Expense Reimbursement Form Doc - Page 2

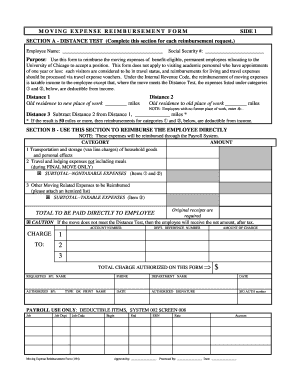

What is expense reimbursement form doc?

Expense reimbursement form doc is a document used by organizations to track and reimburse employees for business-related expenses. It is a standardized form that employees fill out to report their expenses and request reimbursement.

What are the types of expense reimbursement form doc?

There are several types of expense reimbursement form doc that organizations may use, including:

Mileage reimbursement form: Used to track and reimburse employees for mileage expenses incurred during business travel.

Meal reimbursement form: Used to track and reimburse employees for meal expenses incurred during business-related activities.

Travel reimbursement form: Used to track and reimburse employees for travel-related expenses, such as airfare, accommodation, and transportation.

General expense reimbursement form: Used to track and reimburse employees for various business-related expenses, such as office supplies, client entertainment, and professional development.

Medical expense reimbursement form: Used to track and reimburse employees for medical expenses not covered by insurance, such as co-pays and prescription costs.

How to complete expense reimbursement form doc

Completing an expense reimbursement form doc is a straightforward process. Here are the steps to follow:

01

Gather all relevant receipts and documents for the expenses you incurred.

02

Fill out the employee information section, including your name, employee ID, department, and contact information.

03

Provide detailed information about each expense, including the date, description, and amount.

04

Attach the corresponding receipts or supporting documents for each expense.

05

Calculate the total amount of reimbursement requested and provide any additional comments or explanations if necessary.

06

Submit the completed form to the appropriate department or supervisor for review and approval.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is an example of expense reimbursement?

Typically, these expenses are related to travel and can include the costs associated with hotels, food, ground transportation, and flights (travel reimbursement). Companies may also reimburse employees for other types of expenses, such as tuition reimbursement for college courses or continuing education classes.

How do you write a reimbursement note?

How to Write 1 – The Form Used To Seek Reimbursement Is Available By Download Here. 2 – Supply Some Standard Information To The Header. 3 – Itemize Each Expense That Should Be Repaid To The Spender. 4 – Supply A Summary Report On Reimbursable Expenses. 5 – Verify These Facts Then Submit For Approval.

How do I fill out an expense reimbursement?

How to Complete an Expense Reimbursement Form: Add personal information. Enter purchase details. Sign the form. Attach receipts. Submit to the management or accounting department.

What documentation is needed for reimbursement?

For payments to merchants, include an application showing the amount to be paid or an invoice. For reimbursements to employees, include an application or invoice from the merchant with proof of payment.

How do you prepare for reimbursement?

A step-by-step guide to employee expense reimbursement Form a policy for the expense reimbursement process. Determine what expenses employees can claim. Create a system for collecting employee expense claims. Verify the legitimacy of expenses. Pay reimbursements within a specified timeframe.

How do I fill out an expense form?

How to create an expense report Determine what expenses you want to include in your report. List the expenses that meet your criteria, including the details listed above. Total the expenses included in your report. Add notes about expenses incurred or total paid.