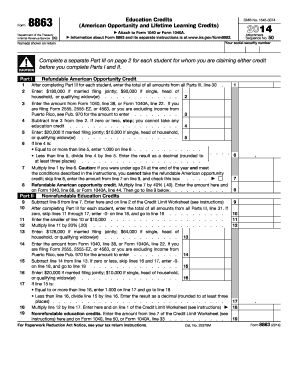

1040x Instructions 2014 - Page 2

What is 1040x instructions 2014?

1040x instructions 2014 is a guide provided by the Internal Revenue Service (IRS) for taxpayers who need to amend their tax return for the year 2014. This document outlines the specific steps and requirements for individuals who need to make changes to their previously filed Form 1040 for that tax year.

What are the types of 1040x instructions 2014?

There are primarily two types of instructions provided in the 1040x instructions 2014:

How to complete 1040x instructions 2014

Completing the 1040x instructions 2014 requires careful attention to detail and following the instructions provided by the IRS. Here are the general steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.