Amortization Formula

What is amortization formula?

The amortization formula is a mathematical equation used to calculate the periodic payments needed to pay off a loan over a specific period of time. It takes into account the principal amount, interest rate, and loan term to determine the amount that needs to be paid each month or period.

What are the types of amortization formula?

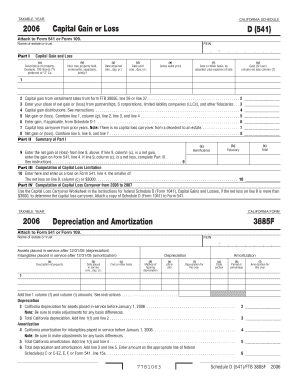

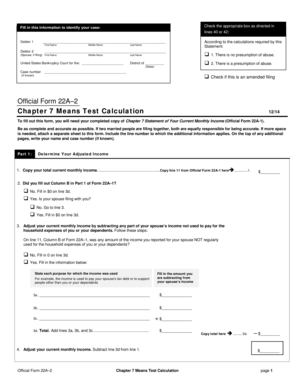

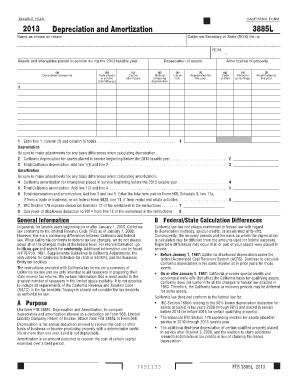

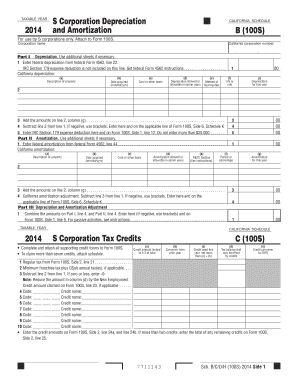

There are several types of amortization formulas that are commonly used, including: 1. Straight-Line Amortization: This formula evenly distributes the principal and interest payments over the loan term. 2. Declining Balance Amortization: This formula front-loads the interest payments, resulting in decreasing principal amounts over time. 3. Annuity Amortization: This formula calculates equal payments that encompass both principal and interest over the loan term. 4. Balloon Payment Amortization: This formula involves making smaller periodic payments with a larger final payment, commonly referred to as a balloon payment.

How to complete amortization formula

Completing an amortization formula involves the following steps: 1. Gather the necessary information: You will need the loan amount, interest rate, and loan term. 2. Choose an amortization formula: Select the appropriate formula based on your needs, such as straight-line, declining balance, or annuity. 3. Plug in the values: Input the gathered information into the formula to calculate the periodic payment. 4. Calculate the payment amount: Use a financial calculator or spreadsheet software to determine the payment amount. 5. Review and verify: Double-check your calculations to ensure accuracy. 6. Apply the formula: Use the calculated payment amount to make periodic payments throughout the loan term.

In conclusion, understanding the amortization formula and the different types available can help you effectively manage your loans. By using pdfFiller, you can take advantage of its online document creation, editing, and sharing capabilities. With unlimited fillable templates and powerful editing tools, pdfFiller is the ideal PDF editor to streamline your document workflows.