California Workers Compensation Mileage Rate 2016

What is california workers compensation mileage rate 2016?

In California, the workers' compensation mileage rate for 2016 refers to the rate at which employees are reimbursed for the mileage they incur while traveling for work-related purposes. This rate helps cover the expenses associated with using their personal vehicles during the course of their employment.

What are the types of california workers compensation mileage rate 2016?

There are two types of workers' compensation mileage rates applicable in California for the year 2016:

Standard Mileage Rate: This rate is set by the Internal Revenue Service (IRS) and is commonly used by employers to calculate the mileage reimbursement for their employees. The standard mileage rate for 2016 was 54 cents per mile.

Medical and Moving Rate: This rate is specific to medical and moving expenses. For 2016, the IRS set the rate at 19 cents per mile.

How to complete california workers compensation mileage rate 2016

To complete the California workers' compensation mileage rate for 2016, follow these steps:

01

Track Mileage: Keep a record of the miles you travel for work-related purposes. Make sure to note down the date, purpose, and destination of each trip.

02

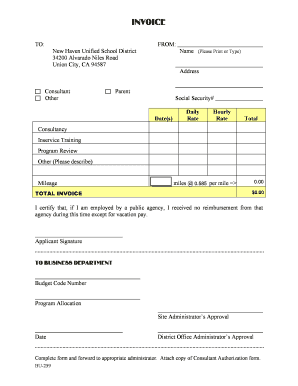

Calculate Reimbursement: Use the appropriate mileage rate (standard or medical and moving) to calculate the reimbursement amount for each trip.

03

Submit Documentation: Submit the necessary documentation, such as a mileage log or expense report, to your employer or insurance company to claim the reimbursement.

04

Follow Employer's Guidelines: Adhere to your employer's guidelines and policies regarding the submission and approval process for mileage reimbursement.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

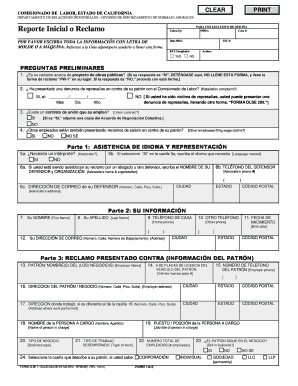

Who completes dwc1 form?

The moment a manager, supervisor, or other employer learns of an employee accident, they must make a DWC-1 form available to the injured employee.

How do I fill out a DWC 1 form?

Filling out a DWC-1 form is actually pretty straightforward.On the form, you will need to only fill out the “Employee” section, which asks for basic information: Name, date, and address. Date and location of injury. Brief description of injury. List of injured body parts. Social Security Number.

How is workers comp calculated in California?

To calculate your regular weekly wage, you divide your annual salary by 52. If someone makes $52,000 a year, this would amount to $1,000 weekly. The maximum benefit would be $666.66 in this case as state law stipulates the maximum benefit is 2/3 of your pretax gross wage.

How long does workers comp have to pay mileage in California?

How Long Will it Take to Get Reimbursed? According to case law, the insurance company has 60 days from receipt of the request to pay or dispute the mileage reimbursement request. Medical mileage reimbursement is your right as an injured worker in California.

What is DWC in workers comp?

The Division of Workers' Compensation (DWC) monitors the administration of workers' compensation claims, and provides administrative and judicial services to assist in resolving disputes that arise in connection with claims for workers' compensation benefits.

How long does it take to get a mileage check?

The IRS mileage rules set the standard reaction time to 120 days when it comes to keeping records and reimbursements up to date in your company. Employees should receive a payment within 30 days of having business mileage expenses.