Debt Elimination - Page 2

What is Debt Elimination?

Debt elimination is the process of completely eliminating or reducing the amount of debt that an individual or organization owes. It is a strategic financial move to regain financial freedom and peace of mind by getting rid of debt burdens.

What are the types of Debt Elimination?

There are several types of debt elimination methods that individuals can consider. Some of the common types include debt snowball method, debt avalanche method, debt consolidation, debt settlement, and bankruptcy.

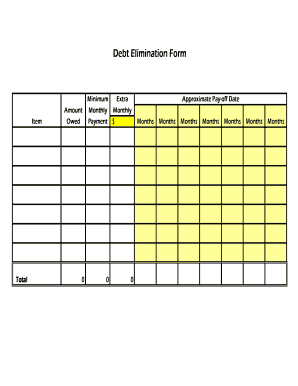

How to complete Debt Elimination

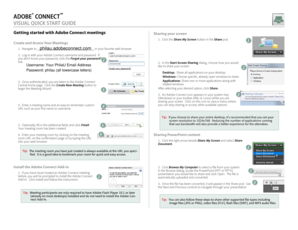

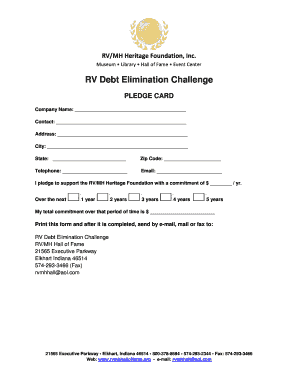

Completing debt elimination requires discipline, patience, and a well-thought-out plan. Here are some steps to help you successfully eliminate your debt:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.