Buy Sell Agreement Cross Purchase

What is buy sell agreement cross purchase?

A buy sell agreement cross purchase is a legal contract that outlines the procedures for buying or selling a business or shares of a business between the owners or shareholders. It is a commonly used method to ensure a smooth transfer of ownership and protect the interests of all parties involved.

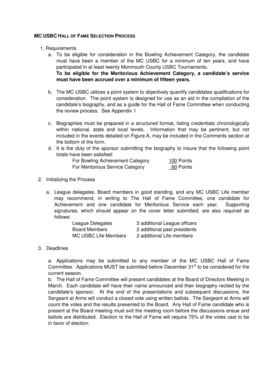

What are the types of buy sell agreement cross purchase?

There are three main types of buy sell agreement cross purchase:

Entity Purchase Agreement: In this type, the business entity itself purchases the interest or shares from the departing owner.

Cross-Purchase Agreement: Here, the remaining owners or shareholders buy the interest or shares from the departing owner.

Wait-and-See Agreement: This type allows for both the business entity and the remaining owners or shareholders to have the option to purchase the interest or shares.

How to complete buy sell agreement cross purchase

Completing a buy sell agreement cross purchase involves the following steps:

01

Identify the parties involved: Determine the buyers and sellers in the agreement.

02

Negotiate the terms: Discuss and agree upon the purchase price, payment terms, and other relevant details.

03

Draft the agreement: Create a legally binding contract that outlines the agreed-upon terms and conditions.

04

Review and revise: Carefully review the agreement with all parties involved and make any necessary revisions.

05

Sign and execute: Once all parties are satisfied with the terms, sign the agreement and make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out buy sell agreement cross purchase

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you write a simple purchase agreement?

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

What are the key elements of a buy-sell agreement?

Here is how buy-sell agreements work: Determine which events invoke a triggered buyout. Establish who has rights and purchase obligations. Identify the names and address of the purchasers. Set a purchase price or valuation with applicable discounts. Establish payment terms as well as their intervals.

How does a cross purchase agreement work?

A cross-purchase agreement is a document that allows a company's partners or other shareholders to purchase the interest or shares of a partner who dies, becomes incapacitated or retires. The mechanism often relies on a life insurance policy in the event of a death to facilitate that exchange of value.

What is a cross purchase buy-sell agreement?

They are: A list of buyout conditions that could trigger the agreement (divorce, bankruptcy, death, etc) A structure for the partners to buy or sell their interest in the business. A recent valuation of the company. Sources of funding for any purchase or sale of a partner's business interest.

How are buy sell agreements structured?

A buy/sell agreement is generally structured in one of two ways — as a cross-purchase agreement or as a redemption agreement. A cross-purchase agreement is an agreement between individual members. In a funded cross-purchase agreement, each member purchases a life insurance policy on the life of every other member.

What are the four types of buy sell agreements?

There are four common buyout structures: Traditional cross purchase plan. Each owner who is left in the business agrees to purchase the co-owner's shares if that individual dies or leaves the business. Entity redemption plan. One-way buy sell plan. Wait-and-see buy sell plan.