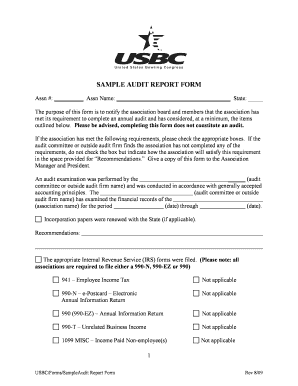

What is an Audit Report?

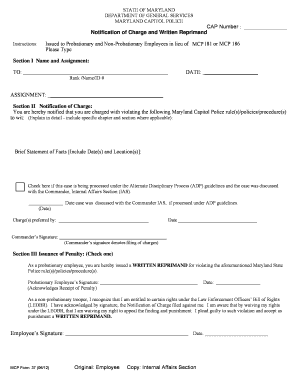

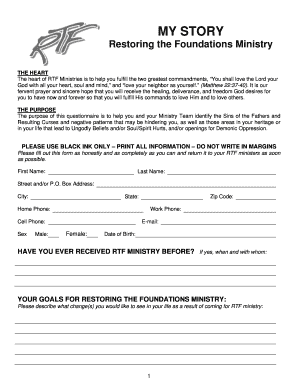

An Audit Report is a written document that provides an assessment of a company's financial statements, processes, and internal controls. It is prepared by an independent auditor who reviews the financial records and procedures of a company to determine if they comply with accounting standards and regulations. The Audit Report includes findings, conclusions, and recommendations based on the auditor's analysis.

What are the types of Audit Report?

There are several types of Audit Reports, including:

Unqualified Opinion: This is the most desired type of Audit Report as it indicates that the company's financial statements are accurate and comply with accounting standards.

Qualified Opinion: This type of Audit Report is issued when the auditor identifies specific issues or limitations that affect the reliability of the financial statements. However, the issues identified are not significant enough to question the overall fairness of the statements.

Adverse Opinion: An Adverse Opinion is given when the auditor concludes that the financial statements do not accurately represent the company's financial position and results of operations. This is a serious concern as it indicates major discrepancies or non-compliance with accounting standards.

Disclaimer of Opinion: This type of Audit Report is issued when the auditor is unable to express an opinion on the financial statements due to limitations or insufficient evidence. It could be a result of a lack of cooperation from the company or significant uncertainties in the financial records.

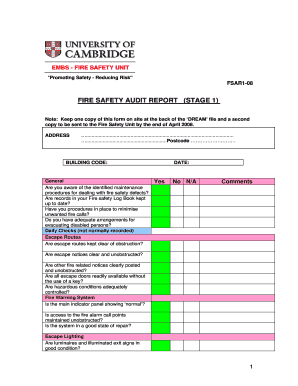

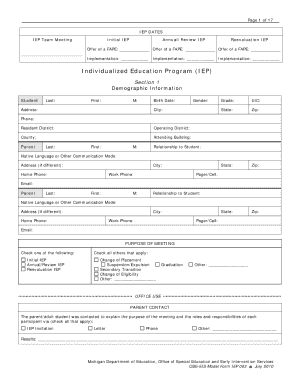

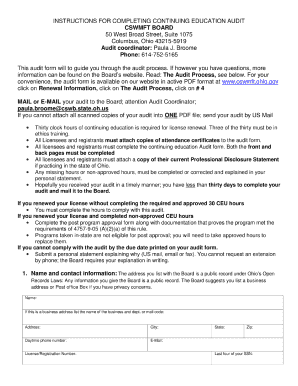

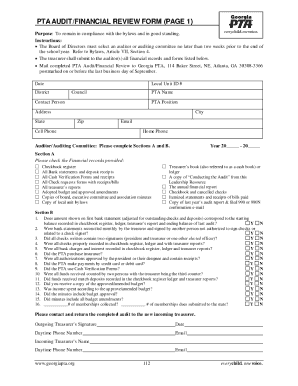

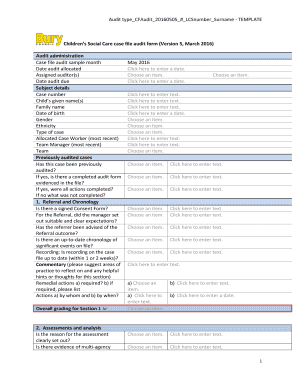

How to complete an Audit Report

Completing an Audit Report requires careful attention to detail and thorough analysis. Here are the steps to follow:

01

Gather all necessary financial records and supporting documents.

02

Review the financial statements and compare them with the supporting documents to ensure accuracy.

03

Evaluate the company's internal controls and assess their effectiveness in preventing fraud or errors.

04

Conduct tests and procedures to verify the integrity and reliability of the financial data.

05

Summarize the findings and conclusions based on the analysis conducted.

06

Prepare the Audit Report, including the executive summary, scope of audit, methodology used, findings, recommendations, and any other relevant information.

07

Review the report for clarity, coherence, and adherence to accounting standards.

08

Submit the Audit Report to the appropriate stakeholders, such as the company's management, board of directors, or regulatory bodies.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.