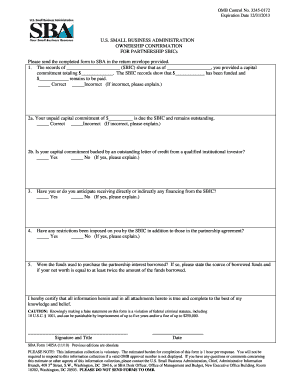

What is business plan template sba?

A business plan template SBA refers to a document that outlines the goals, objectives, strategies, and financial projections of a business. It is specifically designed to meet the requirements set by the Small Business Administration (SBA), which provides various resources and support for small businesses. By using a business plan template SBA, entrepreneurs can create a comprehensive blueprint for their venture, detailing their vision, target market, marketing strategies, operations plan, and financial forecasts. This template serves as a guide for startups and existing businesses alike, helping them navigate the complexities of business planning and secure funding.

What are the types of business plan template sba?

There are different types of business plan templates available for use, depending on the specific needs and requirements of the business. Some common types include:

Traditional business plan template: This is the most common type of business plan template, which includes sections on executive summary, company description, market analysis, marketing strategies, financial projections, and more.

Lean startup business plan template: This type of template is suitable for startups that aim to quickly test and iterate their business model. It focuses on the core elements of the business and allows for flexibility and adaptation.

One-page business plan template: As the name suggests, this template condenses the entire business plan into a single page. It is ideal for entrepreneurs who prefer a concise and straightforward approach.

Nonprofit business plan template: Specifically designed for nonprofit organizations, this template includes additional sections such as mission statement, fundraising strategies, and social impact assessment.

How to complete business plan template sba

Completing a business plan template SBA requires thorough research, careful analysis, and strategic thinking. Here are the steps to follow:

01

Start with an executive summary: Provide a brief overview of your business, highlighting its unique value proposition and potential for growth.

02

Describe your company: Include information about your company's history, mission, vision, and legal structure.

03

Conduct market research: Identify your target market, analyze competitors, and assess market trends and opportunities.

04

Outline your products or services: Clearly define what you offer and explain how it solves a problem or meets a need in the market.

05

Develop a marketing and sales strategy: Detail your marketing approach, pricing strategy, distribution channels, and sales forecasts.

06

Create an operations plan: Outline your organizational structure, key personnel, and day-to-day operations.

07

Prepare financial projections: Forecast your revenue, expenses, and cash flow, and provide supporting documents such as balance sheets and income statements.

08

Include an appendix: Attach any additional documents that support your business plan, such as market research data, resumes of key team members, or legal contracts.

By following these steps and utilizing a business plan template SBA, you can create a comprehensive and compelling business plan that will impress lenders, investors, and stakeholders.