What are W8 Templates?

W8 Templates are standardized forms used to provide information to the Internal Revenue Service (IRS) for tax purposes. These forms are crucial for individuals and businesses to report income earned from various sources.

What are the types of W8 Templates?

There are several types of W8 Templates, including:

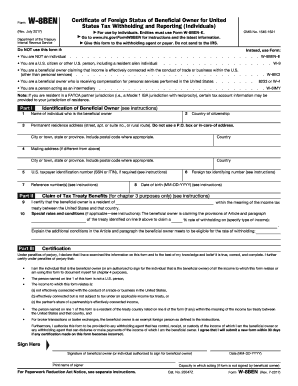

W-8BEN: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)

W-8BEN-E: Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)

W-8ECI: Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States

W-8EXP: Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting

How to complete W8 Templates

Completing W8 Templates is essential for ensuring compliance with tax regulations. Here are some steps to guide you through the process:

01

Provide accurate personal or business information in the designated fields

02

Sign and date the form as required

03

Submit the completed form to the relevant parties or authorities as needed

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out W8 Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I create a W8 form?

Guide To Fill W-8 BEN Form for Investing in US Stocks Step 1: Enter Legal Name. Step 2: Mention your Current Citizenship. Step 3: Permanent Address. Step 4: Mailing Address. Step 5: U.S. Taxpayer Identification Number. Step 6: Foreign Tax Identifying Number. Step 7: Reference Number. Step 8: Date Of Birth.

Where can I download W8 form?

▶ For use by individuals. Entities must use Form W-8BEN-E. ▶ Go to .irs.gov/FormW8BEN for instructions and the latest information.

Who issues a W8 form?

The W-8BEN is an Internal Revenue Service (IRS) mandated form to collect correct Nonresident Alien (NRA) taxpayer information for individuals for reporting purposes and to document their status for tax reporting purposes.

What is a w8 form used for?

The W-8BEN is an Internal Revenue Service (IRS) mandated form to collect correct Nonresident Alien (NRA) taxpayer information for individuals for reporting purposes and to document their status for tax reporting purposes.

What is the difference between a W8 and a w9?

Form W-9 is to be filled out by US workers that have a SSN or TIN, while W-8 forms are filled out by foreign individuals and non-resident aliens who receive income from US sources.

Who needs to fill out a W-8 form?

Give Form W-8 BEN to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding. Submit Form W-8 BEN when requested by the withholding agent or payer whether or not you are claiming a reduced rate of, or exemption from, withholding.