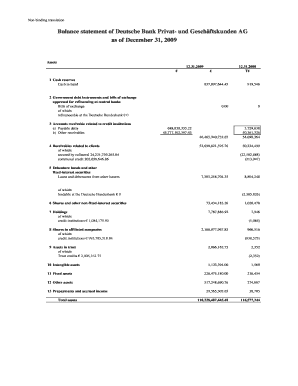

Balance Statement

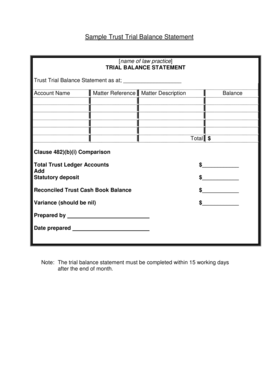

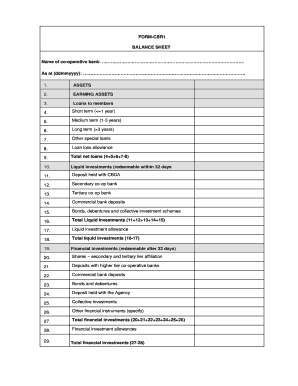

What is a balance statement?

A balance statement, also known as a balance sheet, is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and shareholders' equity and is a key tool for evaluating a company's financial health.

What are the types of balance statement?

There are two main types of balance statements: the classified balance sheet and the unclassified balance sheet. 1. Classified Balance Sheet: This type of balance sheet groups assets and liabilities into current and non-current categories. Current assets and liabilities are those that are expected to be used or settled within one year, while non-current assets and liabilities have a longer timeframe. 2. Unclassified Balance Sheet: This type of balance sheet does not classify assets and liabilities into current and non-current categories. Instead, it presents them as a single list.

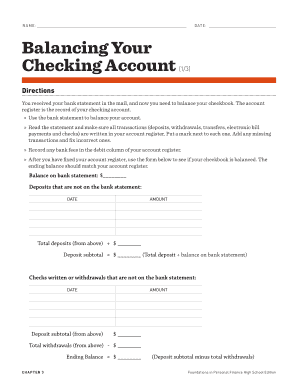

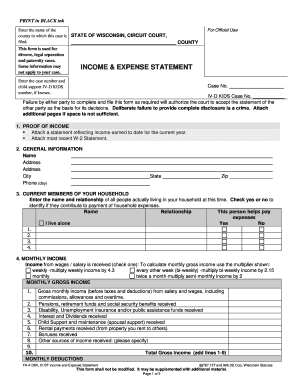

How to complete a balance statement

Completing a balance statement is a vital task for businesses to assess their financial condition accurately. Here are the steps to follow: 1. Gather financial data: Collect all the necessary financial information, including the company's assets, liabilities, and shareholders' equity. 2. Format the balance statement: Prepare the layout of the balance statement, ensuring it includes relevant headers and sections for assets, liabilities, and shareholders' equity. 3. Calculate total assets and total liabilities: Sum up the values of all assets and liabilities separately. 4. Determine shareholders' equity: Subtract liabilities from assets to calculate the shareholders' equity. 5. Review and verify accuracy: Double-check all the numbers and ensure the balance sheet is accurate and error-free. By following these steps, businesses can complete a comprehensive and reliable balance statement to gain insights into their financial position.

With pdfFiller, users have the power to create, edit, and share documents online, including balance statements. Offering an extensive collection of unlimited fillable templates and robust editing tools, pdfFiller is the ultimate PDF editor that users can rely on to effortlessly complete their documents.