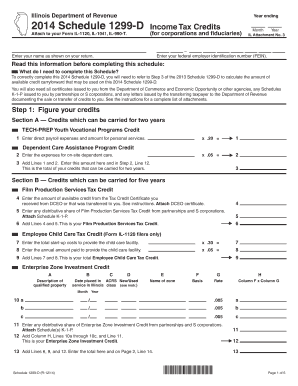

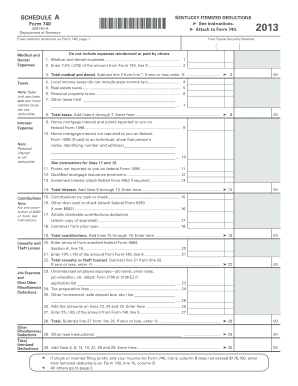

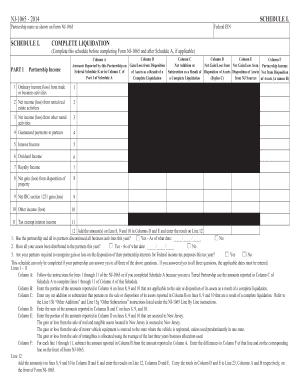

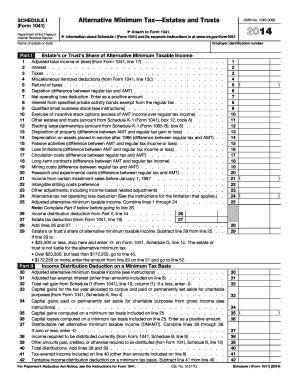

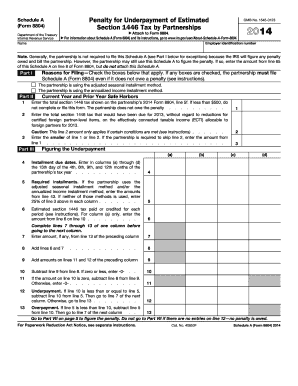

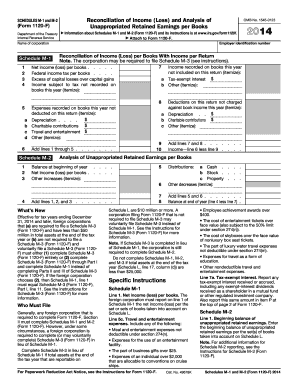

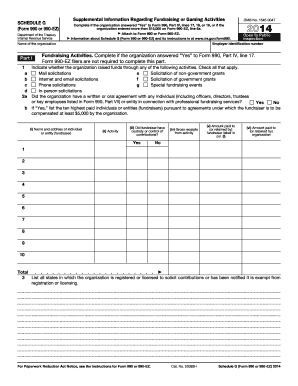

2014 Schedule A

What is 2014 schedule a?

2014 Schedule A is a tax form used by taxpayers to report itemized deductions on their federal income tax return. It is also known as Form 1040 Schedule A. By filling out this form, taxpayers can deduct various expenses, such as medical expenses, state and local taxes, mortgage interest, and charitable contributions, from their taxable income. It is important to accurately fill out this form to claim the deductions you are eligible for and reduce your overall tax liability.

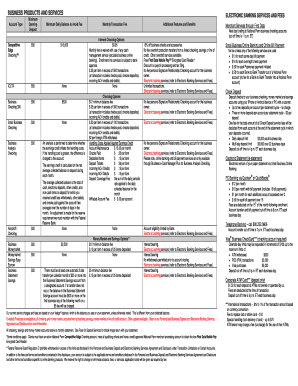

What are the types of 2014 schedule a?

There are several types of deductions that can be claimed on 2014 Schedule A. Some of the common types include:

How to complete 2014 schedule a

Completing 2014 Schedule A may seem daunting, but with the right guidance, it can be a straightforward process. Here are the steps to complete this tax form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.