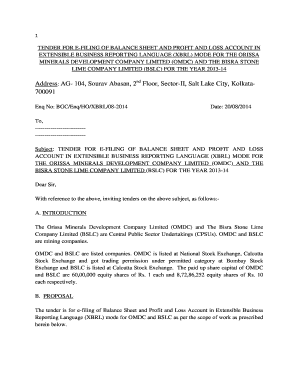

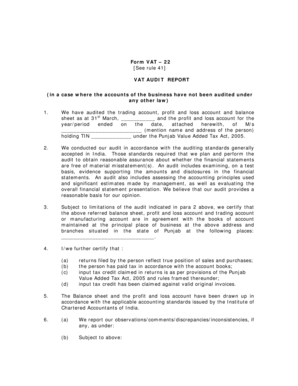

Format Of Balance Sheet And Profit And Loss Account

What is the format of balance sheet and profit and loss account?

The format of a balance sheet and profit and loss account is a standardized presentation of financial information. It provides a snapshot of a company's financial position and its performance over a specific period of time. The balance sheet consists of assets, liabilities, and equity, while the profit and loss account shows the revenue, expenses, and net income or loss.

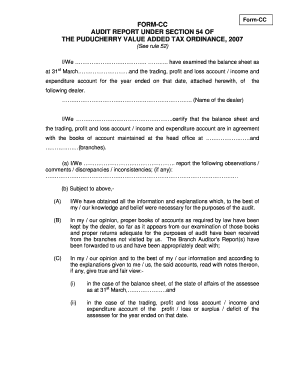

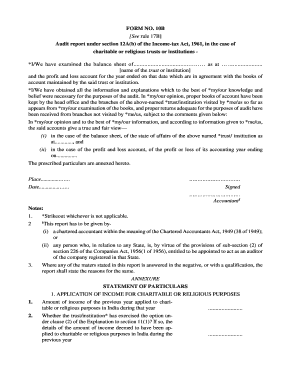

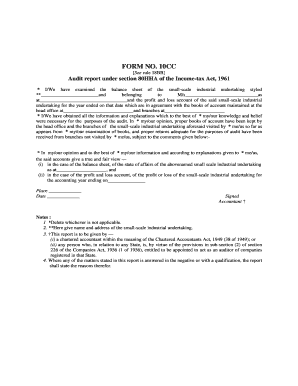

What are the types of format of balance sheet and profit and loss account?

There are generally two types of formats used for balance sheets and profit and loss accounts: vertical format and horizontal format. The vertical format presents the financial information in a vertical columnar arrangement, typically with assets listed on one side and liabilities and equity on the other. The horizontal format, on the other hand, presents the financial information in a horizontal row-by-row arrangement, with each line item listed sequentially.

How to complete the format of balance sheet and profit and loss account

Completing the format of a balance sheet and profit and loss account requires careful organization of financial data. Here are the general steps to follow:

With pdfFiller, completing the format of balance sheets and profit and loss accounts is made easier. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.