What is Basic Business Budget Template?

A Basic Business Budget Template is a tool that helps businesses plan and track their finances. It provides an organized format to record income, expenses, and cash flow projections. This template serves as a blueprint for businesses to outline their financial goals, allocate resources, and make informed decisions.

What are the types of Basic Business Budget Template?

There are several types of Basic Business Budget Templates available, each catering to specific business needs. Some common types include:

Monthly Budget Template: This template focuses on monthly financial planning and tracking.

Annual Budget Template: This template is designed to plan and manage finances over a year.

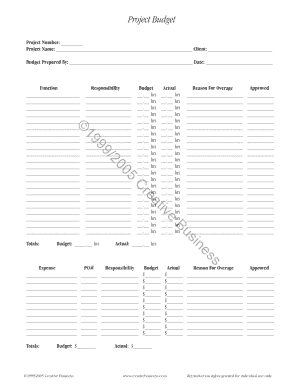

Project Budget Template: It helps businesses estimate and allocate resources for specific projects.

Departmental Budget Template: This template allows businesses to allocate budgets to different departments within the organization.

Startup Budget Template: Ideal for new businesses, this template helps plan expenses during the initial stages.

How to complete Basic Business Budget Template

Completing a Basic Business Budget Template is a straightforward process. Here are the steps to follow:

01

Gather financial information: Collect all relevant financial data, such as income statements, expense reports, and cash flow projections.

02

Enter income details: Input your sources of income, including sales revenue, investments, and any other forms of income.

03

Enter expense details: List all your business expenses, including fixed costs (rent, salaries) and variable costs (utilities, marketing expenses).

04

Calculate totals: Sum up your income and expense figures to calculate total revenue, total expenses, and the resulting profit or loss.

05

Review and adjust: Analyze your budget to ensure it aligns with your business goals. Make adjustments if necessary and create strategies for financial improvement.

06

Save and share: Save the completed Basic Business Budget Template to your preferred format (PDF, Excel) and share it with relevant stakeholders.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.