve a VA loan?

Veterans United's underwriting process typically takes around 45 days to fully complete. However, your loan underwriting timeline may vary depending on a variety of factors. Reach out to a Veterans United VA loan expert today at 1-800-884-5560 about your specific situation.

How often do underwriters deny VA loans?

Common Reasons for VA Loan Denial in Underwriting VA loan denial isn't uncommon, but your odds are generally better with a VA loan. ing to HMDA data, 12.93% of VA loan applications received a denial in 2022, compared to 17.29% of FHA loans and 17.9% of conventional loans.

Does the VA have underwriters?

a. VA's underwriting standards are intended to provide guidelines for underwriters. Decisions must be based on sound application of the standards, and underwriters are expected to use good judgment and flexibility in applying underwriting guidelines.

How to become a VA approved underwriter?

at least 3 years experience in processing, pre-underwriting or underwriting mortgage loans, and. at least 1 year of the most recent 3 years must have included making underwriting decisions on VA loans, or. a current AMP (Accredited Mortgage Professional) designation from the Mortgage Bankers Association (MBA), or.

What will cause VA loan to get disapproved?

Common Reasons VA Loans are Denied Poor credit. Significant changes in credit. Income outside the qualification range. High debt-to-income ratio.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Nonsupervised Lender’s Nomination and Recommendation of Credit Underwriter?

Nonsupervised Lender’s Nomination and Recommendation of Credit Underwriter is a process where nonsupervised lenders nominate and recommend credit underwriters for assessing creditworthiness and making lending decisions.

Who is required to file Nonsupervised Lender’s Nomination and Recommendation of Credit Underwriter?

Nonsupervised lenders who engage in loan origination and are not regulated as supervised lenders are required to file this nomination and recommendation.

How to fill out Nonsupervised Lender’s Nomination and Recommendation of Credit Underwriter?

To fill out the form, provide the lender's information, details of the nominated credit underwriter, and relevant qualifications or experience of the underwriter in the specified sections.

What is the purpose of Nonsupervised Lender’s Nomination and Recommendation of Credit Underwriter?

The purpose is to streamline the process of credit assessment by allowing nonsupervised lenders to nominate qualified credit underwriters, ensuring that lending decisions are made by experienced professionals.

What information must be reported on Nonsupervised Lender’s Nomination and Recommendation of Credit Underwriter?

Information required includes the lender's name and contact details, the nominated underwriter's name and qualifications, a description of the underwriter's relevant experience, and any supporting documentation that verifies their credentials.

Fill out your nonsupervised lenders nomination and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonsupervised Lenders Nomination And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.