Monthly Amortization Schedule

What is monthly amortization schedule?

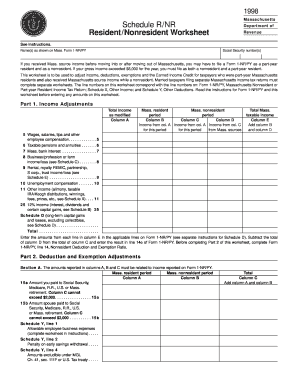

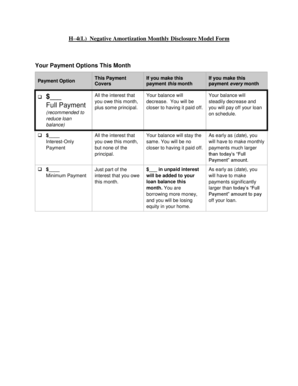

A monthly amortization schedule is a table that details how much of each loan payment goes towards the principal balance, interest fees, and any other charges. It helps borrowers understand how their payments are allocated over time

What are the types of monthly amortization schedule?

There are two main types of monthly amortization schedules: fixed-rate and adjustable-rate. Fixed-rate schedules have stable payments throughout the loan term, while adjustable-rate schedules have payments that may fluctuate based on market conditions.

How to complete monthly amortization schedule

To complete a monthly amortization schedule, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.