Get the free Schedule WD - revenue wi

Show details

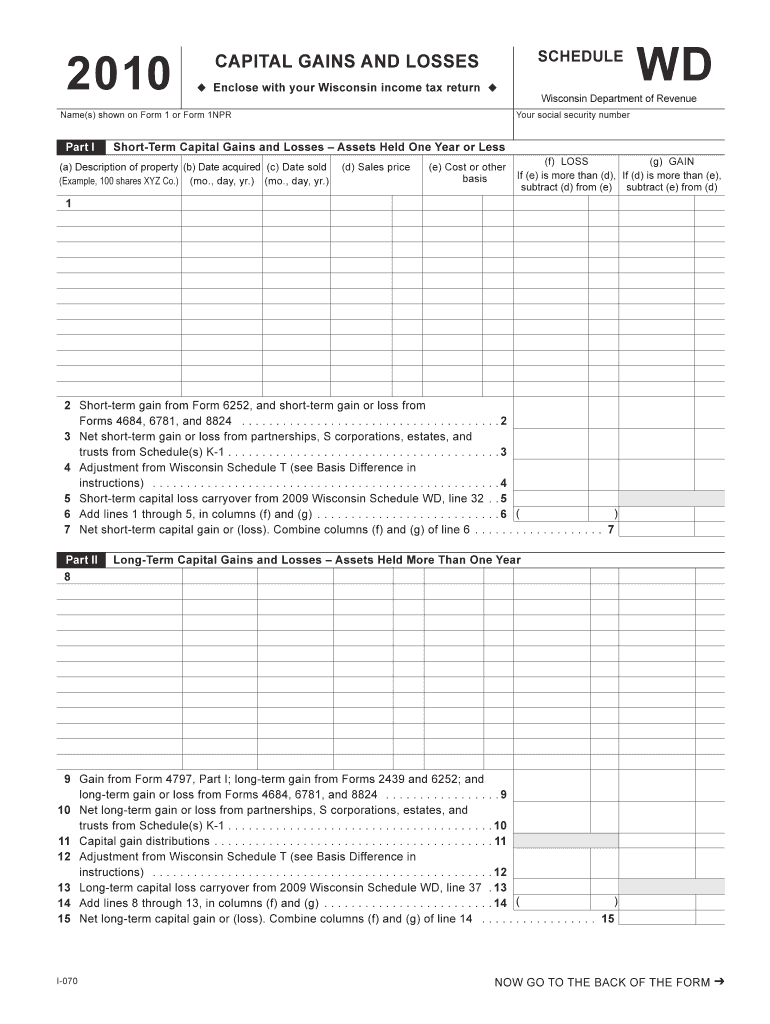

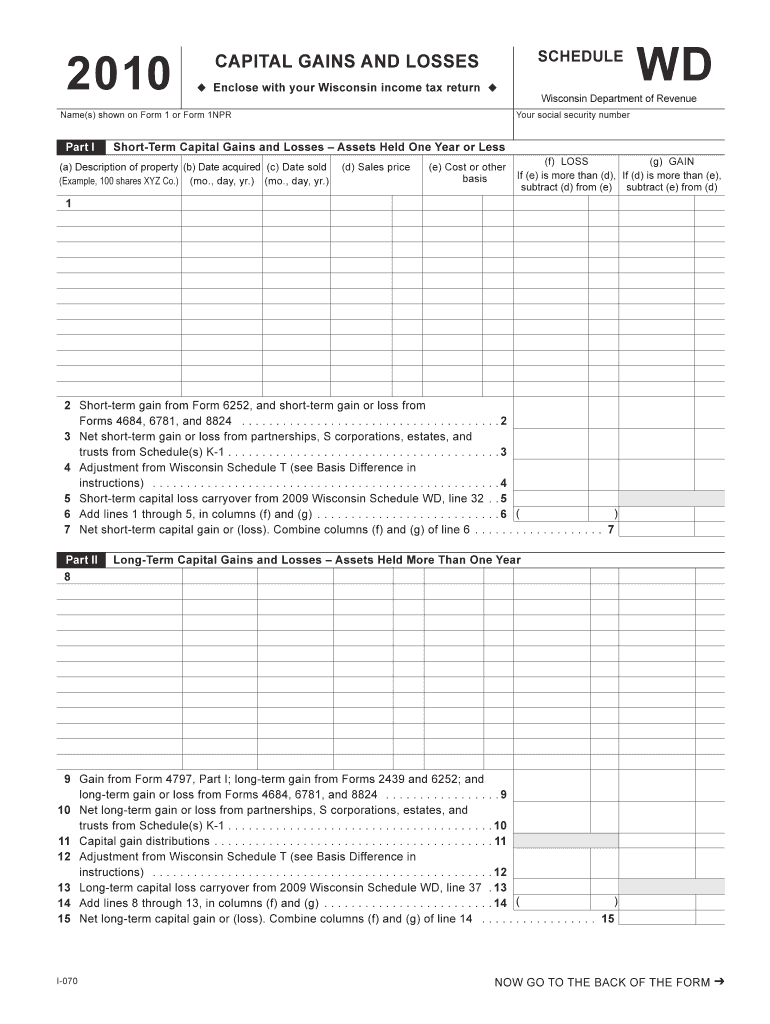

This form is used to report capital gains and losses for Wisconsin income tax purposes, including details on short-term and long-term capital assets.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule wd - revenue

Edit your schedule wd - revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule wd - revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule wd - revenue online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit schedule wd - revenue. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule wd - revenue

How to fill out Schedule WD

01

Obtain a copy of Schedule WD from the relevant tax authority or download it from their website.

02

Begin by filling out your identifying information at the top of the form, including your name and taxpayer identification number.

03

Review the instructions provided with Schedule WD to understand the purpose of the form and the required information.

04

Complete each section of the schedule by providing the requested details, such as income, deductions, and any relevant calculations.

05

Double-check your entries for accuracy and completeness before moving on to the next section.

06

If applicable, attach any necessary supporting documents to your completed Schedule WD.

07

Review the entire form one last time for errors or omissions.

08

Submit Schedule WD along with your tax return by the specified deadline.

Who needs Schedule WD?

01

Individuals or businesses required to report specific income, deductions, or credits related to wages and compensation.

02

Taxpayers who have obligations under certain tax regulations requiring them to disclose wage information.

Fill

form

: Try Risk Free

People Also Ask about

Do you pay capital gains after 65?

However, since this tax break was dropped in 1997, there is no capital gains tax exemption specifically for seniors. This means right now, the law doesn't allow for any exemptions based on your age.

Does Wisconsin tax long-term capital gains?

Wisconsin taxes capital gains as income. Long-term capital gains can apply a deduction of 30% (or 60% for capital gains from the sale of farm assets). The capital gains tax rate reaches 7.65%.

What is the state tax on long-term capital gains?

No preferential rates: Unlike federal taxes, California does not offer lower tax rates for long-term capital gains. Ordinary income tax rates apply: Capital gains are subject to the same progressive tax rates as regular income, which range from 1% to 13.3%

What is a schedule WD?

