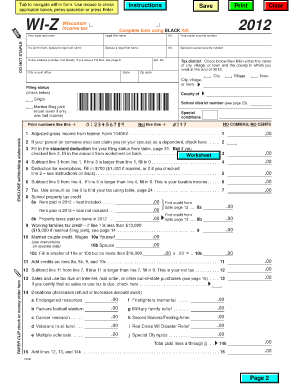

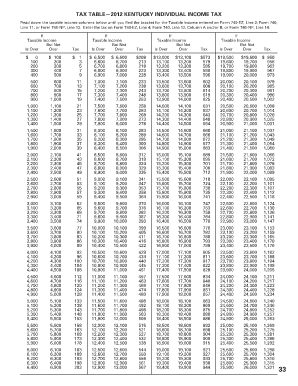

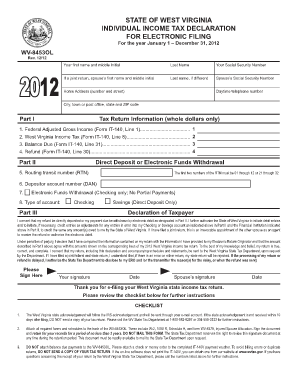

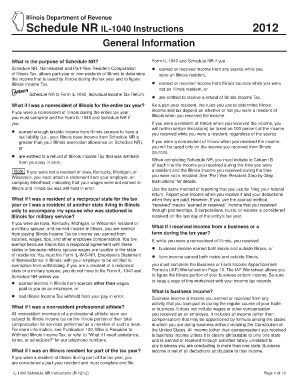

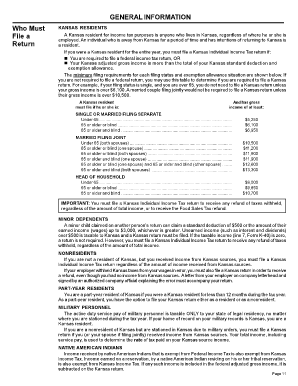

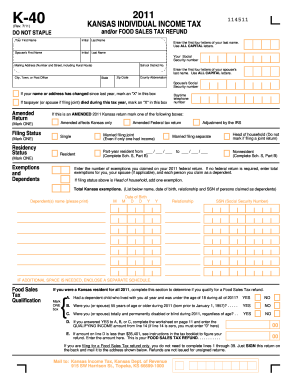

What is 2012 tax forms?

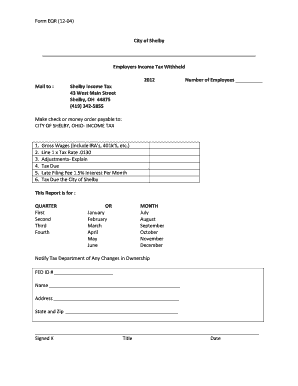

In 2012 tax forms refer to the official documents that individuals and businesses need to file their taxes for the year 2012. These forms contain important information such as income, deductions, credits, and other relevant details that help calculate the amount of tax owed or refund due.

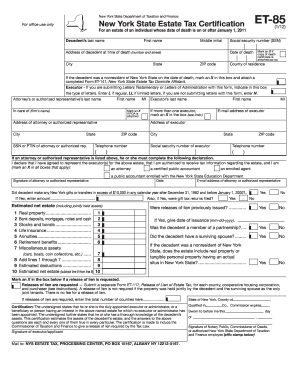

What are the types of 2012 tax forms?

There are several types of 2012 tax forms that cater to different situations and requirements. Some of the commonly used forms include:

Form This is the primary individual income tax return form for most taxpayers.

Form 1040A: A simplified version of Form 1040 for taxpayers with less complex financial situations.

Form 1040EZ: The simplest tax form for taxpayers with no dependents and certain other criteria.

Form Used for filing partnership tax returns.

Form Used for filing corporate tax returns.

Form For tax-exempt organizations to report their financial information.

How to complete 2012 tax forms

Completing 2012 tax forms may seem daunting, but with the right tools and guidance, it can be a smooth process. Here are the general steps to follow when completing your 2012 tax forms:

01

Gather all the necessary documents, such as W-2 forms, 1099 forms, and receipts for deductions.

02

Choose the appropriate tax form based on your filing status and financial situation.

03

Carefully review the instructions provided with the tax form to understand how to fill it out correctly.

04

Enter your personal information, income, deductions, and credits accurately and thoroughly.

05

Double-check all the information entered to ensure its accuracy.

06

Sign and date the completed tax form before submitting it to the relevant tax authorities.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.