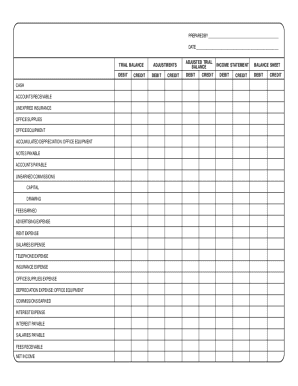

Excel Balance Sheet Template - Page 2

What is Excel Balance Sheet Template?

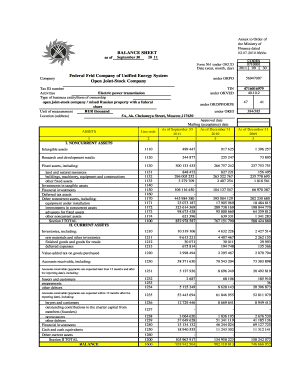

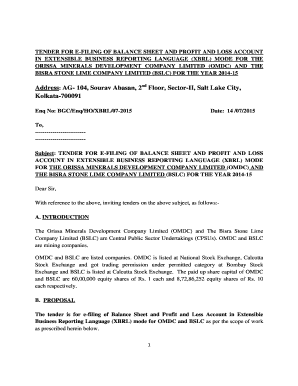

Excel Balance Sheet Template is a pre-designed spreadsheet that helps businesses or individuals organize and summarize their financial data. It provides a structured format for presenting assets, liabilities, and equity, allowing users to easily track their financial position.

What are the types of Excel Balance Sheet Template?

There are several types of Excel Balance Sheet Templates available, each tailored to specific needs and industries. Some common types include:

Basic Excel Balance Sheet Template: This template provides a simple and straightforward layout for recording financial information.

Detailed Excel Balance Sheet Template: This template includes additional sections and subcategories for a more comprehensive financial analysis.

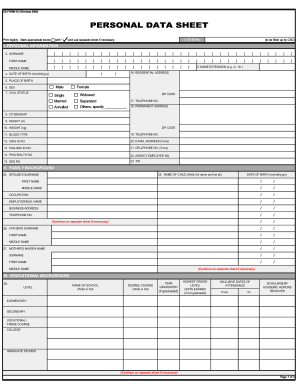

Personal Finance Excel Balance Sheet Template: Specifically designed for personal use, this template helps individuals track their income, expenses, and net worth.

Business Excel Balance Sheet Template: Ideal for small or large businesses, this template includes sections to record assets, liabilities, equity, and other financial metrics.

How to complete Excel Balance Sheet Template

Completing an Excel Balance Sheet Template is easy if you follow these steps:

01

Open the Excel Balance Sheet Template in Microsoft Excel or any spreadsheet program.

02

Start by entering the name of your business or organization.

03

Fill in the relevant sections with your financial information, such as assets, liabilities, and equity.

04

Double-check your entries for accuracy and ensure that all formulas are working correctly.

05

Save the completed template for future reference or printing.

With pdfFiller, users can effortlessly create, edit, and share their Excel Balance Sheet Templates online. With unlimited fillable templates and powerful editing tools, pdfFiller is the perfect solution for managing and organizing financial data.

Video Tutorial How to Fill Out Excel Balance Sheet Template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

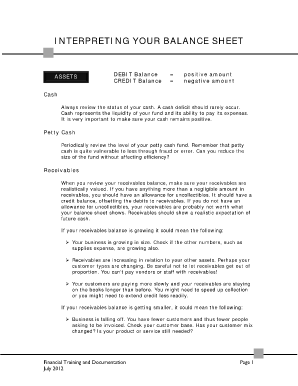

How do you structure a balance sheet?

The Basics. Three aspects comprise a balance sheet: assets, liabilities, and shareholders' or owners' equity. In simple terms, the liabilities plus the shareholders' equity should equal the assets. If the accounting is done correctly, both sides of the balance sheet will be equal.

How do you layout a balance sheet?

How to Prepare a Basic Balance Sheet Determine the Reporting Date and Period. Identify Your Assets. Identify Your Liabilities. Calculate Shareholders' Equity. Add Total Liabilities to Total Shareholders' Equity and Compare to Assets.

What are the 3 basic parts of a balance sheet?

As an overview of the company's financial position, the balance sheet consists of three major sections: (1) the assets, which are probable future economic benefits owned or controlled by the entity. (2) the liabilities, which are probable future sacrifices of economic benefits. and (3) the owners' equity, calculated as

How do you make a balance sheet step by step?

How to make a balance sheet Invest in accounting software. Create a heading. Use the basic accounting equation to separate each section. Include all of your assets. Create a section for liabilities. Create a section for owner's equity. Add total liabilities to total owner's equity.

What is the formula used to create a balance sheet?

A balance sheet is calculated by balancing a company's assets with its liabilities and equity. The formula is: total assets = total liabilities + total equity. Total assets is calculated as the sum of all short-term, long-term, and other assets.

What is a balance sheet template?

Empower your business finances with a balance sheet template that shows year-to-year comparisons, increases or decreases in net worth, assets and liabilities, and more. Determine equity and make more informed business decisions.