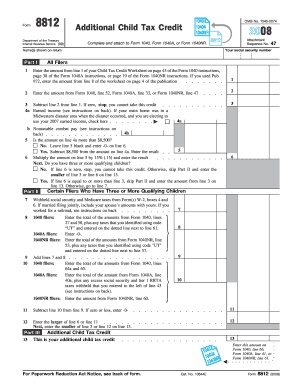

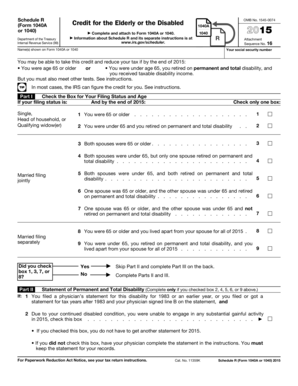

2014 Form 1040a

What is 2014 form 1040a?

The 2014 form 1040a is a simplified version of the 1040 form used for filing individual income tax returns in the United States. It is designed for taxpayers who have relatively uncomplicated tax situations and who meet certain eligibility criteria. Using this form can make the process of filing taxes easier and less time-consuming, as it eliminates the need for some of the more complex calculations required by the regular 1040 form.

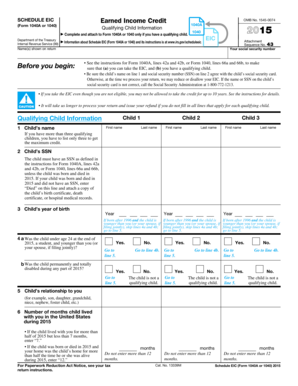

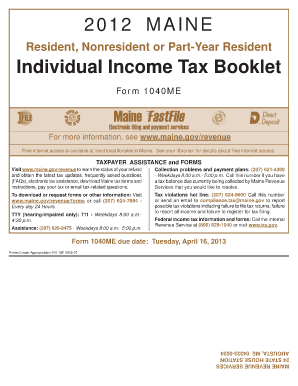

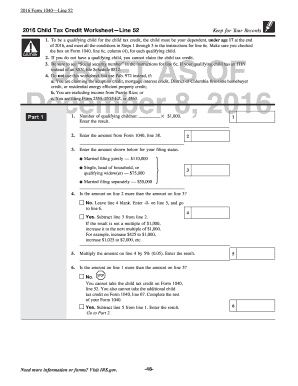

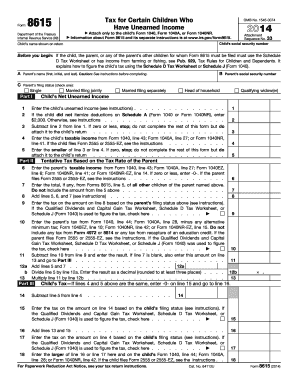

What are the types of 2014 form 1040a?

The 2014 form 1040a comes in several types, each designed to accommodate different tax situations. These types include:

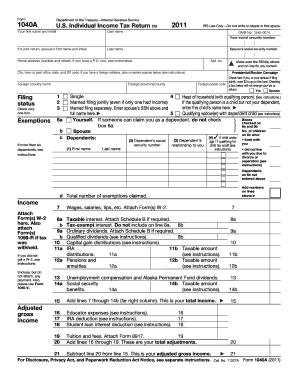

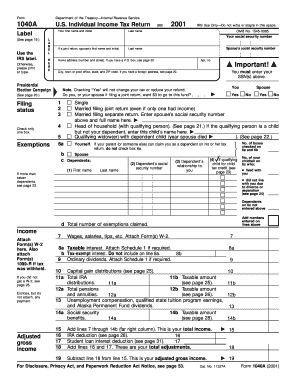

How to complete 2014 form 1040a

Completing the 2014 form 1040a is a straightforward process. Here are the general steps to follow:

Remember that pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.