Deed Of Gift Real Estate

What is deed of gift real estate?

A deed of gift real estate is a legal document used to transfer the ownership of a property as a gift. It is commonly used when one party wishes to gift a property to another without any exchange of money. This deed outlines the details of the transfer and usually requires the approval of all parties involved.

What are the types of deed of gift real estate?

There are several types of deed of gift real estate, including: - Warranty Deed: Guarantees that the grantor is the rightful owner of the property and has the right to transfer it. - Quitclaim Deed: Transfers whatever interest the grantor has in the property, without any guarantees. - Gift Deed: Specifically used for transferring property as a gift, without any monetary exchange. - Special Warranty Deed: Guarantees that the grantor has not done anything to harm the title during their ownership.

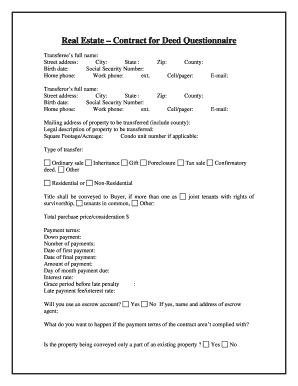

How to complete deed of gift real estate?

Completing a deed of gift real estate can be a straightforward process if you follow these steps: 1. Obtain the necessary form: Whether it's a template or one provided by a legal professional, make sure you have the correct form for your deed of gift. 2. Fill in the details: Include all relevant information about the property, the parties involved, and the nature of the gift. 3. Sign the deed: All parties must sign the deed in the presence of a notary public to ensure its legality. 4. Record the deed: File the completed deed with the appropriate local government office to officially transfer the property's ownership.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.