Get the free Self-Employment Q and A: Disabled Veterans and Self-Employment

Show details

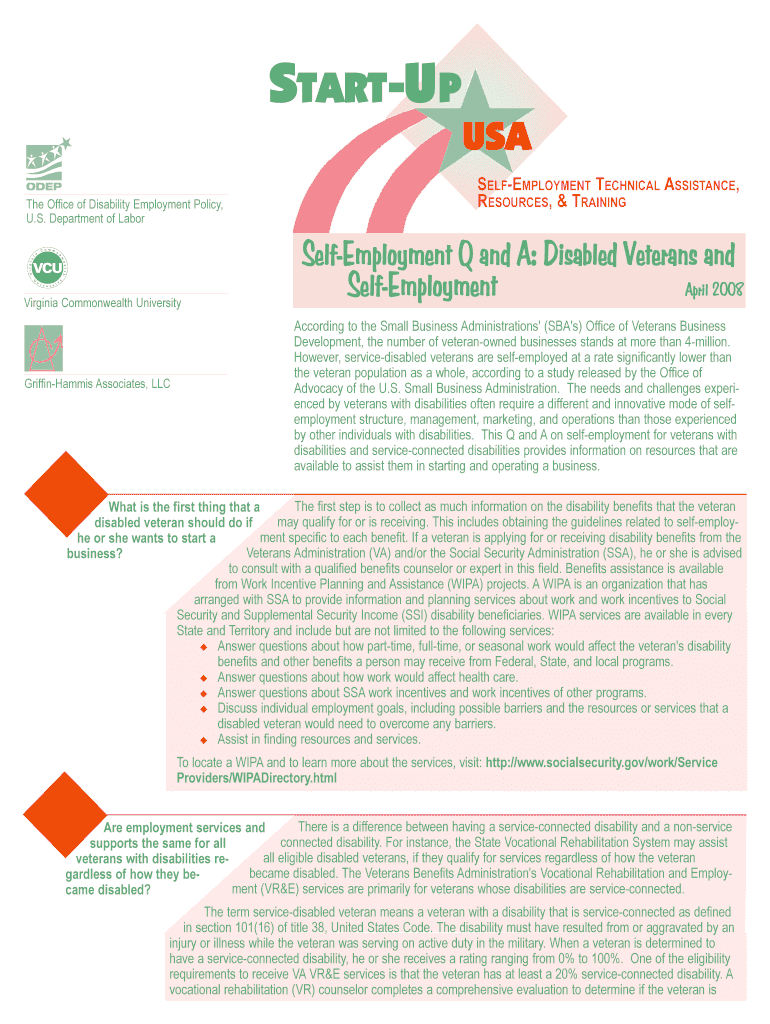

This document provides essential information for disabled veterans looking to pursue self-employment, including available resources, benefits, and assistance programs to help them start and operate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self-employment q and a

Edit your self-employment q and a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self-employment q and a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self-employment q and a online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit self-employment q and a. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self-employment q and a

How to fill out Self-Employment Q and A: Disabled Veterans and Self-Employment

01

Gather necessary documentation: Collect all relevant information such as your Veteran status, disability rating, and any previous employment records.

02

Determine your business idea: Decide on the type of self-employment you are interested in pursuing.

03

Fill out the application form: Provide accurate and truthful information in the Self-Employment Q and A form, including your business plan and financial projections.

04

Explain your disability's impact: Describe how your disability affects your ability to work and how self-employment accommodates your needs.

05

Review your submission: Double-check all entries for accuracy and completeness before submitting.

06

Submit the application: Send your completed Self-Employment Q and A form to the appropriate department or office.

Who needs Self-Employment Q and A: Disabled Veterans and Self-Employment?

01

Disabled veterans who are looking to start their own business or are considering self-employment as an option for income.

02

Veterans seeking to understand the resources and support available for self-employment opportunities.

03

Individuals who need guidance on how to manage their disability while pursuing self-employment.

Fill

form

: Try Risk Free

People Also Ask about

How long do you have to be employed to use a VA loan?

A national expert in VA lending and author of “The Book on VA Loans,” Chris has been featured in The New York Times, the Wall Street Journal and more. Veterans: Check your 0% down eligibility today! VA loan lenders typically require two years of consistent income, but every employment scenario is different.

Does VA require 2 years of self-employment?

The VA prefers the applicant to be self-employed for a two-year period. The underwriter may consider a candidate that has a full year of documented self-employment and past regular employment or education in the same line of work.

Can you be 100% disabled veteran and still work?

So, can you work while receiving 100 percent disability from the VA? The answer is yes. Your VA disability compensation is not affected by employment status. This means that you can earn any amount of income, whether it be from part-time or full-time work, without losing your benefits.

What are the requirements for a VA loan for self-employed people?

Can You Get a VA Loan if You're Self-Employed? Yes, in most cases self-employed applicants will need two years of tax returns and other critical business documents to verify their income and contend for a VA loan.

Does VA require 2 year employment history?

If the lender includes the borrower's income, an explanation of why income of short-term employment was used, must be documented on VA Form 26-6393 , Loan Analysis. Generally, such income cannot be considered stable and reliable unless it has continued and is verified for 2 years.

Does VA require 2 years tax returns for rental income?

Lenders commonly want to see a two-year history of rental income on tax returns in order to count this as effective income toward mortgage qualification. Some lenders might need lease agreements and other documentation, while others won't.

Does self-employment affect disability benefits?

How Does Self-Employment Affect Social Security Disability Benefits? Self-employment impacts eligibility for Social Security Disability Insurance (SSDI) because applicants must meet the SSA's requirements for both income and work activity, known as substantial gainful activity (SGA).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Self-Employment Q and A: Disabled Veterans and Self-Employment?

Self-Employment Q and A: Disabled Veterans and Self-Employment is a resource designed to provide information and guidance to disabled veterans regarding the options, benefits, and considerations involved in pursuing self-employment.

Who is required to file Self-Employment Q and A: Disabled Veterans and Self-Employment?

Disabled veterans who are considering or currently engaged in self-employment activities may be required to file this information to access certain benefits or to comply with reporting standards.

How to fill out Self-Employment Q and A: Disabled Veterans and Self-Employment?

To fill out Self-Employment Q and A: Disabled Veterans and Self-Employment, individuals should provide accurate details about their business activities, income sources, expenses, and any other relevant financial information as required.

What is the purpose of Self-Employment Q and A: Disabled Veterans and Self-Employment?

The purpose of Self-Employment Q and A: Disabled Veterans and Self-Employment is to educate disabled veterans on self-employment opportunities, facilitate access to resources, and ensure compliance with reporting obligations.

What information must be reported on Self-Employment Q and A: Disabled Veterans and Self-Employment?

Information that must be reported includes details about business structure, income earned, business-related expenses, and any other pertinent financial data that affects the veteran's eligibility for benefits.

Fill out your self-employment q and a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self-Employment Q And A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.