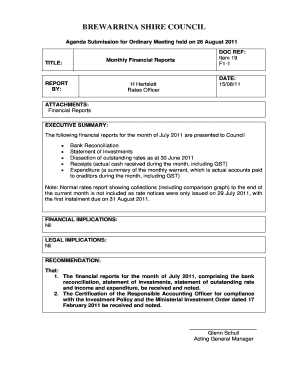

Bank Reconciliation Statement Rules

What is bank reconciliation statement rules?

Bank reconciliation statement rules refer to the guidelines and procedures that need to be followed while preparing a bank reconciliation statement. This statement is a crucial financial document that helps in matching the balances of an organization's bank account with its own internal records.

What are the types of bank reconciliation statement rules?

There are two types of bank reconciliation statement rules:

Reconciling deposits:

Reconciling withdrawals:

How to complete bank reconciliation statement rules

To complete bank reconciliation statement rules, follow these steps:

01

Gather bank statements:

02

Compare records:

03

Identify discrepancies:

04

Adjust records:

05

Update reconciliation statement:

06

Reconcile balances:

By following these steps, you can successfully complete the bank reconciliation statement rules and ensure accurate financial records.

Video Tutorial How to Fill Out bank reconciliation statement rules

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

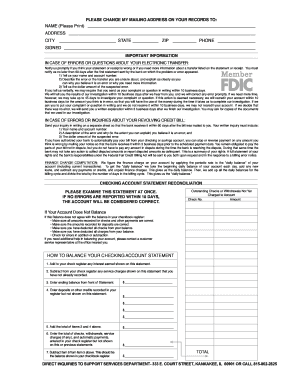

How do you format a bank reconciliation statement?

Bank Reconciliation Procedure On the bank statement, compare the company's list of issued checks and deposits to the checks shown on the statement to identify uncleared checks and deposits in transit. Using the cash balance shown on the bank statement, add back any deposits in transit. Deduct any outstanding checks.

What is the format of bank reconciliation?

A bank reconciliation statement is a schedule prepared by a company in an electronic or paper format as part of a bank reconciliation process that compares the company's general ledger cash account with its bank statement to ensure every transaction is accounted for and the ending balances match.

What is the reconciliation statement?

A bank reconciliation statement is a summary of banking and business activity that reconciles an entity's bank account with its financial records. The statement outlines the deposits, withdrawals, and other activities affecting a bank account for a specific period.

What are the 10 steps to reconciling a bank statement?

Bank reconciliation steps Get bank records. You need a list of transactions from the bank. Get business records. Open your ledger of income and outgoings. Find your starting point. Run through bank deposits. Check the income on your books. Run through bank withdrawals. Check the expenses on your books. End balance.

What are the steps in preparing a bank reconciliation statement and give example?

Steps in Preparation of Bank Reconciliation Statement Check for Uncleared Dues. Compare Debit and Credit Sides. Check for Missed Entries. Correct them. Revise the Entries. Make BRS Accordingly. Add Un-presented Cheques and Deduct Un-credited Cheques. Make Final Changes.

What is bank reconciliation statement rules?

A bank reconciliation statement is a document that compares the cash balance on a company's balance sheet to the corresponding amount on its bank statement. Reconciling the two accounts helps identify whether accounting changes are needed.

Related templates