AZ Credit Card Authorization for Payment of Fines free printable template

Show details

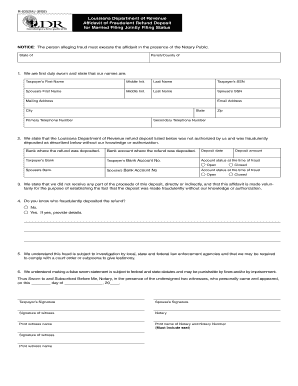

Reset Kingman/Cerbat Justice Court P. O. Box 29 Kingman Az. 86402 928-753-0710 Fax 928-753-7840 CREDIT CARD AUTHORIZATION FOR PAYMENT OF FINES PLEASE PRINT Cardholder Name Cardholder Phone Credit Card Billing Address City State Zip Credit Card 3 Digit Security Code on Back of Expiration Date I Authorize the Kingman Justice Court to Charge the above Credit Card in the Amount of Defendant s Name Case Number / Citation Cardholder Signature Date When...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign arizona authorization fines kingman form download

Edit your kingman municipal court pay fines form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona payment fines cerbat online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arizona credit card authorization fines form search online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit az card authorization fines printable form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out arizona credit payment kingman form

How to fill out AZ Credit Card Authorization for Payment of Fines

01

Obtain the AZ Credit Card Authorization form from the relevant agency or website.

02

Fill in your personal details including name, address, and phone number.

03

Enter the credit card information, including card number, expiration date, and security code.

04

Specify the amount to be authorized for payment of fines.

05

Sign and date the form indicating your consent.

06

Submit the completed form as instructed (mail, email, or in person).

Who needs AZ Credit Card Authorization for Payment of Fines?

01

Individuals who have received fines that they wish to pay using a credit card.

02

Business or organizations that are responsible for paying fines on behalf of employees.

03

Any individual needing to formalize credit card payment for legal or financial penalties.

Fill

credit card authorization form cerbat

: Try Risk Free

People Also Ask about arizona card authorization payment fines print

What should my withholding percentage be in Arizona?

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

What is the new tax form for Arizona 2023?

Effective January 31, 2023, employers must provide Arizona employees with an updated Form A-4, which reflects the State's lower individual income tax rates. Arizona employers are required to make Arizona Form A-4 available to employees at all times and to inform them of Arizona's withholding election options.

What is the Arizona form 309?

Purpose of Form Use Arizona Form 309 to figure your credit for taxes paid to Arizona and another state or country on the same income. If claiming a credit for more than one state or country, complete a separate Form 309 for each state or country.

What is form 345 for Arizona?

Arizona Form 345 (Credit for New Employment) - 2022 Arizona TaxFormFinder.

Who qualifies for the Arizona property tax credit?

As for the property tax credit, individuals may qualify for a credit if they were residents of Arizona the entire year and meet all of the following criteria: Paid property taxes or rent on a main home in Arizona during the tax year.

How does the AZ private school tax credit work?

The Arizona Private School Tuition Tax Credit allows Arizona taxpayers to give to AZTO and receive a dollar-for-dollar tax credit against your Arizona Income Taxes. AZTO then issues tuition awards to eligible students attending one of AZTO's participating schools.

What is the Arizona private school tax credit for 2023?

The Original Credit was signed into law in 1997. The 2023 contribution limits are $1,308 for those filing married jointly and $655 for individuals. Arizona Form 323 is used to claim this credit. All K-12 applicants attending one of AZTO's participating schools are eligible.

How do I claim my Arizona tax credit?

To qualify for the Arizona Charitable Tax Credit, donations must be made to state-certified QCOs or QFCOs (Chapter 3). The deadline for making a donation and claiming a tax credit under the AZ Charitable Tax Credit for 2021 is April 17, 2023 (Chapter 4).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get arizona credit kingman cerbat?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific kingman justice court pay online and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit az card authorization payment fines form fillable in Chrome?

az credit authorization payment fines cerbat download can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I fill out arizona credit card authorization fines form fillable on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your arizona credit authorization payment fines cerbat pdf. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is AZ Credit Card Authorization for Payment of Fines?

AZ Credit Card Authorization for Payment of Fines is a form used to authorize the payment of fines through credit card transactions within the Arizona legal and administrative systems.

Who is required to file AZ Credit Card Authorization for Payment of Fines?

Individuals who need to pay fines, fees, or other court-related payments in Arizona are required to file the AZ Credit Card Authorization for Payment of Fines.

How to fill out AZ Credit Card Authorization for Payment of Fines?

To fill out the AZ Credit Card Authorization for Payment of Fines, provide your personal information, credit card details, the amount to be paid, and sign the form to authorize the transaction.

What is the purpose of AZ Credit Card Authorization for Payment of Fines?

The purpose of AZ Credit Card Authorization for Payment of Fines is to facilitate the secure and convenient payment of fines using a credit card while ensuring that the payment is authorized by the cardholder.

What information must be reported on AZ Credit Card Authorization for Payment of Fines?

The information that must be reported includes the payer's name, address, contact information, credit card number, expiration date, the amount of the fine, and the author's signature.

Fill out your az payment fines kingman online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona Fines Form Cerbat Online is not the form you're looking for?Search for another form here.

Keywords relevant to arizona card authorization payment fines make

Related to credit card authorization cerbat form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.