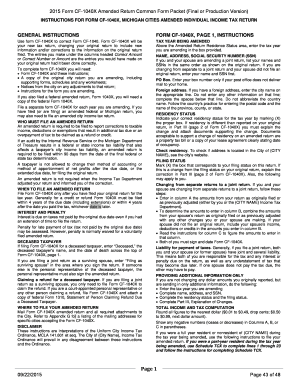

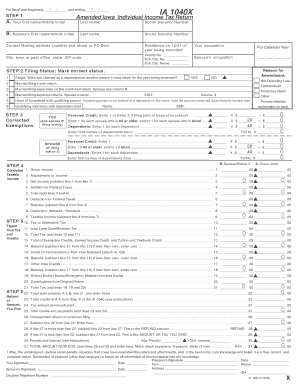

What is 1040x mailing address?

The 1040x mailing address refers to the specific address where you need to send your completed Form 1040x, which is used to amend a previously filed tax return. It is important to send your form to the correct address to ensure that it reaches the appropriate tax office for processing.

What are the types of 1040x mailing address?

There are different types of 1040x mailing addresses based on your location and the type of tax return you are amending. The types of 1040x mailing addresses include:

Standard Mailing Address: This is the default mailing address for most taxpayers. It is used when you are not attaching any payment or additional documents to your amended return.

Special Mailing Address for Payment or Additional Documents: If you need to include a payment or attach additional documents to your amended return, you may need to use a different mailing address. This address is specifically designated for such purposes.

Electronic Filing Address: If you choose to file your amended return electronically, you will need to use the electronic filing address provided by the IRS.

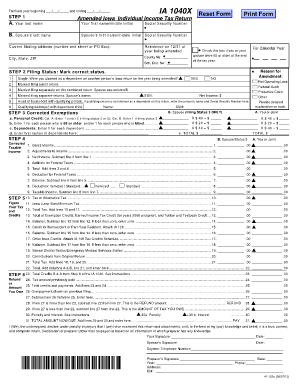

How to complete 1040x mailing address

To complete the 1040x mailing address correctly, follow these steps:

01

Obtain Form 1040x: Download Form 1040x from the IRS website or obtain a physical copy.

02

Fill out the necessary information: Provide the required information on the form, including your personal details, the tax year you are amending, and the changes you are making.

03

Attach any supporting documentation: If you are including any documents to support your amended return, make sure to attach them securely.

04

Determine the appropriate mailing address: Depending on your location and the type of return you are amending, choose the correct 1040x mailing address from the options provided.

05

Mail your completed form: Once you have completed the form and gathered all the necessary documents, mail them to the designated 1040x mailing address using a reliable postal service.

With pdfFiller, you can easily handle your Form 1040x mailing address. pdfFiller is an online platform that allows users to create, edit, and share documents seamlessly. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate solution for all your PDF editing needs.