Credit Card Terms And Conditions Template - Page 3

There’s no need to browse through countless terms and conditions samples trying to find one that is similar to what your company needs. Instead, you can simply choose a template from the list of Credit Card Terms And Conditions forms listed below. The templates available in this section already contain the provisions specific to your industry. All you need to do is fill in your company details and adjust any provisions as needed. Open a template in our convenient PDF editor and easily create a legal agreement.

What is Credit Card Terms And Conditions Template?

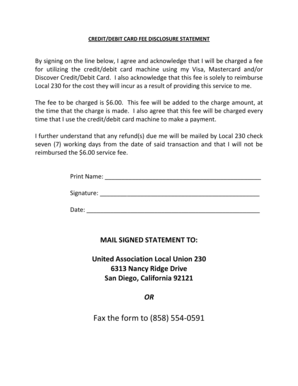

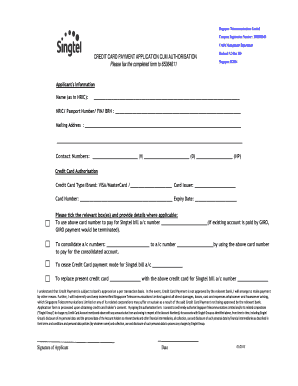

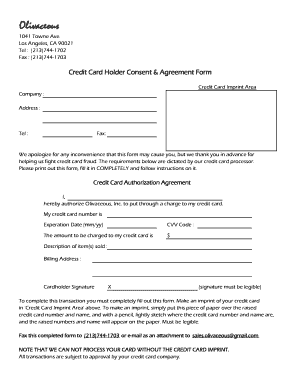

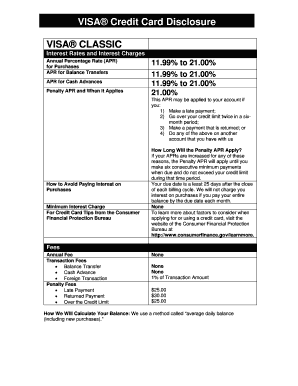

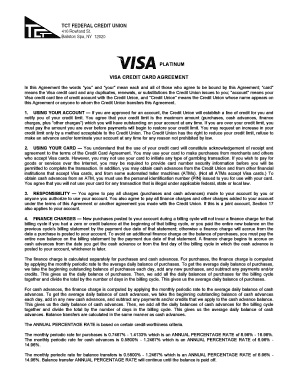

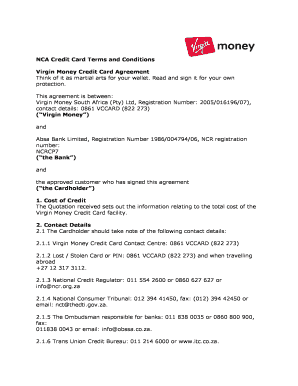

A Credit Card Terms And Conditions Template is a pre-designed document outlining the rules and regulations governing the use of a credit card. It typically includes information on interest rates, fees, payment terms, and other important details related to the card.

What are the types of Credit Card Terms And Conditions Template?

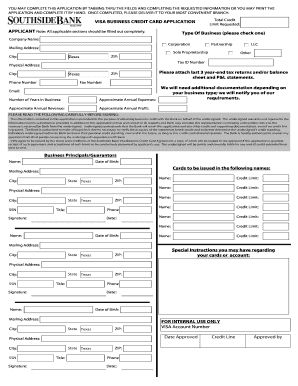

There are several types of Credit Card Terms And Conditions Templates available, including:

How to complete Credit Card Terms And Conditions Template

Completing a Credit Card Terms And Conditions Template is easy with the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.