Auto Insurance Proposal Template - Page 3

What is Auto Insurance Proposal Template?

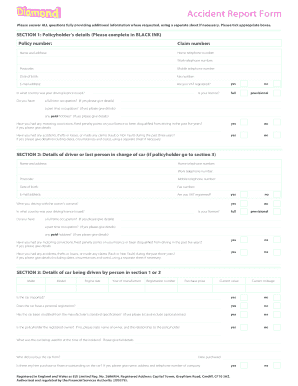

Auto Insurance Proposal Template is a standardized document that outlines the terms and conditions of an auto insurance proposal. It includes important details such as coverage limits, deductibles, and premiums. This template serves as a starting point for insurance agents and brokers to customize and present proposals to their clients.

What are the types of Auto Insurance Proposal Template?

There are several types of Auto Insurance Proposal Templates available, catering to different insurance needs and requirements. Some common types include: 1. Liability Coverage Proposal: This template focuses on providing coverage for damages or injuries caused by the insured driver to others. 2. Comprehensive Coverage Proposal: This template offers a more extensive coverage that includes damages caused by non-collision incidents such as theft, vandalism, or natural disasters. 3. Collision Coverage Proposal: This template specifically covers damages to the insured vehicle resulting from a collision with another vehicle or object. 4. Personal Injury Protection Proposal: This template emphasizes coverage for medical expenses and lost wages incurred by the insured driver and passengers in the event of an accident. 5. Uninsured/Underinsured Motorist Proposal: This template provides coverage for damages caused by an uninsured or underinsured driver.

How to complete Auto Insurance Proposal Template

Completing an Auto Insurance Proposal Template is a straightforward process. Follow these steps: 1. Start by entering the client's name, contact information, and policy number, if applicable. 2. Provide an overview of the coverage being proposed, including the type of coverage, coverage limits, and deductibles. 3. Customize the template to reflect the client's specific needs and preferences. This may include adding additional coverage options or adjusting the policy terms. 4. Review and double-check all the entered information for accuracy and completeness. 5. Share the completed proposal with the client through pdfFiller's sharing options, such as email or a shared link. 6. Answer any questions the client may have and address any concerns to finalize the proposal.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.