Direct Deposit Authorization Form - Page 2

What is direct deposit authorization form?

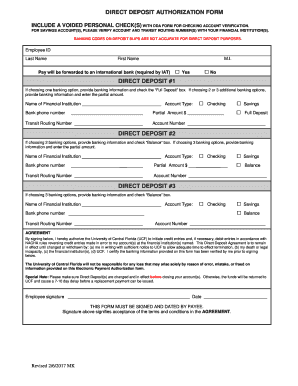

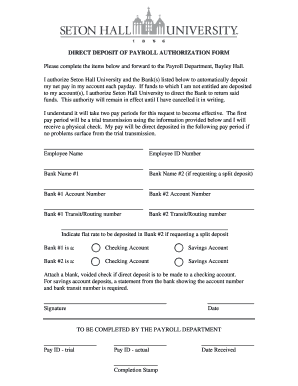

A direct deposit authorization form is a document that allows an individual or a company to electronically transfer funds from one bank account to another. It is a convenient and efficient way to receive payments, such as salaries, pensions, or refunds, directly into your bank account without the need for physical checks.

What are the types of direct deposit authorization form?

There are several types of direct deposit authorization forms available depending on the purpose and nature of the transaction. Some common types include: 1. Payroll Direct Deposit Authorization Form: Used by employees to authorize their employers to directly deposit their salaries into their bank accounts. 2. Social Security Direct Deposit Authorization Form: Used by individuals to receive their social security benefits directly into their bank accounts. 3. Tax Refund Direct Deposit Authorization Form: Used by taxpayers to receive their tax refunds directly into their bank accounts. 4. Vendor Direct Deposit Authorization Form: Used by companies to authorize direct deposits for payments to vendors and suppliers.

How to complete direct deposit authorization form

Completing a direct deposit authorization form is a simple process. Here are the steps to follow: 1. Obtain the direct deposit authorization form from your employer, financial institution, or the relevant organization. 2. Fill in your personal information, including your name, address, phone number, and Social Security number. 3. Provide your bank account details, including the routing number and account number, where you want the funds to be deposited. 4. Specify the type of payment you are authorizing, such as payroll, social security, or tax refund. 5. Review the form for accuracy and completeness. 6. Sign and date the form. 7. Submit the completed form to the appropriate entity.

When it comes to creating, editing, and sharing documents online, pdfFiller provides an exceptional solution. With unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for all your document needs. Enjoy the convenience and efficiency of digital document management with pdfFiller.