Create A Living Trust Online Free

What is create a living trust online free?

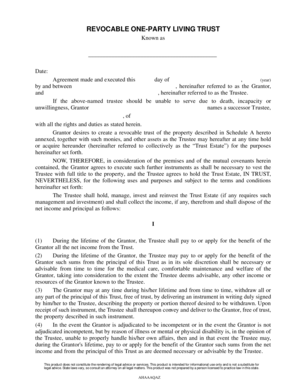

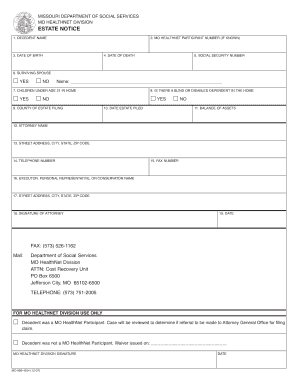

A living trust is a legal document that allows you to decide what happens to your assets and property after you pass away. Creating a living trust online for free means that you can use an online platform or service to draft and create your living trust without having to pay any fees. It offers a convenient and affordable option for individuals who want to establish a trust without the need for expensive legal fees.

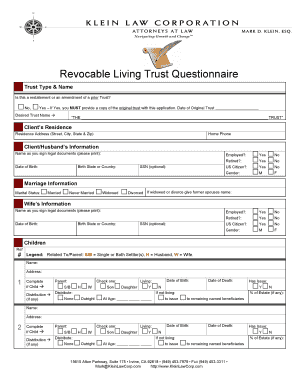

What are the types of create a living trust online free?

When you decide to create a living trust online for free, you can choose from various types depending on your specific needs. Some common types of living trusts include revocable living trusts, irrevocable living trusts, and joint living trusts. Each type has its own advantages and considerations, so it's important to understand the differences before making a decision.

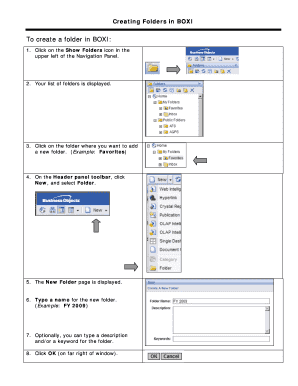

How to complete create a living trust online free

Completing the process of creating a living trust online for free can be done with the following steps:

With pdfFiller, you have the power to create, edit, and share your living trust document online. Offering a wide range of fillable templates and robust editing tools, pdfFiller is your all-in-one solution for getting your documents done efficiently and effectively.