Capital Gain/Loss Addition: If your federal adjusted gross income takes into account capital gains and/or losses, you are required to complete Schedule WD. Schedule WD dictates whether any capital gain/loss addition needs to be recorded.

What is the schedule SB in Wisconsin?

Schedule SB is used to report differences between federal and Wisconsin income. These differences are called modifications and may affect the amount you report as a subtraction modification on line 6 of Form 1.

How to avoid capital gains tax in Wisconsin on home sale?

If you meet the ownership and use tests, the sale of your home qualifies for exclusion of $250,000 gain ($500,000 if married filing a joint return). This exclusion applies if during the 5-year period ending on the date of the sale, you: Owned the home for at least 2 years (the ownership test), and.

Is the 30 capital gain exclusion in Wisconsin?

Federal treatment: Capital gains are generally fully taxable for federal purposes. Wisconsin treatment: Wisconsin law generally allows a deduction for 30% of the net capital gain from assets held more than one year. The deduction is 60% of net long-term capital gain from farm assets held more than one year.

How are long-term capital gains taxed in Wisconsin?

Here, capital gains are taxed as ordinary income, but there's a 30% deduction allowed for net capital gain from assets held more than one year, or long term. For farm assets held more than one year, the deduction is 60% of the net capital gain.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule WD?

Schedule WD is a form used by taxpayers to report the foreign earned income exclusion and the housing exclusion or deduction for U.S. citizens and resident aliens living and working abroad.

Who is required to file Schedule WD?

U.S. citizens and resident aliens who claim the foreign earned income exclusion or the housing exclusion or deduction must file Schedule WD.

How to fill out Schedule WD?

To fill out Schedule WD, taxpayers must provide information regarding their foreign earned income, the dates of their foreign residency, their housing expenses, and any applicable exclusions or deductions.

What is the purpose of Schedule WD?

The purpose of Schedule WD is to allow taxpayers to accurately report their foreign earned income and claim the deductions or exclusions they are entitled to, thereby potentially reducing their U.S. taxable income.

What information must be reported on Schedule WD?

Schedule WD requires reporting foreign earned income, details about the foreign residency period, total housing expenses, and any amounts qualifying for exclusion or deduction.

Fill out your schedule wd - revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule Wd - Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.