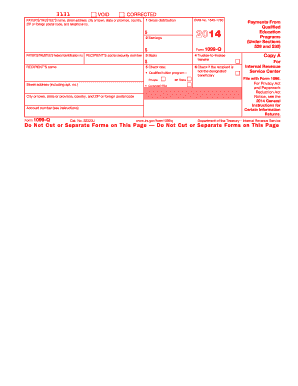

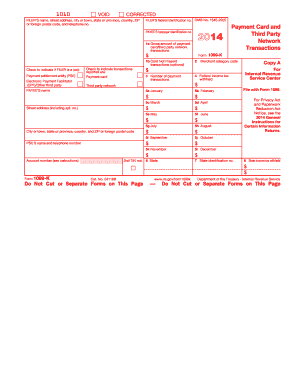

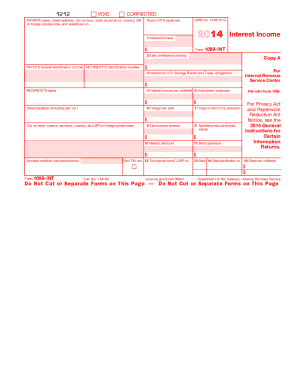

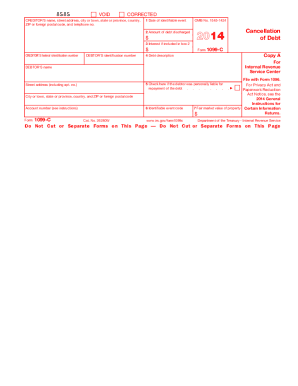

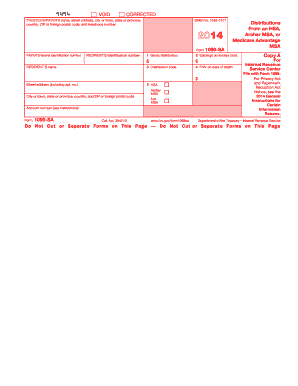

1099 Tax Form 2014

What is 1099 tax form 2014?

The 1099 tax form 2014 is a specific tax form used to report various types of income other than wages, salaries, and tips. It is issued by the Internal Revenue Service (IRS) to individuals or entities who have received income that needs to be reported and potentially taxed.

What are the types of 1099 tax form 2014?

There are several types of 1099 tax forms for different types of income. Some common types include:

1099-MISC: Used to report miscellaneous income like freelance work or rental income.

1099-INT: Used to report interest income earned from investments.

1099-DIV: Used to report dividend income received from stocks or mutual funds.

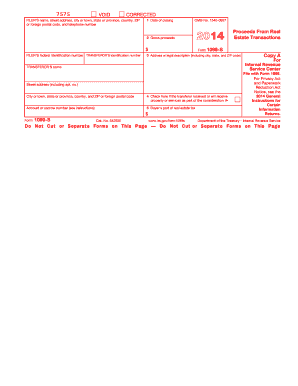

1099-B: Used to report proceeds from broker and barter exchange transactions.

1099-G: Used to report government payments and benefits like unemployment compensation or tax refunds.

1099-R: Used to report distributions from pensions, annuities, retirement plans, or insurance contracts.

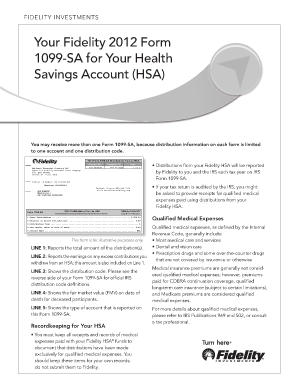

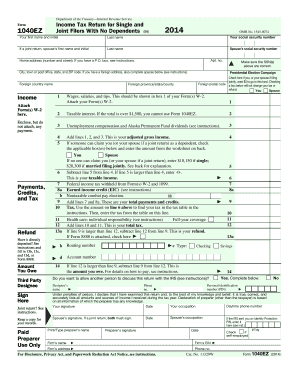

How to complete 1099 tax form 2014

Completing the 1099 tax form 2014 requires attention to detail and accurate reporting. Follow these steps to complete the form:

01

Gather all necessary information, such as recipient's name, address, and Social Security number or taxpayer identification number (TIN).

02

Identify the correct type of 1099 form based on the income being reported.

03

Fill in the payer's information, including name, address, and TIN.

04

Enter the recipient's information in the corresponding fields.

05

Report the income earned in the appropriate box, following the instructions provided by the IRS.

06

Ensure all amounts are accurate and properly calculated.

07

Double-check all information for errors and make sure everything is legible.

08

Submit copies to the IRS and the recipient, as required by the IRS guidelines.

pdfFiller empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, it's the only PDF editor you need to get your documents done.

Video Tutorial How to Fill Out 1099 tax form 2014

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can I look up my 1099 form online?

Sign in to your my Social Security account to get your copy Creating a free my Social Security account takes less than 10 minutes, lets you download your SSA-1099 or SSA-1042S and gives you access to many other online services.

How do you do a 1099 tax form?

How to file a 1099 form Gather the required information. Submit Copy A to the IRS. Submit copy B to the independent contractor. Submit form 1096. Check if you need to submit 1099 forms with your state.

Can you create a 1099 for a previous year?

If you forgot to file your 1099-MISC for last year, it is still not too late. You can still file your form for the previous year. As the penalty increases with time, we recommend submitting your form as soon as you realize your mistake.

How do I get my 1099 from previous years?

If you are looking for 1099s from earlier years, you can contact the IRS and order a “wage and income transcript”. The transcript should include all of the income that you had as long as it was reported to the IRS. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS.