Direct Deposit Authorization Form Quickbooks - Page 2

What is direct deposit authorization form quickbooks?

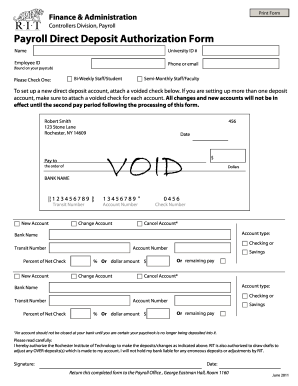

A direct deposit authorization form in QuickBooks is a document that allows an employer to deposit employees' wages directly into their bank accounts. It is a convenient and efficient way to manage payroll and ensure timely and accurate payments to employees. By using this form, businesses can eliminate the need for paper checks and manual distribution of wages, saving time and reducing the risk of errors.

What are the types of direct deposit authorization form quickbooks?

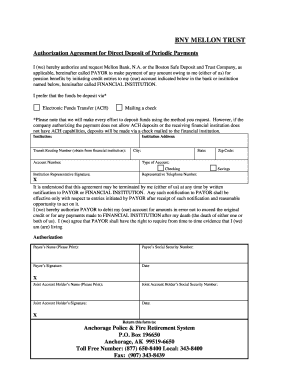

There are different types of direct deposit authorization forms available in QuickBooks, depending on the specific needs and requirements of a business. Some common types include: 1. Employee Direct Deposit Authorization Form: This form is used by employees to provide their banking information and authorize their employer to make direct deposits into their accounts. 2. Vendor Direct Deposit Authorization Form: This form is used by businesses to authorize direct deposit payments to their vendors. 3. Independent Contractor Direct Deposit Authorization Form: This form is used by businesses to authorize direct deposit payments to their independent contractors.

How to complete direct deposit authorization form quickbooks

Completing a direct deposit authorization form in QuickBooks is a straightforward process. Here are the steps to follow: 1. Open QuickBooks and navigate to the Payroll Center. 2. Select the Employees tab and choose the employee for whom you want to set up direct deposit. 3. Click on Direct Deposit Setup and follow the prompts to enter the employee's banking information. 4. Verify the information entered and save the direct deposit authorization form. 5. Repeat the process for each employee who wants to set up direct deposit. By following these steps, you can easily complete the direct deposit authorization form in QuickBooks and enable direct deposit for your employees.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.