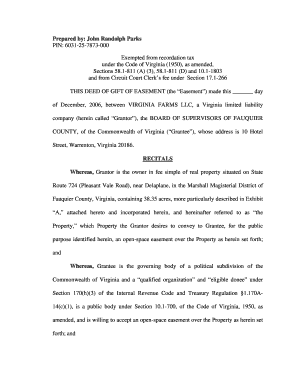

Deed Of Gift Virginia

What is deed of gift virginia?

A deed of gift Virginia is a legal document that transfers ownership of property from one party to another without any monetary exchange. It is a way to gift property to someone without the need for a traditional sale or purchase agreement.

What are the types of deed of gift Virginia?

There are several types of deed of gift Virginia, including: 1. General Warranty Deed: This type of deed guarantees that the property title is free and clear of any liens or encumbrances. 2. Special Warranty Deed: This type of deed guarantees that the property title is free and clear of any liens or encumbrances, but only for the duration of the grantor's ownership. 3. Quit Claim Deed: This type of deed transfers whatever interest the grantor has in the property, without guaranteeing the validity of the title. 4. Bargain and Sale Deed: This type of deed does not provide any warranties or guarantees, but implies that the grantor has the right to transfer the property. 5. Life Estate Deed: This type of deed allows the grantor to maintain ownership of the property for the duration of their life, after which it transfers to the designated beneficiary.

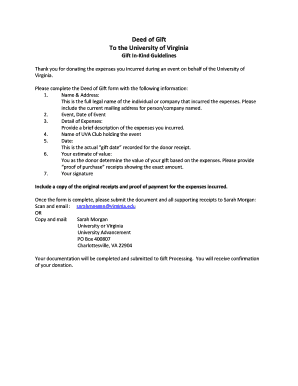

How to complete deed of gift Virginia

Completing a deed of gift Virginia involves the following steps: 1. Identify the parties: Clearly state the names and addresses of the grantor and the grantee. 2. Describe the property: Provide a detailed description of the property, including its address and any relevant identifying information. 3. Include any restrictions or conditions: If there are any specific conditions or restrictions on the gift, they should be clearly stated in the deed. 4. Sign and notarize the deed: Both the grantor and the grantee must sign the deed in the presence of a notary public. 5. Record the deed: File the deed with the appropriate county or city office to ensure its legality and official recognition.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.