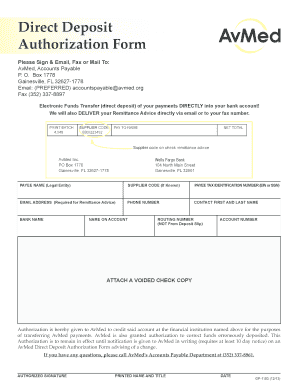

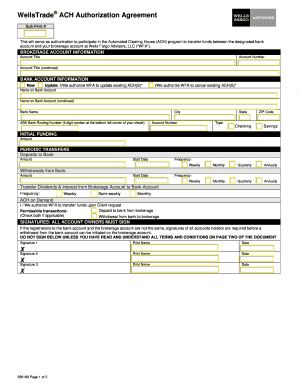

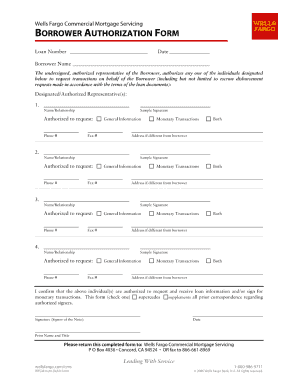

Direct Deposit Authorization Form Wells Fargo

What is direct deposit authorization form wells fargo?

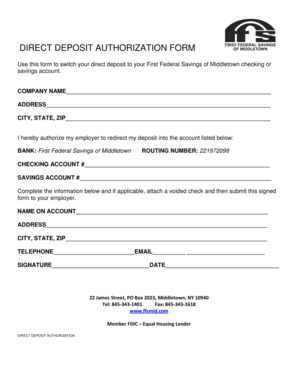

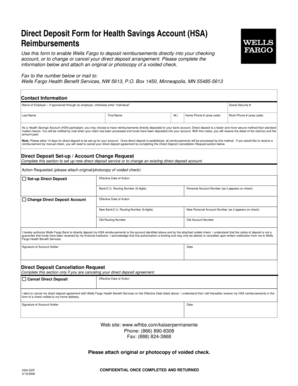

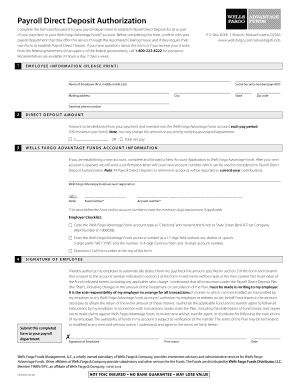

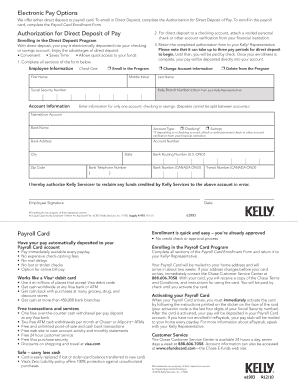

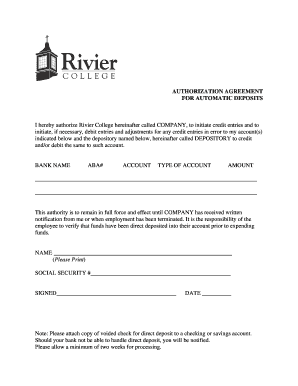

A direct deposit authorization form Wells Fargo is a document that allows you to authorize Wells Fargo Bank to automatically deposit payments into your account. It provides a convenient and time-saving way to receive recurring payments, such as your salary, pension, or government benefits, directly into your Wells Fargo account.

What are the types of direct deposit authorization form wells fargo?

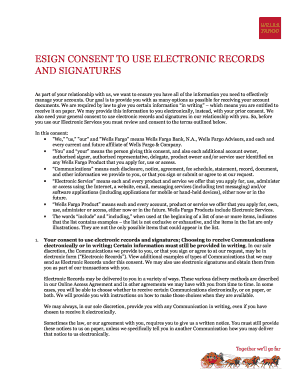

There are two main types of direct deposit authorization forms offered by Wells Fargo:

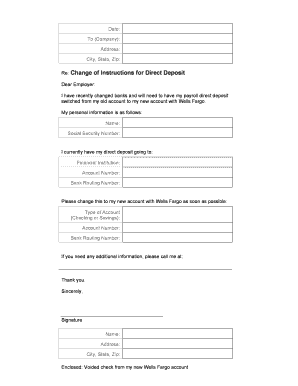

How to complete direct deposit authorization form wells fargo

Completing a direct deposit authorization form with Wells Fargo is a straightforward process. Here are the steps to follow:

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and effortlessly.