Annual Student Budget - Page 2

What is Annual Student Budget?

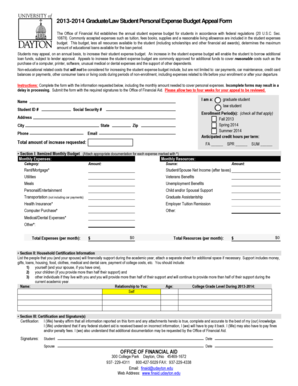

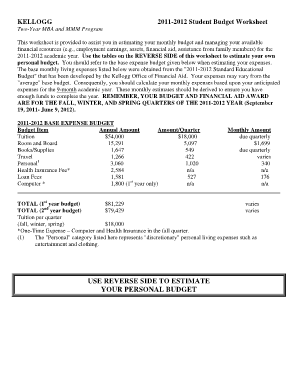

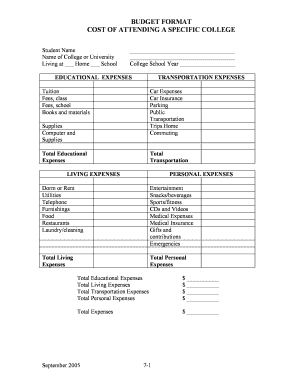

The Annual Student Budget refers to the estimated amount of money that a student needs to cover their expenses for an entire academic year. It includes the cost of tuition, books, accommodation, transportation, food, and other miscellaneous expenses.

What are the types of Annual Student Budget?

There are several types of Annual Student Budget, depending on the sources of income and the expenses involved. The most common types are:

Personal Budget: This type of budget is prepared by students themselves and includes income from part-time jobs, scholarships, and allowances.

Parental Budget: Some students receive financial support from their parents, who create a budget to cover their child's expenses.

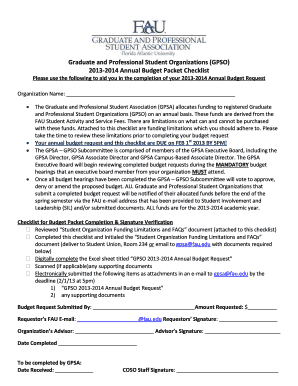

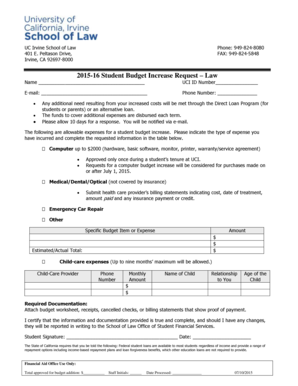

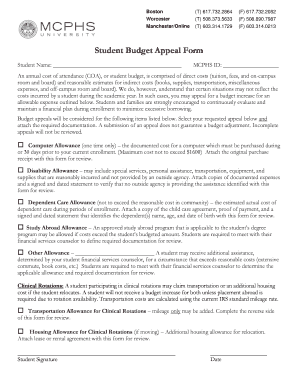

University Budget: In some cases, universities offer financial aid and scholarships to students, providing them with a budget specific to their needs.

Government Budget: Students who are eligible for government grants or loans will have a budget that considers these sources of income.

How to complete Annual Student Budget

Completing an Annual Student Budget is essential to ensure proper financial planning. Follow these steps to complete your budget:

01

Calculate your income: Determine all the sources of income you will have for the academic year, such as part-time jobs, scholarships, or financial aid.

02

Identify your expenses: Make a list of all the expenses you anticipate, including tuition fees, accommodation, transportation, books, food, and other miscellaneous costs.

03

Set priorities: Allocate your income to different expenses according to their importance. Ensure essential expenses like tuition and accommodation are adequately covered.

04

Track your spending: Keep a record of all your expenses and compare them to your budget regularly. This will help you identify any discrepancies and make adjustments if needed.

05

Adjust as necessary: If your income or expenses change throughout the year, update your budget accordingly to stay on track.

06

Seek assistance if needed: If you're unsure about creating or managing your budget, seek guidance from financial experts or university resources.

Remember, pdfFiller empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you'll need to efficiently manage your documents.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the steps to creating a budget student budget?

How to create a budget while in college Calculate your net income. List monthly expenses. Organize your expenses into fixed and variable categories. Determine average monthly costs for each expense. Make adjustments.

What should my budget be as a college student?

Example college student budget Expenses for the semesterBudget for the semesterBudget per monthTuition and fees$3,800Spent at the beginning of the semesterSchool supplies$500Spent at the beginning of the semester on supplies and booksRent$2,600$650Utilities$160$404 more rows • Jul 5, 2022

How do you set up a 50 30 20 budget?

The 50/30/20 rule is an easy budgeting method that can help you to manage your money effectively, simply and sustainably. The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt.

How do college students make budget sheets?

How to make a student budget Record your income/available funds. First, you'll need to gather all of your sources of income. Write down your fixed expenses. Next is your fixed expenses. Track your variable expenses. Consider your savings goals. Write it all out. Make adjustments as time goes on.

How do you create a simple budget spreadsheet?

A simple, step-by-step guide to creating a budget in Google Sheets Step 1: Open a Google Sheet. Step 2: Create Income and Expense Categories. Step 3: Decide What Budget Period to Use. Step 4: Use simple formulas to minimize your time commitment. Step 5: Input your budget numbers. Step 6: Update your budget.

How do I budget myself as a college student?

How to create a budget while in college Calculate your net income. List monthly expenses. Organize your expenses into fixed and variable categories. Determine average monthly costs for each expense. Make adjustments.