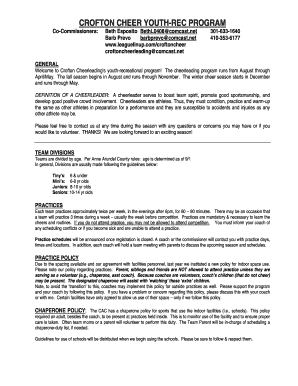

Get the free FINRA Property & Casualty Insurance

Show details

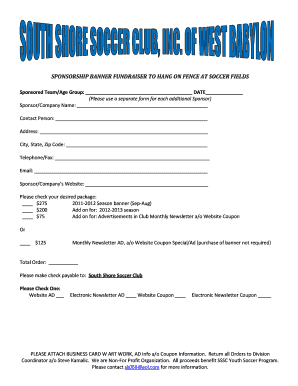

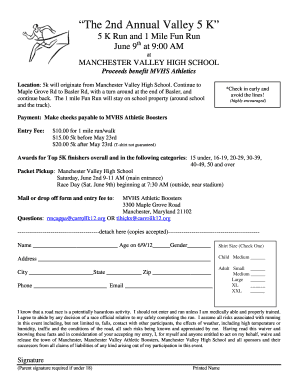

This document serves as an application for a Business Owner’s Policy, intended for businesses to protect against potential losses and liabilities while allowing customization of coverage options

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign finra property casualty insurance

Edit your finra property casualty insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your finra property casualty insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing finra property casualty insurance online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit finra property casualty insurance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out finra property casualty insurance

How to fill out FINRA Property & Casualty Insurance

01

Obtain the FINRA Property & Casualty Insurance application form.

02

Carefully read the instructions provided on the form.

03

Fill out your personal and business information, including your name, address, and contact information.

04

Provide details about your business activities and operations to assess coverage needs.

05

Indicate the types of property and casualty coverage you are applying for, such as liability, property damage, or worker's compensation.

06

Disclose any previous claims or risk factors associated with your business.

07

Review and double-check all information for accuracy and completeness.

08

Submit the completed application form along with any required documentation or fees to the appropriate FINRA office.

Who needs FINRA Property & Casualty Insurance?

01

Individuals or businesses involved in property management or real estate.

02

Insurance agents and brokers who deal with property and casualty insurance.

03

Financial advisors offering property and casualty insurance as part of their services.

04

Any enterprise requiring coverage for potential liabilities and damages.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean to be certified by FINRA?

Alongside the SEC, FINRA oversees U.S. member broker-dealers and their personnel, including individuals who recommend or sell securities products to the public. FINRA's mission is protecting you, the investor, and ensuring the integrity of our country's securities markets.

What is the FINRA rule 6100?

FINRA Rule 6100 Series (Quoting and Trading in NMS Stocks) is related to a set of rules concerning NMS stocks. Tier 1 stocks are those included in the S&P 500 index, Russell 1000 index and some exchange-traded funds. Tier 2 stocks all NMS securities that are not Tier 1.

What does the FINRA do?

FINRA Regulates Broker-Dealers, Capital Acquisition Brokers and Funding Portals. A Broker-Dealer is in the business of buying or selling securities on behalf of its customers or its own account or both. A Capital Acquisition Broker is a Broker-Dealer subject to a narrower rule book.

What is Property & Casualty P&C insurance?

Property and casualty insurance, commonly referred to as P&C insurance, is a broad term that refers to various types of insurance. In simple terms, it's insurance coverage that helps protect your assets, including the property you own. 4 min to read.

Which insurance policy does not require FINRA?

Errors and Omission (E&O) Insurance coverage is not required by FINRA, and many firms simply do not carry this type of insurance.

What is FINRA in insurance?

FINRA-certified brokers have registered and undergone stringent Qualification Exams. They are also required to complete ongoing Continuing Education (CE) programs each year to ensure industry standards and practices are maintained. It's all part of our shared goal of ensuring market integrity and investor protection.

What does FINRA mean in insurance?

The Financial Industry Regulatory Authority (FINRA) is an independent, nongovernmental organization that writes and enforces the rules governing registered brokers and broker-dealer firms in the United States.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FINRA Property & Casualty Insurance?

FINRA Property & Casualty Insurance refers to the insurance coverage necessary for firms regulated by the Financial Industry Regulatory Authority (FINRA) to protect against various risks related to property and liability.

Who is required to file FINRA Property & Casualty Insurance?

Registered broker-dealers that conduct business in the financial markets are required to file for FINRA Property & Casualty Insurance to ensure compliance with regulatory requirements and safeguard operations.

How to fill out FINRA Property & Casualty Insurance?

To fill out FINRA Property & Casualty Insurance, firms need to complete the designated forms provided by FINRA, ensuring all fields are accurately completed and relevant documentation is attached for the coverage being requested.

What is the purpose of FINRA Property & Casualty Insurance?

The purpose of FINRA Property & Casualty Insurance is to provide financial protection against potential losses due to property damage, liability claims, and other unforeseen events that could impact a firm’s operations and assets.

What information must be reported on FINRA Property & Casualty Insurance?

On FINRA Property & Casualty Insurance, firms must report details such as the type of insurance coverage, limits of liability, policy terms, premium amounts, and any claims that have been filed.

Fill out your finra property casualty insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Finra Property Casualty Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.